- South Korea

- /

- Electrical

- /

- KOSE:A229640

Revenues Not Telling The Story For LS Eco Energy Ltd. (KRX:229640) After Shares Rise 38%

Despite an already strong run, LS Eco Energy Ltd. (KRX:229640) shares have been powering on, with a gain of 38% in the last thirty days. The annual gain comes to 122% following the latest surge, making investors sit up and take notice.

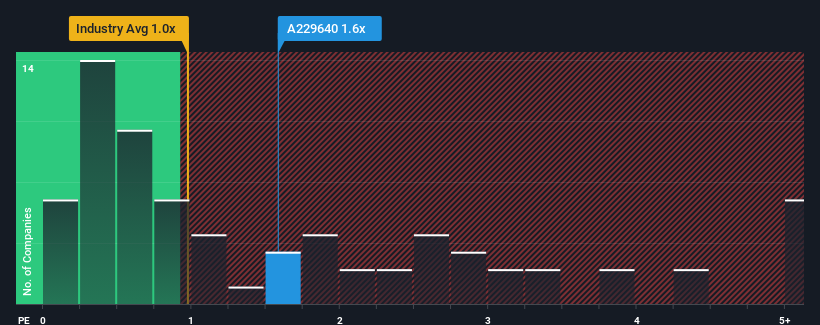

Following the firm bounce in price, you could be forgiven for thinking LS Eco Energy is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for LS Eco Energy

How Has LS Eco Energy Performed Recently?

Recent times have been pleasing for LS Eco Energy as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LS Eco Energy.Is There Enough Revenue Growth Forecasted For LS Eco Energy?

In order to justify its P/S ratio, LS Eco Energy would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. As a result, it also grew revenue by 12% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 14% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 17% each year, which is noticeably more attractive.

With this information, we find it concerning that LS Eco Energy is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in LS Eco Energy's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see LS Eco Energy trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for LS Eco Energy (1 is concerning!) that you should be aware of.

If you're unsure about the strength of LS Eco Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade LS Eco Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A229640

LS Eco Energy

Manufactures and sells cables for the electricity boards and news agencies worldwide.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives