- South Korea

- /

- Construction

- /

- KOSE:A000720

What Hyundai Engineering & Construction Co.,Ltd.'s (KRX:000720) 26% Share Price Gain Is Not Telling You

Hyundai Engineering & Construction Co.,Ltd. (KRX:000720) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 45%.

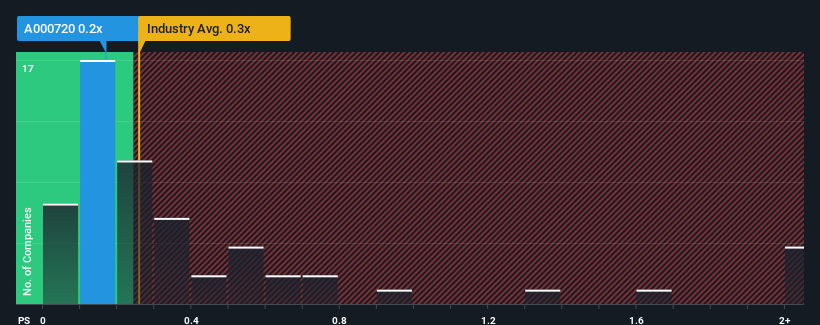

Although its price has surged higher, there still wouldn't be many who think Hyundai Engineering & ConstructionLtd's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Korea's Construction industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in Hyundai Engineering & ConstructionLtd. Read for free now.View our latest analysis for Hyundai Engineering & ConstructionLtd

What Does Hyundai Engineering & ConstructionLtd's P/S Mean For Shareholders?

Recent times have been advantageous for Hyundai Engineering & ConstructionLtd as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hyundai Engineering & ConstructionLtd.How Is Hyundai Engineering & ConstructionLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hyundai Engineering & ConstructionLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Pleasingly, revenue has also lifted 81% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.3% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 3.2% growth per annum, that's a disappointing outcome.

In light of this, it's somewhat alarming that Hyundai Engineering & ConstructionLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Hyundai Engineering & ConstructionLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Hyundai Engineering & ConstructionLtd currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Hyundai Engineering & ConstructionLtd that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Engineering & ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000720

Hyundai Engineering & ConstructionLtd

Hyundai Engineering & Construction Co.,Ltd.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives