- South Korea

- /

- Trade Distributors

- /

- KOSE:A011810

Shareholders in STX (KRX:011810) have lost 86%, as stock drops 13% this past week

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame STX Corporation (KRX:011810) shareholders if they were still in shock after the stock dropped like a lead balloon, down 89% in just one year. That'd be a striking reminder about the importance of diversification. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 17% in three years. The falls have accelerated recently, with the share price down 37% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for STX

STX wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

STX's revenue didn't grow at all in the last year. In fact, it fell 10.0%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 89%. That's a stern reminder that profitless companies need to grow the top line, at the very least. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

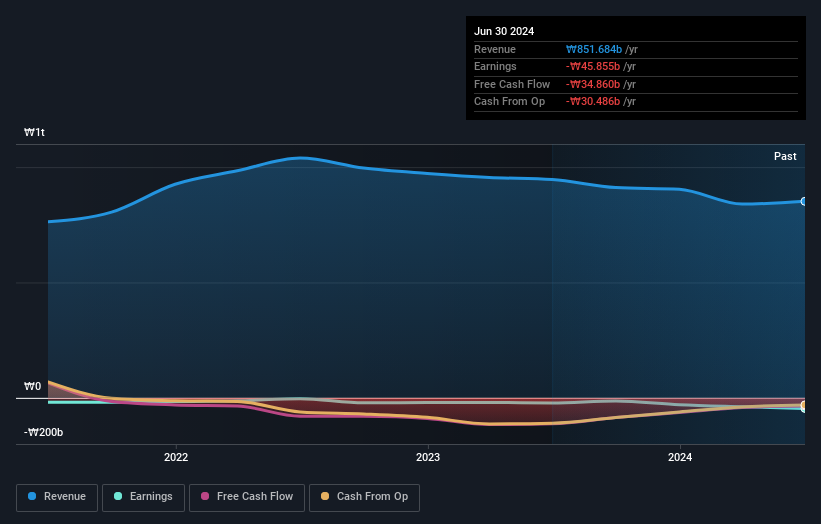

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between STX's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. STX hasn't been paying dividends, but its TSR of -86% exceeds its share price return of -89%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We regret to report that STX shareholders are down 86% for the year. Unfortunately, that's worse than the broader market decline of 2.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for STX (2 make us uncomfortable!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011810

STX

Engages in energy, commodity, and machinery and engine trading activities in South Korea and internationally.

Adequate balance sheet and slightly overvalued.