- South Korea

- /

- Machinery

- /

- KOSDAQ:A900280

Why Investors Shouldn't Be Surprised By Cayman Golden Century Wheel Group Limited's (KOSDAQ:900280) Low P/S

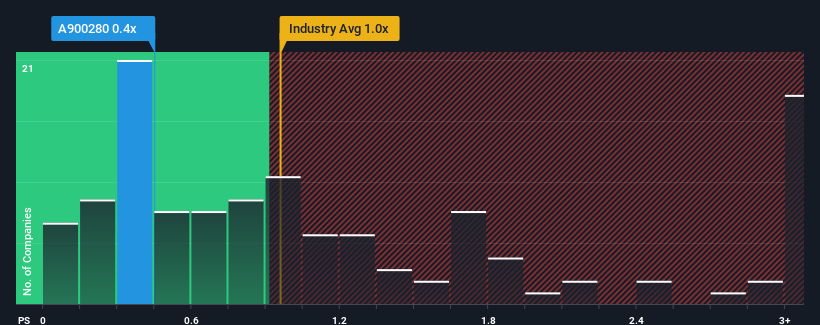

When close to half the companies operating in the Machinery industry in Korea have price-to-sales ratios (or "P/S") above 1x, you may consider Cayman Golden Century Wheel Group Limited (KOSDAQ:900280) as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Cayman Golden Century Wheel Group

What Does Cayman Golden Century Wheel Group's Recent Performance Look Like?

For instance, Cayman Golden Century Wheel Group's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cayman Golden Century Wheel Group will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Cayman Golden Century Wheel Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 58% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 30% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Cayman Golden Century Wheel Group is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Cayman Golden Century Wheel Group's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Cayman Golden Century Wheel Group maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Cayman Golden Century Wheel Group (including 2 which can't be ignored).

If these risks are making you reconsider your opinion on Cayman Golden Century Wheel Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A900280

Cayman Golden Century Wheel Group

Through its subsidiaries, manufactures and sells wheel and tire products for agricultural vehicles in China.

Mediocre balance sheet low.