Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that LS Corp. (KRX:006260) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for LS

What Is LS's Debt?

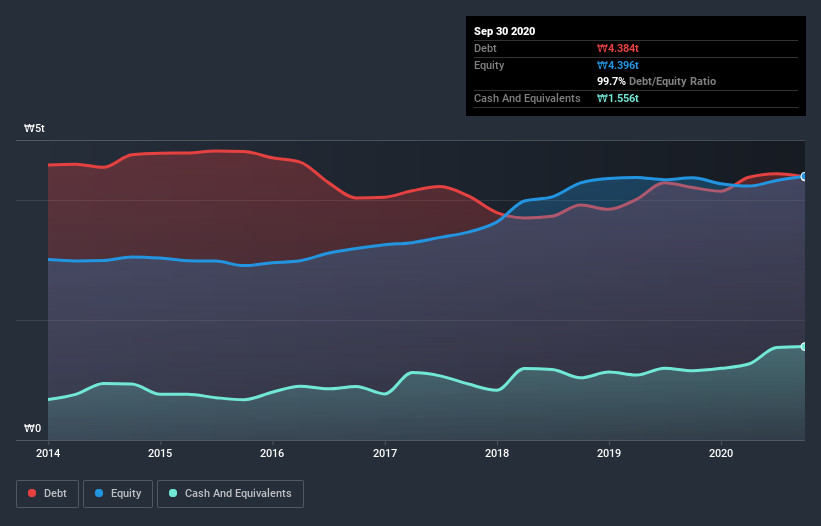

You can click the graphic below for the historical numbers, but it shows that as of September 2020 LS had ₩4.38t of debt, an increase on ₩4.21t, over one year. On the flip side, it has ₩1.56t in cash leading to net debt of about ₩2.83t.

A Look At LS's Liabilities

Zooming in on the latest balance sheet data, we can see that LS had liabilities of ₩4.21t due within 12 months and liabilities of ₩2.77t due beyond that. Offsetting these obligations, it had cash of ₩1.56t as well as receivables valued at ₩2.31t due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩3.12t.

The deficiency here weighs heavily on the ₩2.01t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, LS would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.4 times and a disturbingly high net debt to EBITDA ratio of 5.1 hit our confidence in LS like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even more troubling is the fact that LS actually let its EBIT decrease by 4.1% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine LS's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, LS recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

To be frank both LS's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its interest cover fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like LS has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for LS (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading LS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A006260

LS

Engages in electric power, automation, machinery, materials, and energy businesses in South Korea and internationally.

Solid track record and good value.

Market Insights

Community Narratives