- South Korea

- /

- Machinery

- /

- KOSE:A097230

Despite shrinking by ₩225b in the past week, HJ Shipbuilding & Construction (KRX:097230) shareholders are still up 872% over 1 year

It might be of some concern to shareholders to see the HJ Shipbuilding & Construction Co., Ltd. (KRX:097230) share price down 24% in the last month. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 872% rise, throughout the period. So the recent fall isn't enough to negate the good performance. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

Although HJ Shipbuilding & Construction has shed ₩225b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year HJ Shipbuilding & Construction grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

Unfortunately HJ Shipbuilding & Construction's fell 16% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

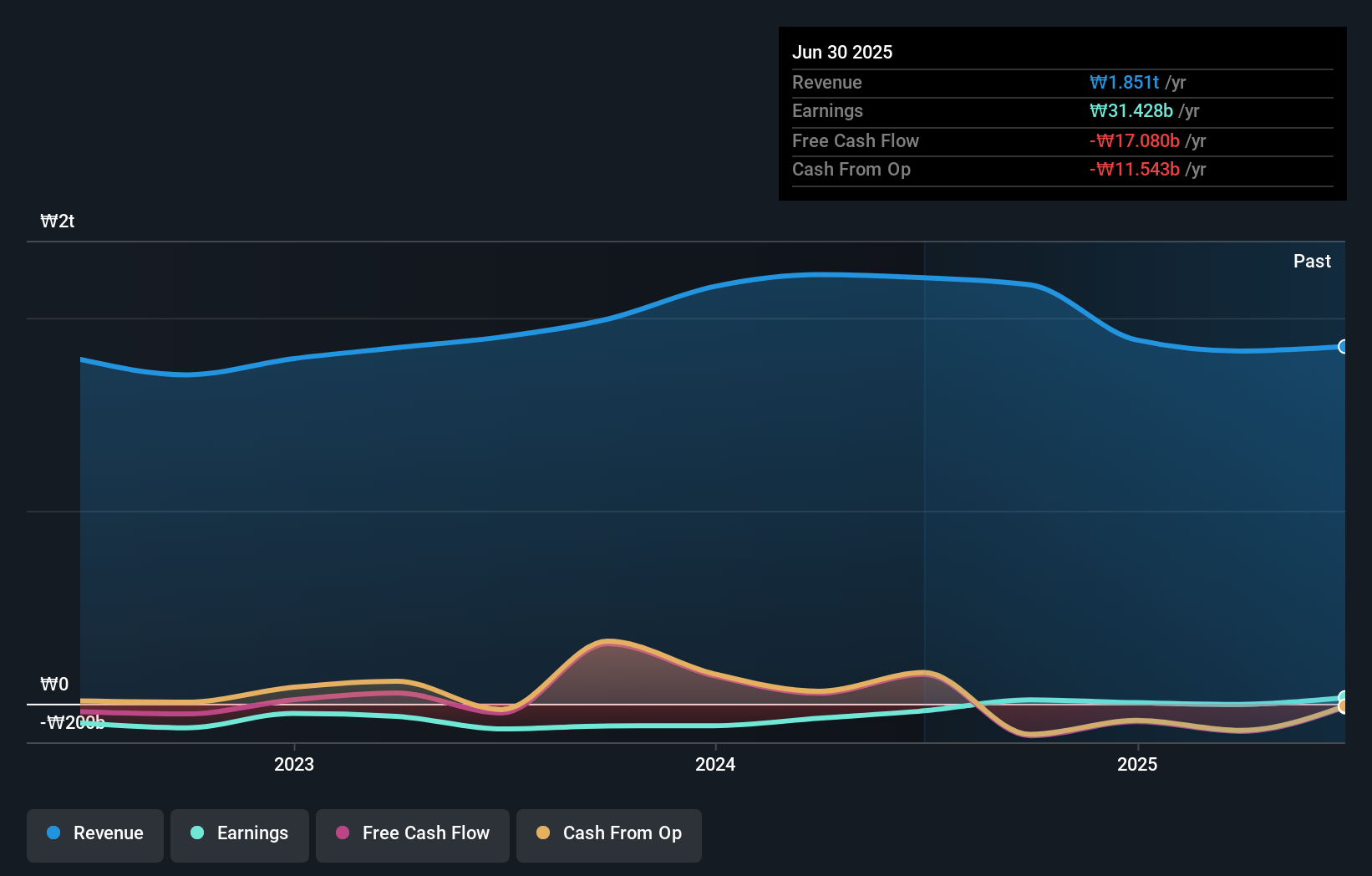

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at HJ Shipbuilding & Construction's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that HJ Shipbuilding & Construction has rewarded shareholders with a total shareholder return of 872% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 23% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for HJ Shipbuilding & Construction (2 are a bit concerning!) that you should be aware of before investing here.

But note: HJ Shipbuilding & Construction may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HJ Shipbuilding & Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A097230

HJ Shipbuilding & Construction

Engages in the defense and special shipbuilding, civil engineering, construction/housing, and plant construction business in South Korea.

Adequate balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)