- South Korea

- /

- Machinery

- /

- KOSE:A119650

KC Cottrell Co., Ltd.'s (KRX:119650) Share Price Boosted 42% But Its Business Prospects Need A Lift Too

Those holding KC Cottrell Co., Ltd. (KRX:119650) shares would be relieved that the share price has rebounded 42% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 53% share price drop in the last twelve months.

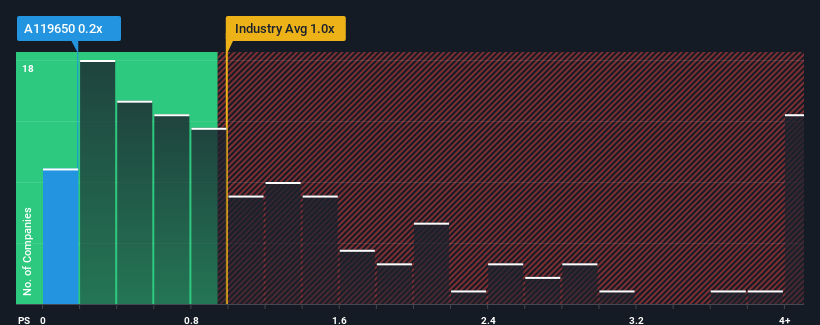

In spite of the firm bounce in price, considering around half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") above 1x, you may still consider KC Cottrell as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for KC Cottrell

What Does KC Cottrell's Recent Performance Look Like?

For example, consider that KC Cottrell's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on KC Cottrell will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KC Cottrell will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For KC Cottrell?

KC Cottrell's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. Still, the latest three year period has seen an excellent 41% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 35% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why KC Cottrell's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On KC Cottrell's P/S

The latest share price surge wasn't enough to lift KC Cottrell's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of KC Cottrell confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 5 warning signs for KC Cottrell (4 shouldn't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if KC Cottrell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A119650

KC Cottrell

Engages in the research and development, engineering, construction, operation, supply, and post-management of environmental equipment and technology.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives