- Italy

- /

- Basic Materials

- /

- BIT:CALT

3 Reliable Dividend Stocks Yielding Up To 4.2%

Reviewed by Simply Wall St

In a week marked by mixed performances among major stock indexes, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reaching record highs while the Russell 2000 saw declines, investors are closely monitoring economic indicators and geopolitical developments. As growth stocks outperformed value stocks significantly, attention has turned to the Federal Reserve's upcoming decisions on interest rates amidst rebounding job growth in November. In this climate of economic uncertainty and sector divergence, dividend stocks offer a reliable income stream for investors seeking stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.41% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

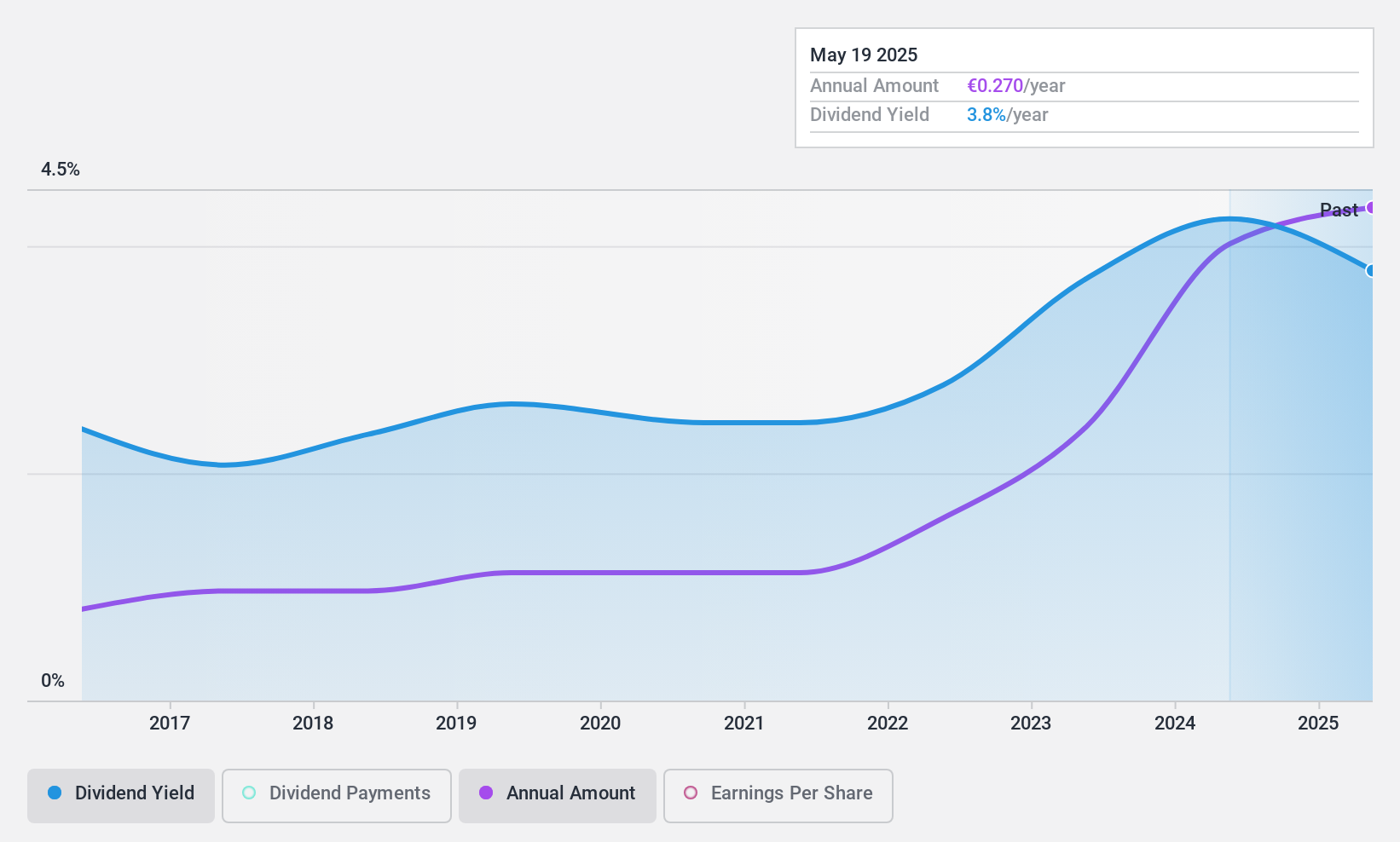

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates in the media, real estate, and publishing sectors through its subsidiaries and has a market cap of €778.38 million.

Operations: Caltagirone SpA generates revenue from several segments, including Publishing (€112.65 million), Constructions (€186.77 million), Management of Properties (€35.27 million), and Cement, Concrete and Aggregates (€1.64 billion).

Dividend Yield: 3.9%

Caltagirone's dividend profile shows stability and growth over the past decade, with a reliable yield of 3.86%. Despite being lower than the top 25% in the Italian market, its dividends are well covered by earnings (payout ratio: 21.7%) and cash flows (cash payout ratio: 9.1%). The stock trades at a significant discount to its estimated fair value, while recent earnings growth of 10.5% supports continued dividend sustainability.

- Get an in-depth perspective on Caltagirone's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Caltagirone shares in the market.

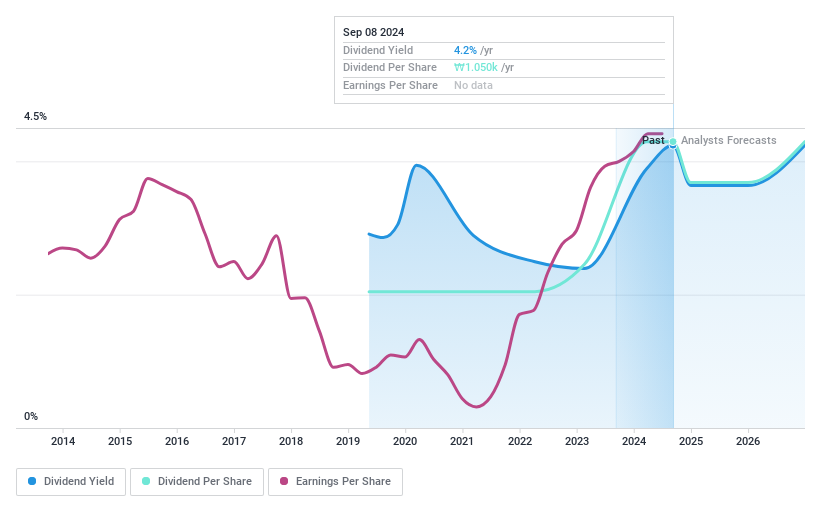

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hy-Lok Corporation operates globally in the fluid and control system industry with a market cap of ₩308.02 billion.

Operations: Hy-Lok Corporation generates revenue primarily from the manufacture and sale of fittings for mechanical equipment, flange valves, unions, and nipples, totaling ₩188.07 billion.

Dividend Yield: 4.2%

Hy-Lok offers a reliable dividend profile, with stable payments over six years and a yield of 4.21%, placing it in the top 25% of the KR market. Its dividends are well covered by earnings (payout ratio: 28.4%) and cash flows (cash payout ratio: 27.8%). The stock trades at a significant discount to its fair value, enhancing its appeal for value investors. Recent share buybacks reflect management's confidence in financial stability and shareholder returns.

- Click to explore a detailed breakdown of our findings in Hy-Lok's dividend report.

- Our comprehensive valuation report raises the possibility that Hy-Lok is priced lower than what may be justified by its financials.

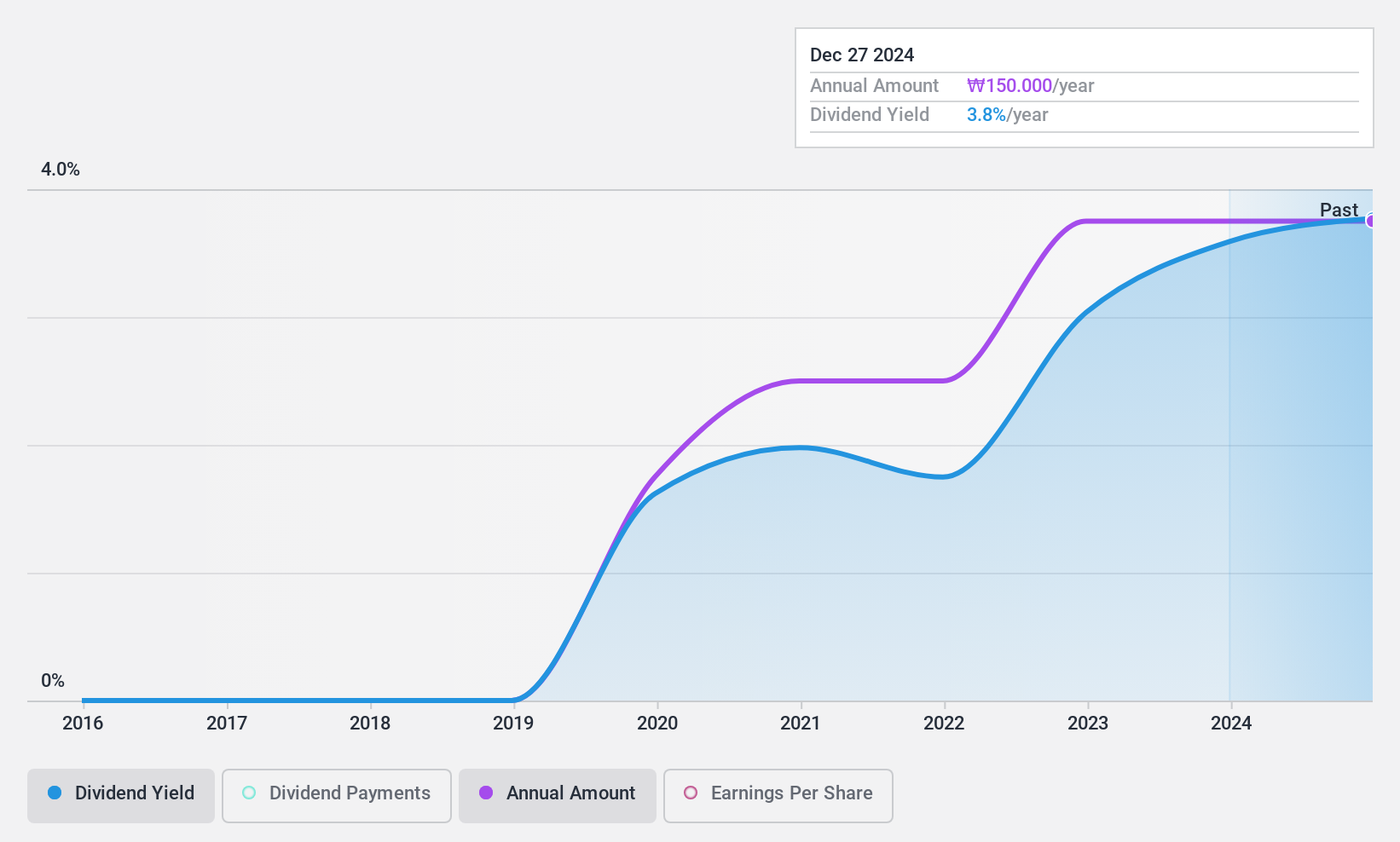

ILJIN HoldingsLtd (KOSE:A015860)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ILJIN Holdings Co., Ltd. operates as a parts and materials specialized company worldwide, with a market cap of ₩176.35 billion.

Operations: ILJIN Holdings Co., Ltd. generates its revenue primarily from Front Line Power at ₩1.46 billion, followed by Tool Material at ₩148.50 million and Medical Devices at ₩57.87 million, with additional income from Real Estate Rental amounting to ₩10.34 million.

Dividend Yield: 4%

ILJIN Holdings Ltd. provides a compelling dividend profile with a yield of 4.02%, ranking in the top 25% of the KR market, supported by a low payout ratio of 25.8% and cash flow coverage at 49.1%. However, dividends have been issued for only five years, indicating limited historical reliability despite stable growth. Recent earnings showed decreased sales and net income, potentially impacting future dividend sustainability and investor sentiment.

- Delve into the full analysis dividend report here for a deeper understanding of ILJIN HoldingsLtd.

- The valuation report we've compiled suggests that ILJIN HoldingsLtd's current price could be inflated.

Seize The Opportunity

- Dive into all 1944 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CALT

Caltagirone

Through its subsidiaries, engages in the cement manufacturing, media, real estate, and publishing activities.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives