- South Korea

- /

- Construction

- /

- KOSE:A006360

Revenues Tell The Story For GS Engineering & Construction Corporation (KRX:006360) As Its Stock Soars 26%

GS Engineering & Construction Corporation (KRX:006360) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

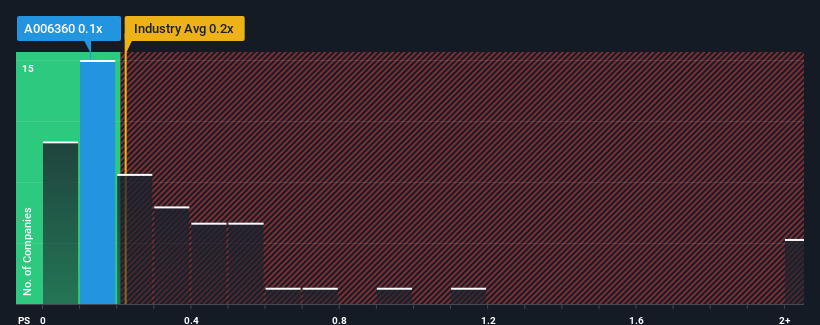

Although its price has surged higher, it's still not a stretch to say that GS Engineering & Construction's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Construction industry in Korea, where the median P/S ratio is around 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for GS Engineering & Construction

How GS Engineering & Construction Has Been Performing

While the industry has experienced revenue growth lately, GS Engineering & Construction's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on GS Engineering & Construction will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GS Engineering & Construction's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.8% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 36% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 1.4% over the next year. With the industry predicted to deliver 2.2% growth , the company is positioned for a comparable revenue result.

With this information, we can see why GS Engineering & Construction is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On GS Engineering & Construction's P/S

GS Engineering & Construction appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at GS Engineering & Construction's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You always need to take note of risks, for example - GS Engineering & Construction has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006360

GS Engineering & Construction

Engages in the civil works and construction, sales of new houses, repairs and maintenance, overseas general construction, and technology consultation activities in South Korea and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives