- South Korea

- /

- Machinery

- /

- KOSE:A329180

Optimistic Investors Push HD Hyundai Heavy Industries Co.,Ltd. (KRX:329180) Shares Up 26% But Growth Is Lacking

HD Hyundai Heavy Industries Co.,Ltd. (KRX:329180) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 71%.

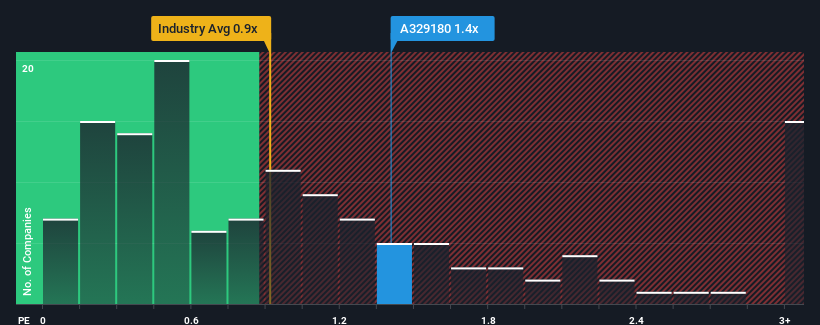

In spite of the firm bounce in price, it's still not a stretch to say that HD Hyundai Heavy IndustriesLtd's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Machinery industry in Korea, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for HD Hyundai Heavy IndustriesLtd

What Does HD Hyundai Heavy IndustriesLtd's P/S Mean For Shareholders?

Recent times have been advantageous for HD Hyundai Heavy IndustriesLtd as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think HD Hyundai Heavy IndustriesLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For HD Hyundai Heavy IndustriesLtd?

The only time you'd be comfortable seeing a P/S like HD Hyundai Heavy IndustriesLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Pleasingly, revenue has also lifted 77% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the analysts following the company. With the industry predicted to deliver 41% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that HD Hyundai Heavy IndustriesLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From HD Hyundai Heavy IndustriesLtd's P/S?

HD Hyundai Heavy IndustriesLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that HD Hyundai Heavy IndustriesLtd's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for HD Hyundai Heavy IndustriesLtd with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Heavy IndustriesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A329180

HD Hyundai Heavy IndustriesLtd

Engages in operating shipbuilding and offshore, naval and special ships, and engine and machinery business units worldwide.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives