- South Korea

- /

- Trade Distributors

- /

- KOSE:A011810

Further weakness as STX (KRX:011810) drops 11% this week, taking one-year losses to 60%

Even the best stock pickers will make plenty of bad investments. And there's no doubt that STX Corporation (KRX:011810) stock has had a really bad year. The share price is down a hefty 60% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 38% in the last three years. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Because STX made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In just one year STX saw its revenue fall by 7.5%. That's not what investors generally want to see. In the absence of profits, it's not unreasonable that the share price fell 60%. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

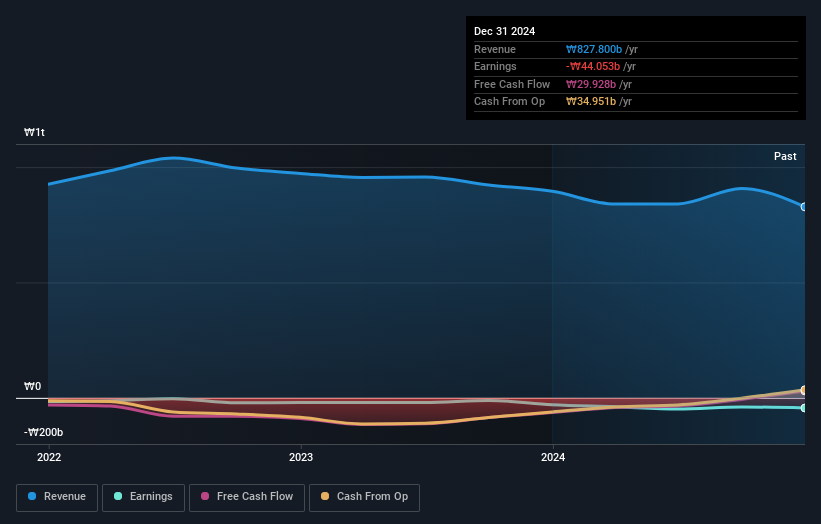

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 8.2% in the twelve months, STX shareholders did even worse, losing 60%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand STX better, we need to consider many other factors. For instance, we've identified 2 warning signs for STX (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

If you're looking to trade STX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011810

STX

Engages in energy, commodity, and machinery and engine trading activities in South Korea and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives