- South Korea

- /

- Trade Distributors

- /

- KOSE:A047050

Posco International Corporation (KRX:047050) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Posco International Corporation (KRX:047050) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

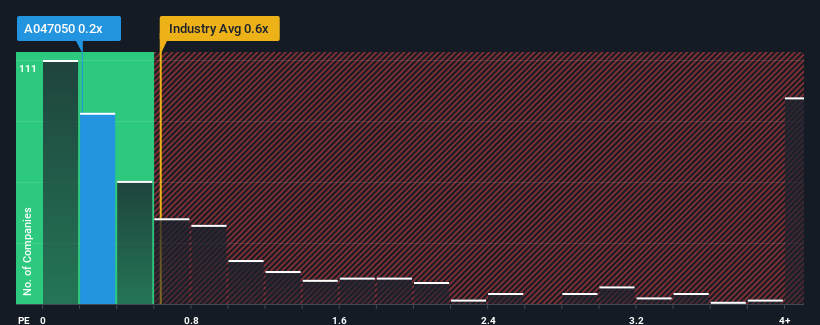

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Posco International's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in Korea is also close to 0.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Posco International

How Posco International Has Been Performing

While the industry has experienced revenue growth lately, Posco International's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Posco International.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Posco International's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. Regardless, revenue has managed to lift by a handy 6.3% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 6.9% each year over the next three years. That's shaping up to be materially higher than the 1.5% per annum growth forecast for the broader industry.

In light of this, it's curious that Posco International's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Posco International's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Posco International looks to be in line with the rest of the Trade Distributors industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Posco International's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Posco International (1 is concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A047050

Posco International

An integrated business company, operates in trade, resources, and infrastructure development/operation businesses.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives