- South Korea

- /

- Electrical

- /

- KOSE:A229640

Revenues Not Telling The Story For LS Eco Energy Ltd. (KRX:229640) After Shares Rise 44%

LS Eco Energy Ltd. (KRX:229640) shareholders have had their patience rewarded with a 44% share price jump in the last month. The last month tops off a massive increase of 296% in the last year.

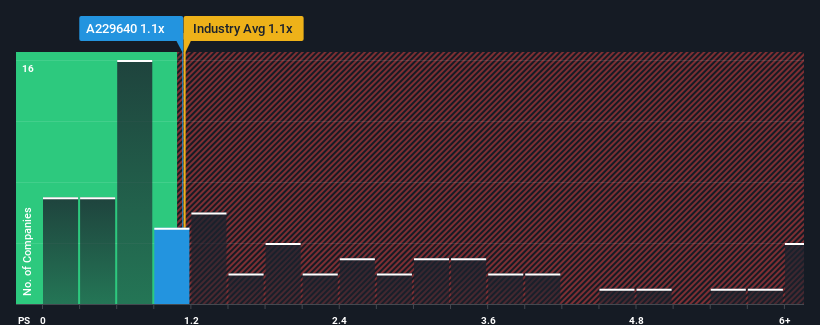

Even after such a large jump in price, there still wouldn't be many who think LS Eco Energy's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when it essentially matches the median P/S in Korea's Electrical industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for LS Eco Energy

What Does LS Eco Energy's P/S Mean For Shareholders?

LS Eco Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LS Eco Energy.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, LS Eco Energy would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 5.5% per annum over the next three years. With the industry predicted to deliver 20% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's curious that LS Eco Energy's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now LS Eco Energy's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that LS Eco Energy's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with LS Eco Energy (at least 1 which is concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade LS Eco Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A229640

LS Eco Energy

Manufactures and sells cables for the electricity boards and news agencies worldwide.

Mediocre balance sheet with limited growth.