- South Korea

- /

- Machinery

- /

- KOSE:A010140

Asian Value Stocks Priced Below Estimated Intrinsic Worth

Reviewed by Simply Wall St

Amid ongoing trade discussions between major economies and recent policy shifts, Asian markets have shown resilience with notable gains in key indices. In this environment of cautious optimism, identifying value stocks priced below their estimated intrinsic worth can be a strategic approach for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1893.00 | ¥3727.32 | 49.2% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.12 | CN¥45.45 | 49.1% |

| Alexander Marine (TWSE:8478) | NT$148.50 | NT$291.28 | 49% |

| Lingbao Gold Group (SEHK:3330) | HK$9.44 | HK$18.21 | 48.1% |

| Newborn Town (SEHK:9911) | HK$8.39 | HK$16.46 | 49% |

| GEM (SZSE:002340) | CN¥6.21 | CN¥12.14 | 48.8% |

| World Fitness Services (TWSE:2762) | NT$82.70 | NT$164.43 | 49.7% |

| Seegene (KOSDAQ:A096530) | ₩27250.00 | ₩52999.15 | 48.6% |

| Bloks Group (SEHK:325) | HK$129.60 | HK$255.66 | 49.3% |

| BrightGene Bio-Medical Technology (SHSE:688166) | CN¥50.36 | CN¥98.57 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy infrastructure sectors with a market cap of ₩12.68 trillion.

Operations: The company's revenue is primarily derived from its Joseon Maritime segment at ₩9.31 trillion and its Construction segment at ₩791.65 billion.

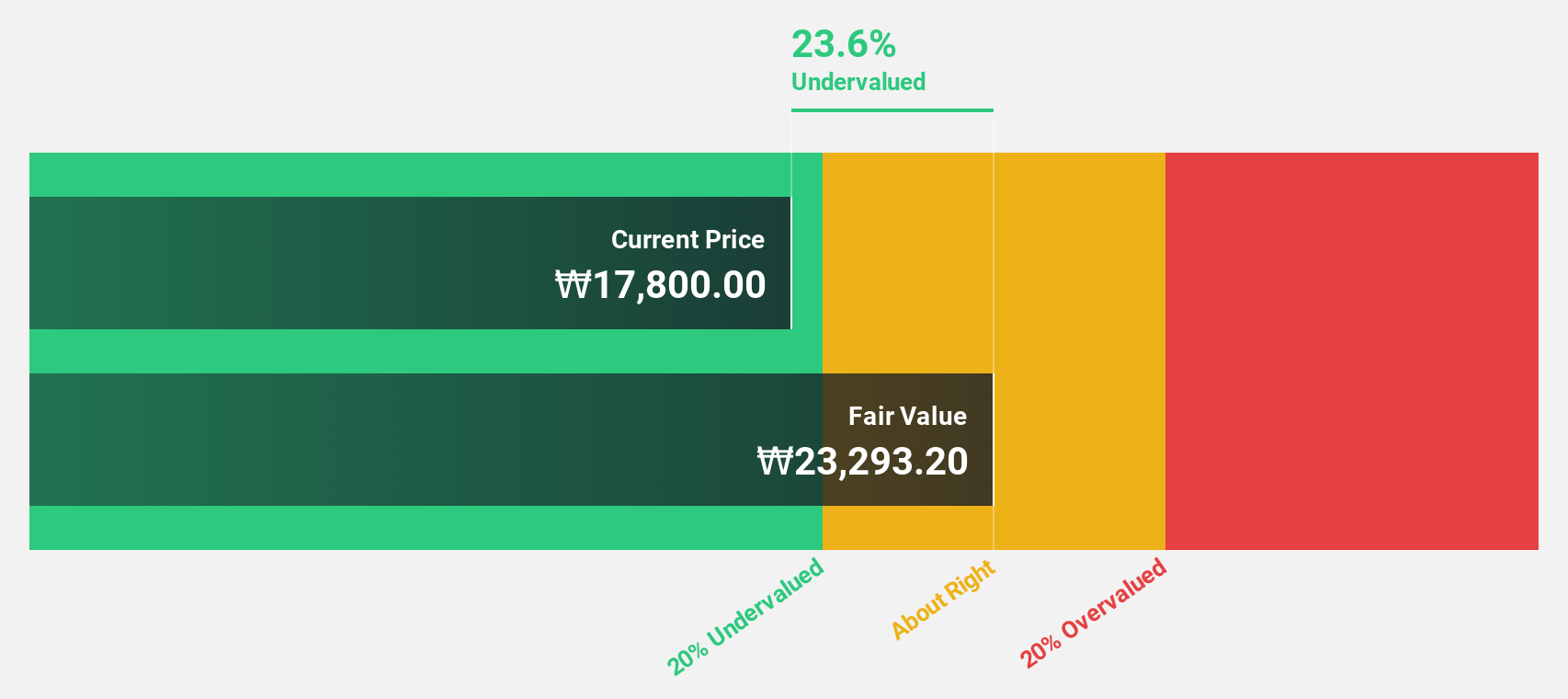

Estimated Discount To Fair Value: 27.4%

Samsung Heavy Industries is trading at ₩14,840, significantly below its estimated fair value of ₩20,432.38. Analysts agree the stock price could rise by 20.2%. The company recently turned profitable with net income of KRW 63.88 billion for 2024, compared to a loss the previous year. Earnings are expected to grow significantly at over 51% annually, outpacing the Korean market's growth rate of 21.1%, despite interest payments not being well covered by earnings.

- Our growth report here indicates Samsung Heavy Industries may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Samsung Heavy Industries stock in this financial health report.

HD-Hyundai Marine Engine (KOSE:A071970)

Overview: HD-Hyundai Marine Engine Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants both in South Korea and internationally, with a market cap of ₩1.39 trillion.

Operations: The company's revenue is primarily derived from its Engine and Equipment segment, which generated ₩315.79 billion.

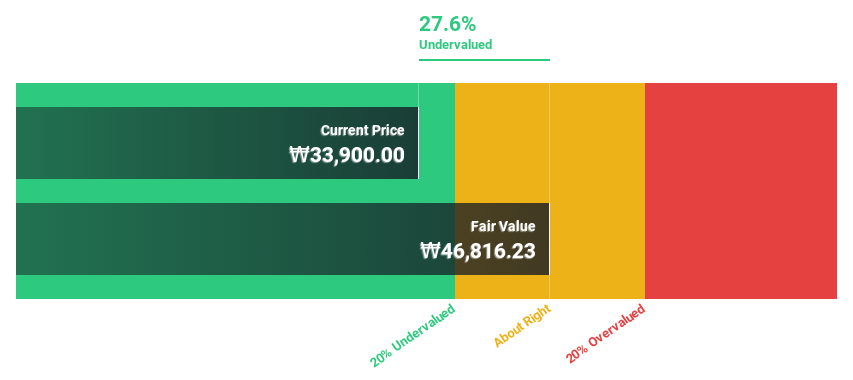

Estimated Discount To Fair Value: 33.5%

HD-Hyundai Marine Engine's earnings surged to KRW 75.78 billion in 2024 from KRW 31.64 billion the previous year, with revenue forecasted to expand at a rapid pace of 27.2% annually, outstripping market growth. Despite recent shareholder dilution and high share price volatility, the stock trades at ₩40,850—33.5% below its estimated fair value of ₩61,451.66—highlighting its potential as an undervalued investment based on cash flows despite large one-off items impacting results.

- According our earnings growth report, there's an indication that HD-Hyundai Marine Engine might be ready to expand.

- Click to explore a detailed breakdown of our findings in HD-Hyundai Marine Engine's balance sheet health report.

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants both in Japan and internationally, with a market cap of ¥387.74 billion.

Operations: The company's revenue segments include Marugame Seimen generating ¥125.38 billion and the Overseas Business contributing ¥102.43 billion.

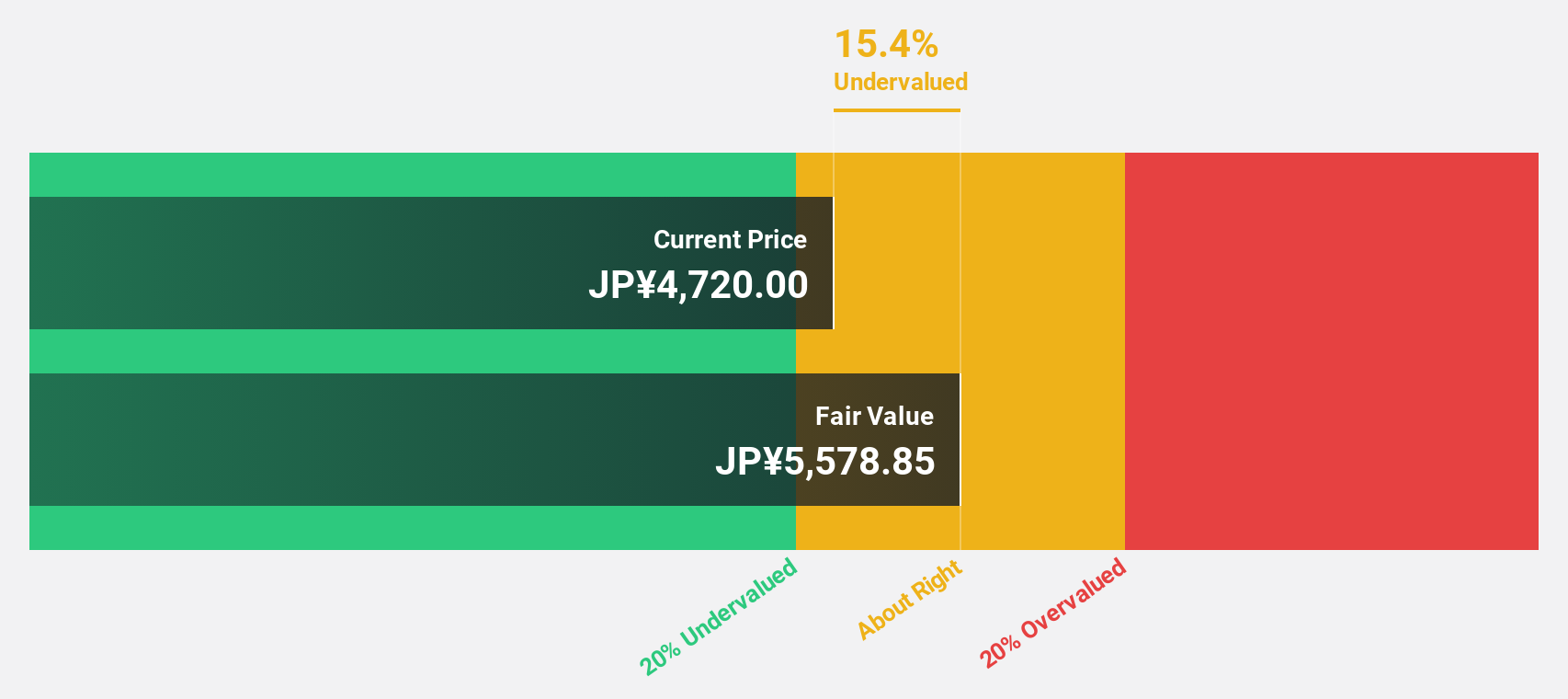

Estimated Discount To Fair Value: 42.8%

TORIDOLL Holdings is trading at ¥4,426, significantly below its estimated fair value of ¥7,739.11. Earnings are projected to grow 35.3% annually, surpassing the JP market's 7.6% growth rate, while revenue is expected to increase by 8.5% per year. However, a low forecasted return on equity of 11.3% and the impact of large one-off items on financial results may temper enthusiasm for this undervalued stock based on cash flows.

- The growth report we've compiled suggests that TORIDOLL Holdings' future prospects could be on the up.

- Take a closer look at TORIDOLL Holdings' balance sheet health here in our report.

Summing It All Up

- Investigate our full lineup of 269 Undervalued Asian Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives