- South Korea

- /

- Construction

- /

- KOSE:A126720

Top 3 Dividend Stocks To Boost Your Income

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by inflation concerns and political uncertainties, investors are seeking stability in the form of reliable income streams. In such an environment, dividend stocks can offer a compelling option for those looking to boost their income while potentially mitigating some market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.40% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.06% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

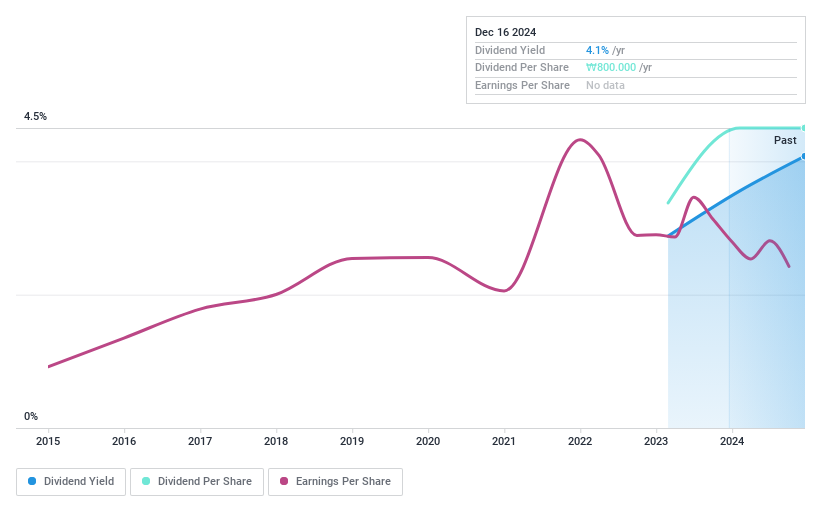

Soosan Industries (KOSE:A126720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soosan Industries Co., Ltd. offers power plant construction and maintenance services in South Korea, with a market cap of ₩285.11 billion.

Operations: Soosan Industries Co., Ltd. generates revenue primarily from power plant maintenance services amounting to ₩311.62 billion and solar power operations contributing ₩10.92 billion.

Dividend Yield: 4%

Soosan Industries, despite a relatively short dividend history of two years, offers a compelling dividend profile with stable and reliable payments. Its dividends are well-covered by both earnings and cash flows, indicated by a low payout ratio of 27% and a cash payout ratio of 40.6%. Trading at 55% below its estimated fair value, it presents potential value for investors. Additionally, its dividend yield is in the top quartile within the KR market.

- Unlock comprehensive insights into our analysis of Soosan Industries stock in this dividend report.

- The analysis detailed in our Soosan Industries valuation report hints at an deflated share price compared to its estimated value.

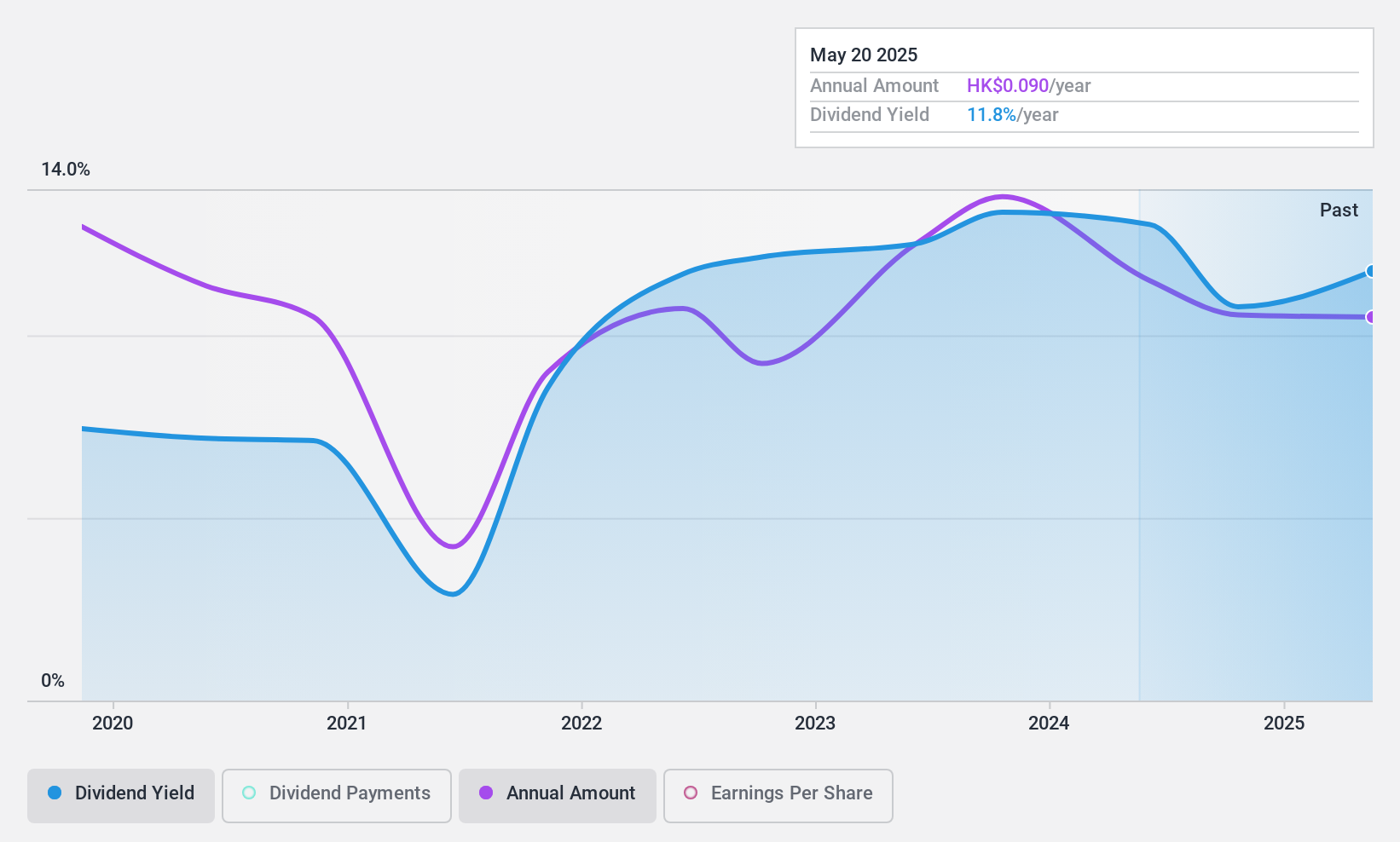

Haitong Unitrust International Financial Leasing (SEHK:1905)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haitong Unitrust International Financial Leasing Co., Ltd. operates as a financial leasing company in the People's Republic of China, with a market cap of HK$7.41 billion.

Operations: Haitong Unitrust International Financial Leasing Co., Ltd.'s revenue primarily comes from its financial services in the commercial sector, amounting to CN¥3.68 billion.

Dividend Yield: 9.7%

Haitong Unitrust International Financial Leasing has a volatile dividend history, with payments decreasing over the past five years. However, its dividends are well-covered by earnings and cash flows, with payout ratios of 47.6% and 4.2%, respectively. Despite trading at a significant discount to estimated fair value, its high debt level raises concerns about financial stability. The company recently approved an interim dividend of RMB 0.43 per 10 shares amidst modest earnings growth of CNY 1.25 billion for nine months in 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Haitong Unitrust International Financial Leasing.

- In light of our recent valuation report, it seems possible that Haitong Unitrust International Financial Leasing is trading behind its estimated value.

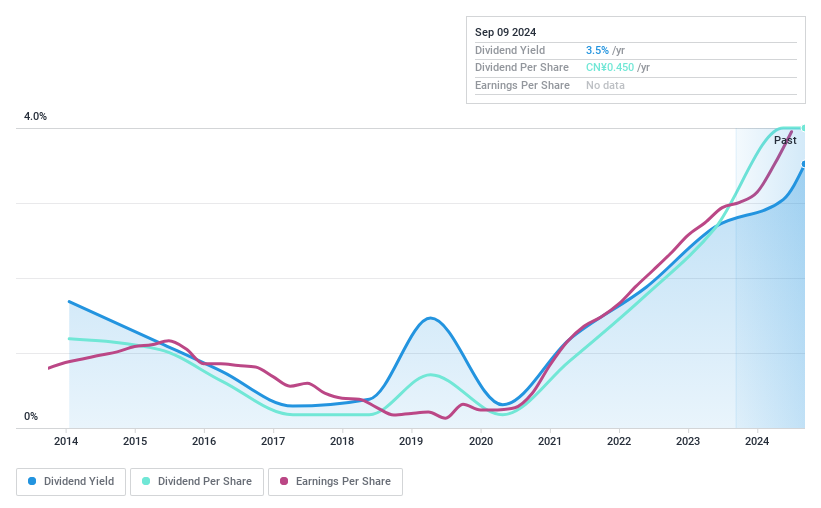

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥10.32 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates its revenue through the research, production, and marketing of Chinese medicinal products within China and internationally.

Dividend Yield: 3%

Zhejiang Jolly Pharmaceutical's dividend yield of 3.01% ranks in the top 25% within China, but its dividends have been volatile over the past decade. Despite a reasonable payout ratio of 60.5%, dividends are not well covered by free cash flows, with a high cash payout ratio of 265.5%. Recent earnings growth to CNY 421.48 million for nine months in 2024 highlights profitability, yet dividend reliability remains uncertain amid ongoing volatility and recent strategic shareholder meetings.

- Click to explore a detailed breakdown of our findings in Zhejiang Jolly PharmaceuticalLTD's dividend report.

- The valuation report we've compiled suggests that Zhejiang Jolly PharmaceuticalLTD's current price could be quite moderate.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1997 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A126720

Soosan Industries

Provides power plant construction and maintenance services in South Korea.

Flawless balance sheet, good value and pays a dividend.