- South Korea

- /

- Electrical

- /

- KOSE:A336260

Revenues Not Telling The Story For Doosan Fuel Cell Co., Ltd. (KRX:336260) After Shares Rise 25%

Doosan Fuel Cell Co., Ltd. (KRX:336260) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

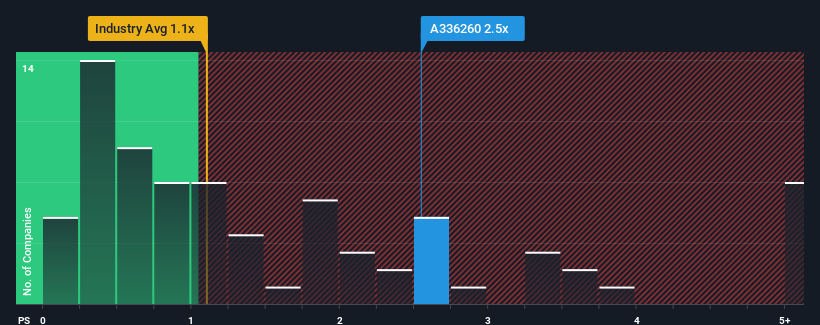

After such a large jump in price, you could be forgiven for thinking Doosan Fuel Cell is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for Doosan Fuel Cell in our free report.Check out our latest analysis for Doosan Fuel Cell

How Has Doosan Fuel Cell Performed Recently?

Doosan Fuel Cell certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Doosan Fuel Cell.How Is Doosan Fuel Cell's Revenue Growth Trending?

Doosan Fuel Cell's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. Revenue has also lifted 8.0% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 20% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 19% per year, which is not materially different.

With this in consideration, we find it intriguing that Doosan Fuel Cell's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Doosan Fuel Cell's P/S?

Doosan Fuel Cell shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Doosan Fuel Cell's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Doosan Fuel Cell with six simple checks.

If these risks are making you reconsider your opinion on Doosan Fuel Cell, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A336260

Doosan Fuel Cell

Develops and distributes power generation fuel cells in South Korea.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives