- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A012450

What Hanwha Aerospace Co., Ltd.'s (KRX:012450) 27% Share Price Gain Is Not Telling You

Hanwha Aerospace Co., Ltd. (KRX:012450) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

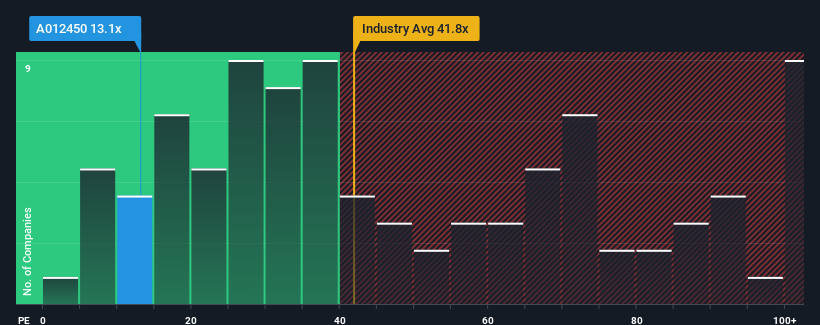

In spite of the firm bounce in price, there still wouldn't be many who think Hanwha Aerospace's price-to-earnings (or "P/E") ratio of 13.1x is worth a mention when the median P/E in Korea is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Hanwha Aerospace as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Hanwha Aerospace

How Is Hanwha Aerospace's Growth Trending?

The only time you'd be comfortable seeing a P/E like Hanwha Aerospace's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 357%. Pleasingly, EPS has also lifted 858% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 10% each year as estimated by the twelve analysts watching the company. With the market predicted to deliver 22% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Hanwha Aerospace is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Hanwha Aerospace's P/E

Hanwha Aerospace appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Hanwha Aerospace's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hanwha Aerospace that you should be aware of.

Of course, you might also be able to find a better stock than Hanwha Aerospace. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A012450

Hanwha Aerospace

Engages in the development, production, and maintenance of aircraft engines worldwide.

Fair value with moderate growth potential.

Market Insights

Community Narratives