- South Korea

- /

- Trade Distributors

- /

- KOSE:A001120

Top Dividend Stocks On KRX In September 2024

Reviewed by Simply Wall St

The South Korean market has seen a modest 1.5% rise over the last week, though it has remained flat over the past 12 months. With earnings projected to grow by 29% annually in the coming years, identifying strong dividend stocks can provide reliable income and potential for capital appreciation amidst these conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.57% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.23% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.67% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.36% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.33% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.76% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.08% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.48% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 5.97% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.62% | ★★★★☆☆ |

Click here to see the full list of 63 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

WINS (KOSDAQ:A136540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WINS Co., Ltd. offers information security solutions and services in South Korea, with a market cap of ₩158.36 billion.

Operations: WINS Co., Ltd. generates revenue of ₩104.58 billion from its Security Software & Services segment.

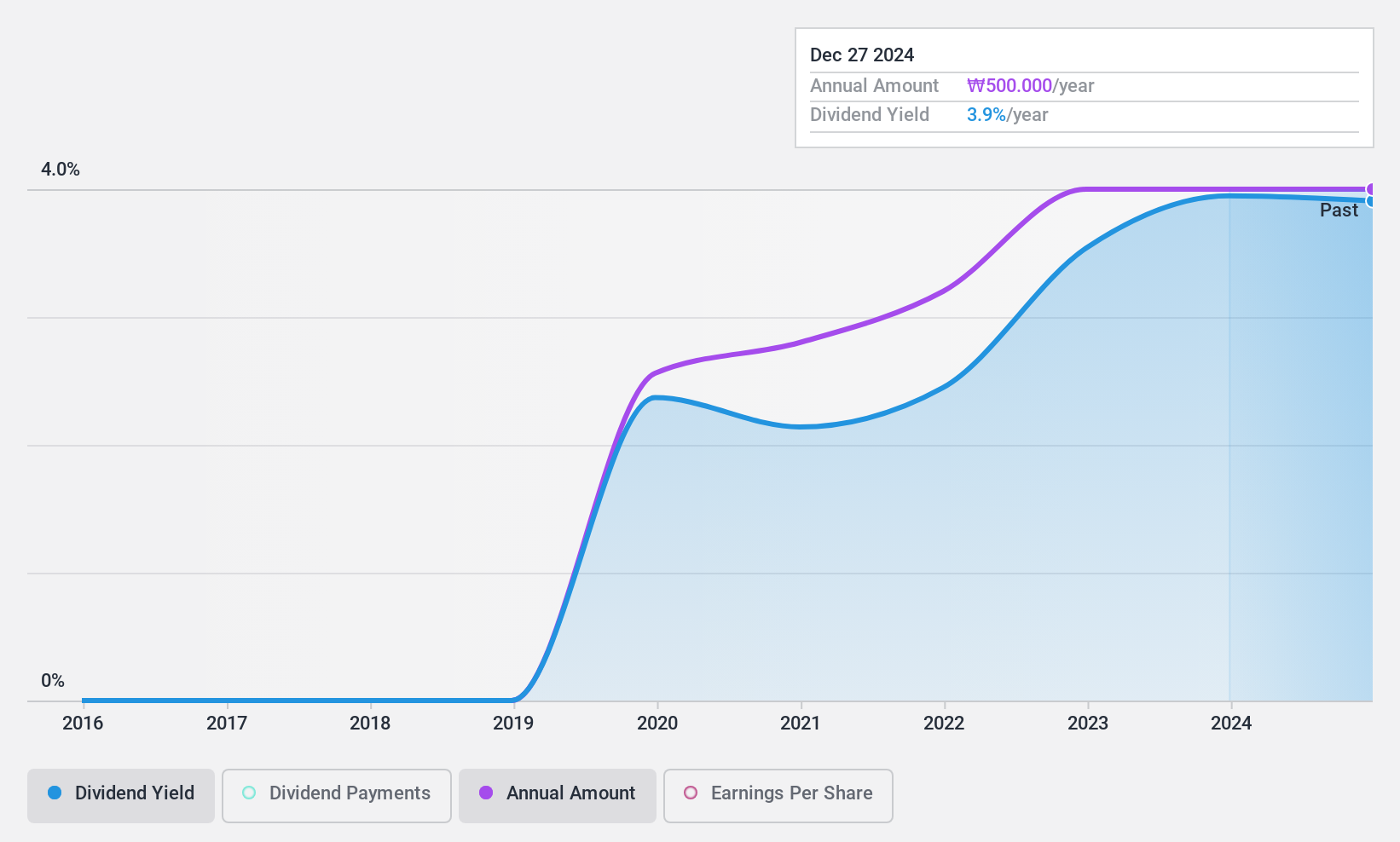

Dividend Yield: 3.9%

WINS Co., Ltd has been paying dividends for five years, with stable and growing payments. The company's dividend yield is 3.9%, placing it in the top 25% of South Korean dividend payers. Dividends are well covered by earnings (31.4% payout ratio) and free cash flow (32% cash payout ratio). Recent earnings showed increased sales but decreased net income, impacting basic earnings per share from KRW 602 to KRW 303 year-over-year for Q2 2024.

- Take a closer look at WINS' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of WINS shares in the market.

LX International (KOSE:A001120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX International Corp. operates in the trading business both in Korea and internationally, with a market cap of approximately ₩10.88 billion.

Operations: LX International Corp.'s revenue primarily comes from three segments: the Resource Sector (₩1.07 billion), Trading/New Business (₩7.16 billion), and the Logistics Division (₩6.99 billion).

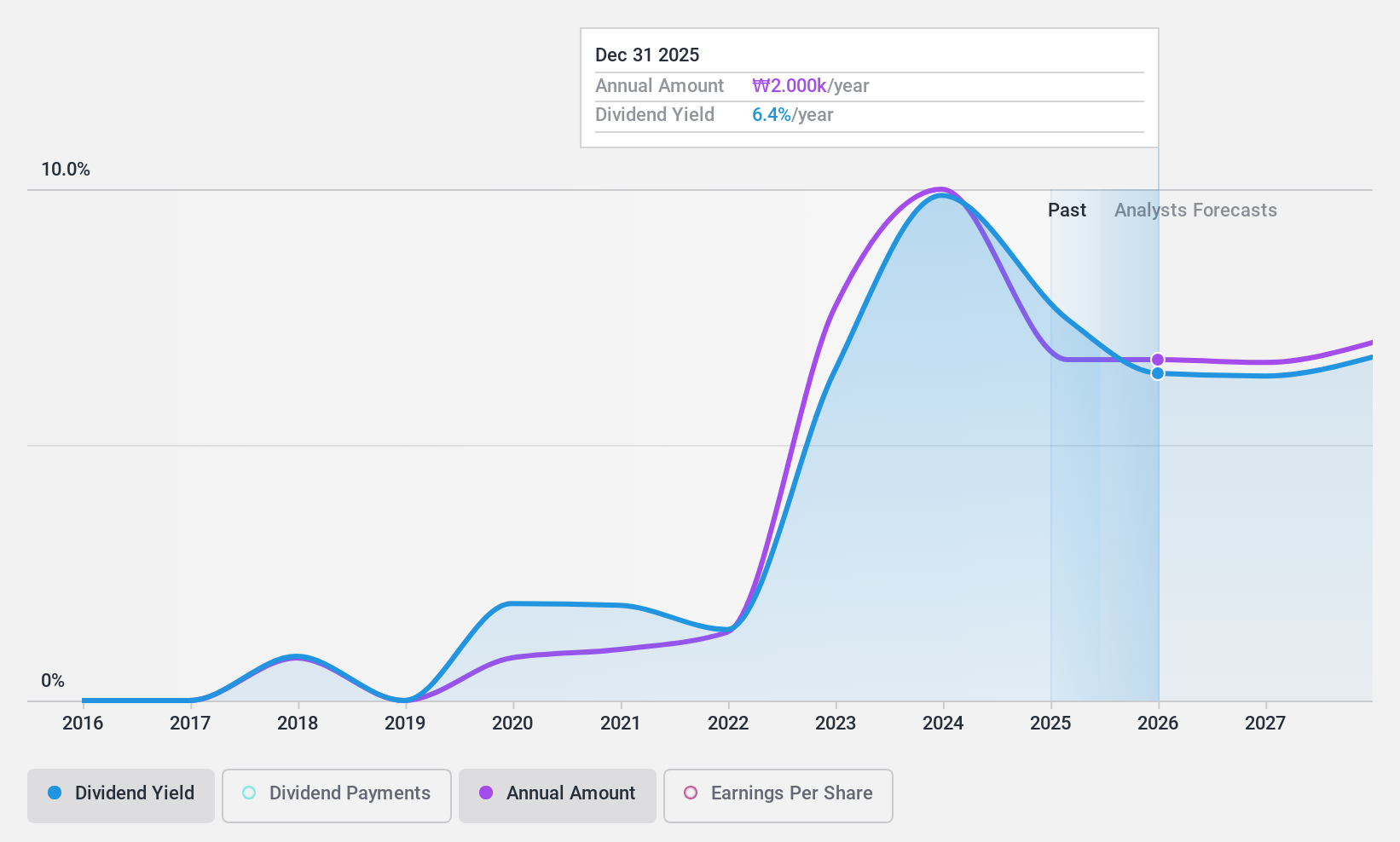

Dividend Yield: 4%

LX International's dividend yield is 3.97%, ranking it in the top 25% of South Korean dividend payers. The dividends are well covered by earnings (35.6% payout ratio) and free cash flow (10.4% cash payout ratio). However, the company has only paid dividends for eight years, with a volatile track record. Recent Q2 2024 results showed significant growth, with sales reaching ₩4 trillion and net income at ₩90.30 billion, up from ₩40.90 billion last year.

- Unlock comprehensive insights into our analysis of LX International stock in this dividend report.

- The valuation report we've compiled suggests that LX International's current price could be quite moderate.

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cuckoo Holdings Co., Ltd., with a market cap of ₩741.22 billion, manufactures and sells electric heaters and daily necessities in South Korea and internationally through its subsidiaries.

Operations: Cuckoo Holdings Co., Ltd. generates revenue primarily from its electric heating appliances segment, amounting to ₩797.73 billion.

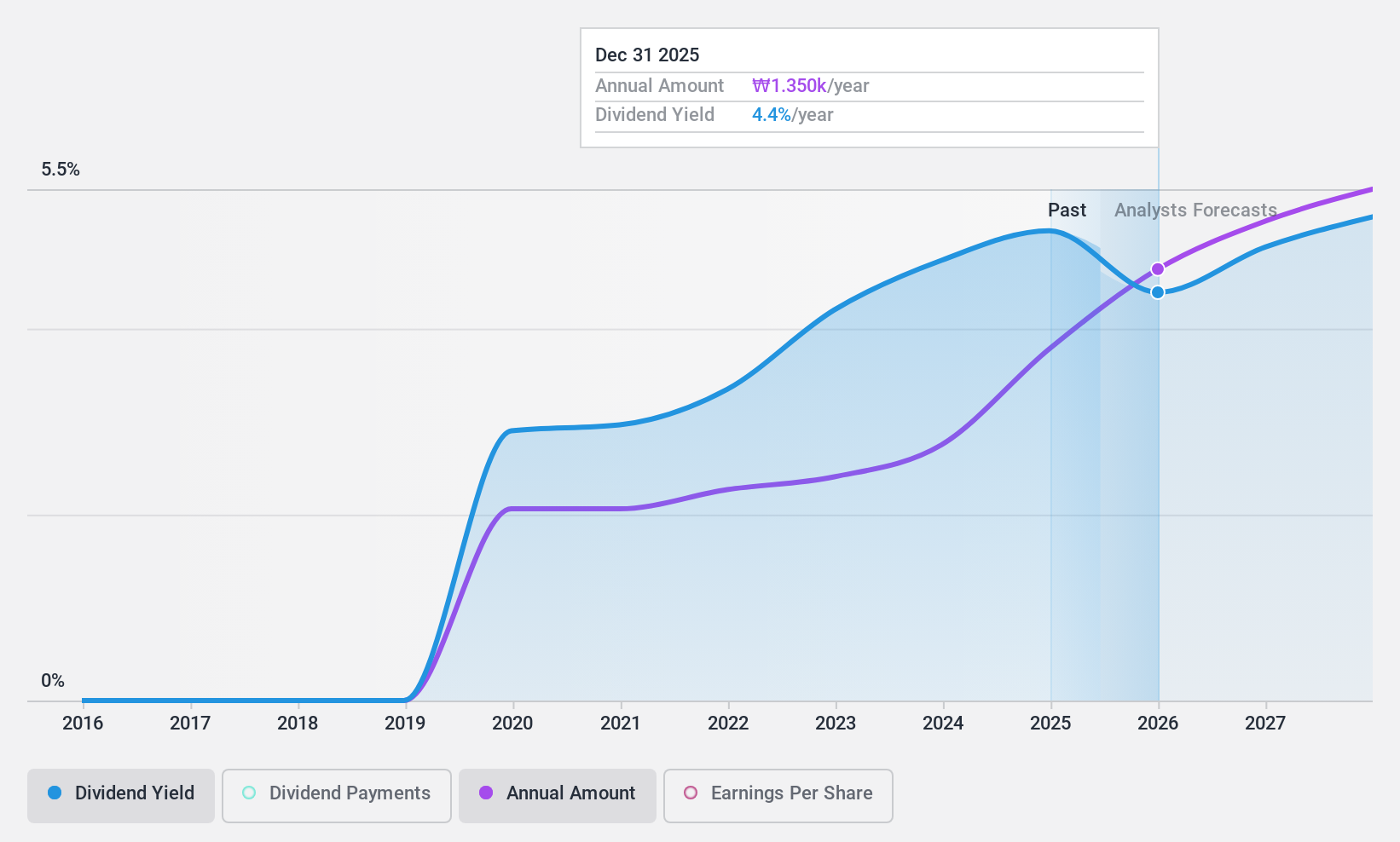

Dividend Yield: 4.6%

Cuckoo Holdings' dividend yield of 4.61% places it among the top 25% in South Korea. The dividends are well-covered by earnings (26.7% payout ratio) and cash flows (41.2% cash payout ratio). Despite a stable growth pattern, the company has only been paying dividends for five years, making its track record relatively short compared to more established dividend payers. Earnings have grown at an annual rate of 8.8% over the past five years, supporting future payouts.

- Get an in-depth perspective on Cuckoo Holdings' performance by reading our dividend report here.

- The analysis detailed in our Cuckoo Holdings valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Gain an insight into the universe of 63 Top KRX Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001120

LX International

Engages in the trading business in Korea and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives