- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A003570

The Trends At S&T Dynamics (KRX:003570) That You Should Know About

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think S&T Dynamics (KRX:003570) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for S&T Dynamics, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.02 = ₩15b ÷ (₩840b - ₩119b) (Based on the trailing twelve months to September 2020).

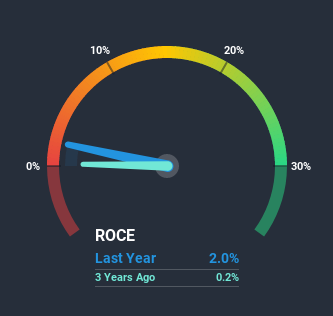

Thus, S&T Dynamics has an ROCE of 2.0%. Ultimately, that's a low return and it under-performs the Aerospace & Defense industry average of 4.3%.

Check out our latest analysis for S&T Dynamics

Historical performance is a great place to start when researching a stock so above you can see the gauge for S&T Dynamics' ROCE against it's prior returns. If you're interested in investigating S&T Dynamics' past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

There hasn't been much to report for S&T Dynamics' returns and its level of capital employed because both metrics have been steady for the past five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if S&T Dynamics doesn't end up being a multi-bagger in a few years time.

Our Take On S&T Dynamics' ROCE

In summary, S&T Dynamics isn't compounding its earnings but is generating stable returns on the same amount of capital employed. And in the last five years, the stock has given away 51% so the market doesn't look too hopeful on these trends strengthening any time soon. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

One more thing, we've spotted 1 warning sign facing S&T Dynamics that you might find interesting.

While S&T Dynamics may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading S&T Dynamics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A003570

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives