- South Korea

- /

- Construction

- /

- KOSE:A013360

Ilsung Construction Co., Ltd. (KRX:013360) Soars 121% But It's A Story Of Risk Vs Reward

Despite an already strong run, Ilsung Construction Co., Ltd. (KRX:013360) shares have been powering on, with a gain of 121% in the last thirty days. The annual gain comes to 149% following the latest surge, making investors sit up and take notice.

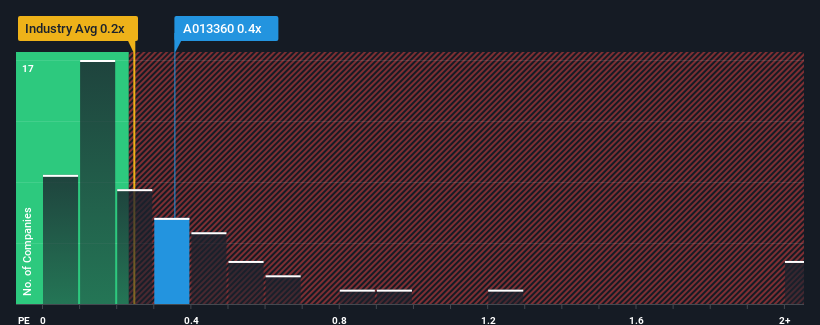

In spite of the firm bounce in price, it's still not a stretch to say that Ilsung Construction's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Construction industry in Korea, where the median P/S ratio is around 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ilsung Construction

What Does Ilsung Construction's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Ilsung Construction over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ilsung Construction's earnings, revenue and cash flow.How Is Ilsung Construction's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Ilsung Construction's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 0.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Ilsung Construction is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Ilsung Construction's P/S Mean For Investors?

Ilsung Construction appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Ilsung Construction revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Ilsung Construction (2 are potentially serious!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A013360

Ilsung Construction

Operates as a construction company in South Korea, Philippines, Myanmar, Cambodia, Laos, Paraguay, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives