- South Korea

- /

- Construction

- /

- KOSE:A010780

Subdued Growth No Barrier To IS DongSeo Co., Ltd.'s (KRX:010780) Price

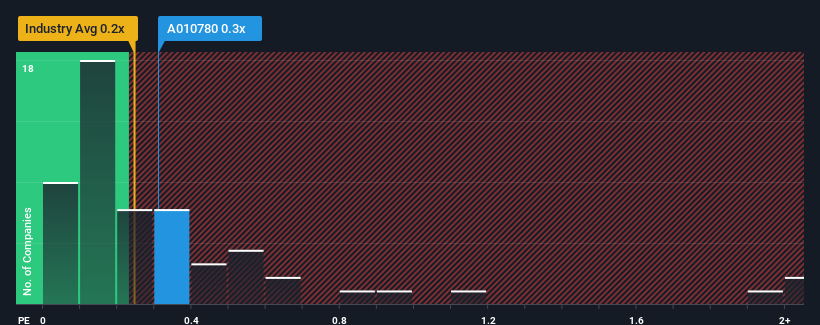

There wouldn't be many who think IS DongSeo Co., Ltd.'s (KRX:010780) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Construction industry in Korea is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for IS DongSeo

What Does IS DongSeo's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, IS DongSeo's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IS DongSeo.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like IS DongSeo's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company are not good at all, suggesting revenue should decline by 7.1% over the next year. Meanwhile, the broader industry is forecast to moderate by 0.1%, which indicates the company should perform poorly indeed.

In light of this, it's somewhat peculiar that IS DongSeo's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

IS DongSeo's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 4 warning signs we've spotted with IS DongSeo (including 1 which is potentially serious).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010780

IS DongSeo

Engages in the construction and construction materials businesses in South Korea.

Average dividend payer and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success