- South Korea

- /

- Machinery

- /

- KOSE:A042660

Is Daewoo Shipbuilding & Marine Engineering (KRX:042660) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Daewoo Shipbuilding & Marine Engineering Co., Ltd. (KRX:042660) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Daewoo Shipbuilding & Marine Engineering

What Is Daewoo Shipbuilding & Marine Engineering's Net Debt?

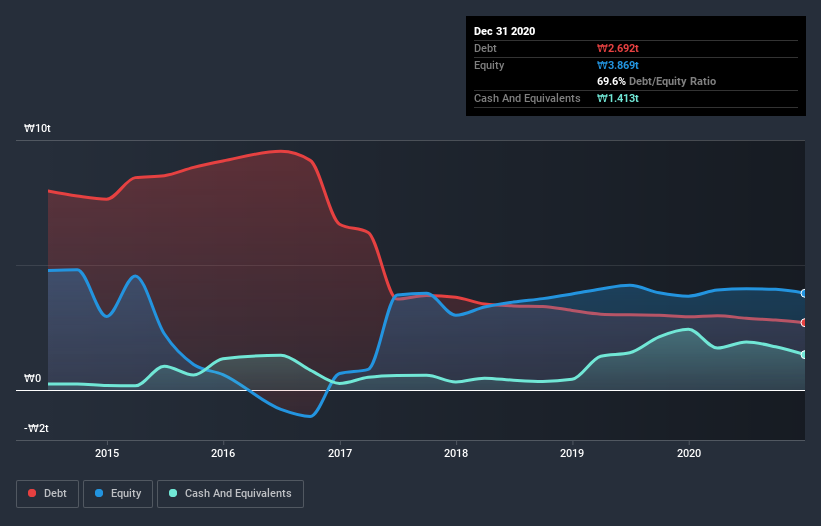

You can click the graphic below for the historical numbers, but it shows that Daewoo Shipbuilding & Marine Engineering had ₩2.69t of debt in December 2020, down from ₩2.93t, one year before. However, because it has a cash reserve of ₩1.41t, its net debt is less, at about ₩1.28t.

How Strong Is Daewoo Shipbuilding & Marine Engineering's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Daewoo Shipbuilding & Marine Engineering had liabilities of ₩5.16t due within 12 months and liabilities of ₩1.29t due beyond that. Offsetting this, it had ₩1.41t in cash and ₩608.2b in receivables that were due within 12 months. So it has liabilities totalling ₩4.43t more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's ₩3.04t market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Daewoo Shipbuilding & Marine Engineering shareholders face the double whammy of a high net debt to EBITDA ratio (5.4), and fairly weak interest coverage, since EBIT is just 1.3 times the interest expense. The debt burden here is substantial. Even worse, Daewoo Shipbuilding & Marine Engineering saw its EBIT tank 64% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Daewoo Shipbuilding & Marine Engineering's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Daewoo Shipbuilding & Marine Engineering actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Daewoo Shipbuilding & Marine Engineering's interest cover left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, it seems to us that Daewoo Shipbuilding & Marine Engineering's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Daewoo Shipbuilding & Marine Engineering (1 is a bit unpleasant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Daewoo Shipbuilding & Marine Engineering, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A042660

Hanwha Ocean

Operates as a shipbuilding and offshore contractor in South Korea and internationally.

Moderate growth potential low.