- South Korea

- /

- Industrials

- /

- KOSE:A034730

Investors Still Aren't Entirely Convinced By SK Inc.'s (KRX:034730) Revenues Despite 25% Price Jump

SK Inc. (KRX:034730) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 58%.

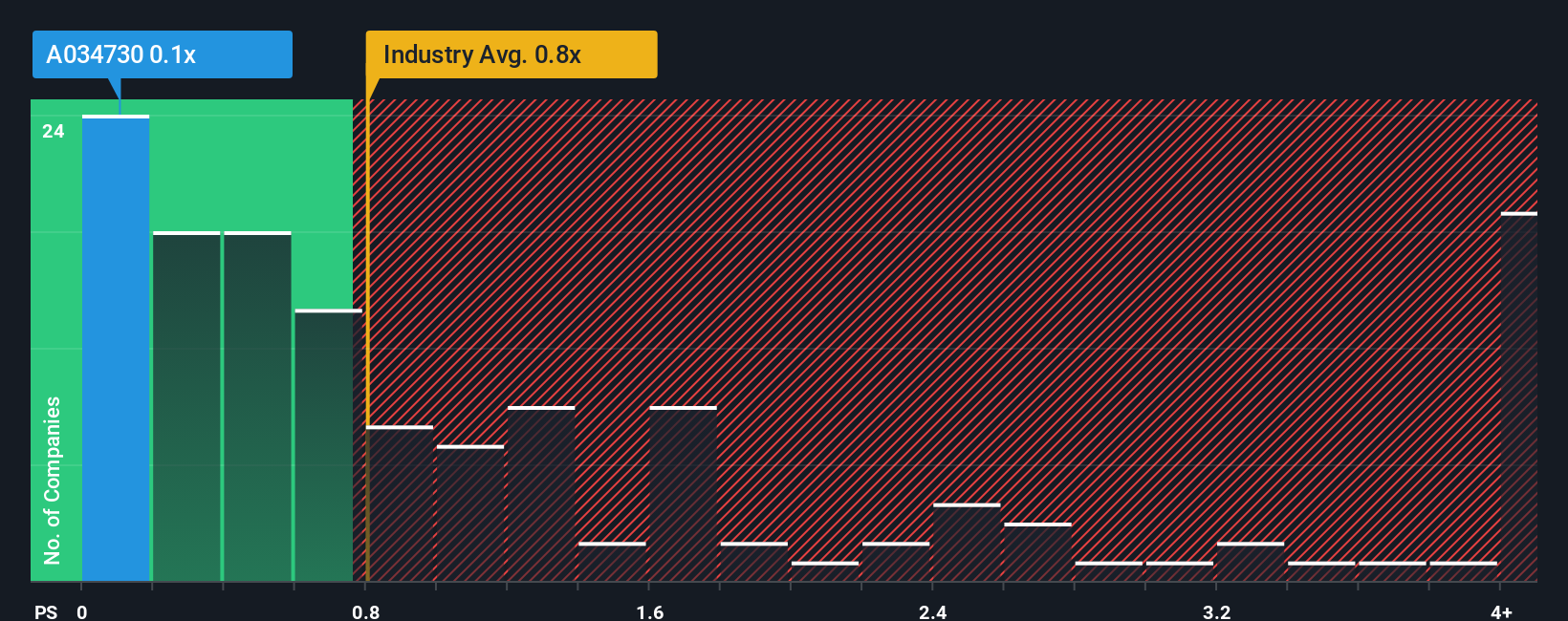

Although its price has surged higher, you could still be forgiven for feeling indifferent about SK's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Industrials industry in Korea is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for SK

How Has SK Performed Recently?

SK could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on SK will help you uncover what's on the horizon.How Is SK's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like SK's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.8%. Regardless, revenue has managed to lift by a handy 6.4% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 3.3% as estimated by the eight analysts watching the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 11%.

Despite the marginal growth, we find it odd that SK is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

SK's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though SK trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - SK has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A034730

SK

Engages in advanced materials, energy, life sciences and biopharmaceuticals, and digital businesses.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives