- South Korea

- /

- Biotech

- /

- KOSE:A302440

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate cuts and mixed economic indicators, the technology-heavy Nasdaq Composite has reached unprecedented heights, surpassing the 20,000 mark for the first time. This environment highlights the potential of high-growth tech stocks, which are often characterized by their innovative capabilities and resilience in a fluctuating market.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

SK bioscienceLtd (KOSE:A302440)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SK bioscience Co., Ltd. is involved in the research, development, production, and distribution of vaccines and biopharmaceuticals both in Korea and internationally, with a market cap of ₩4.28 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ₩201.30 billion. It focuses on the vaccine and biopharmaceutical sectors, operating both domestically and internationally.

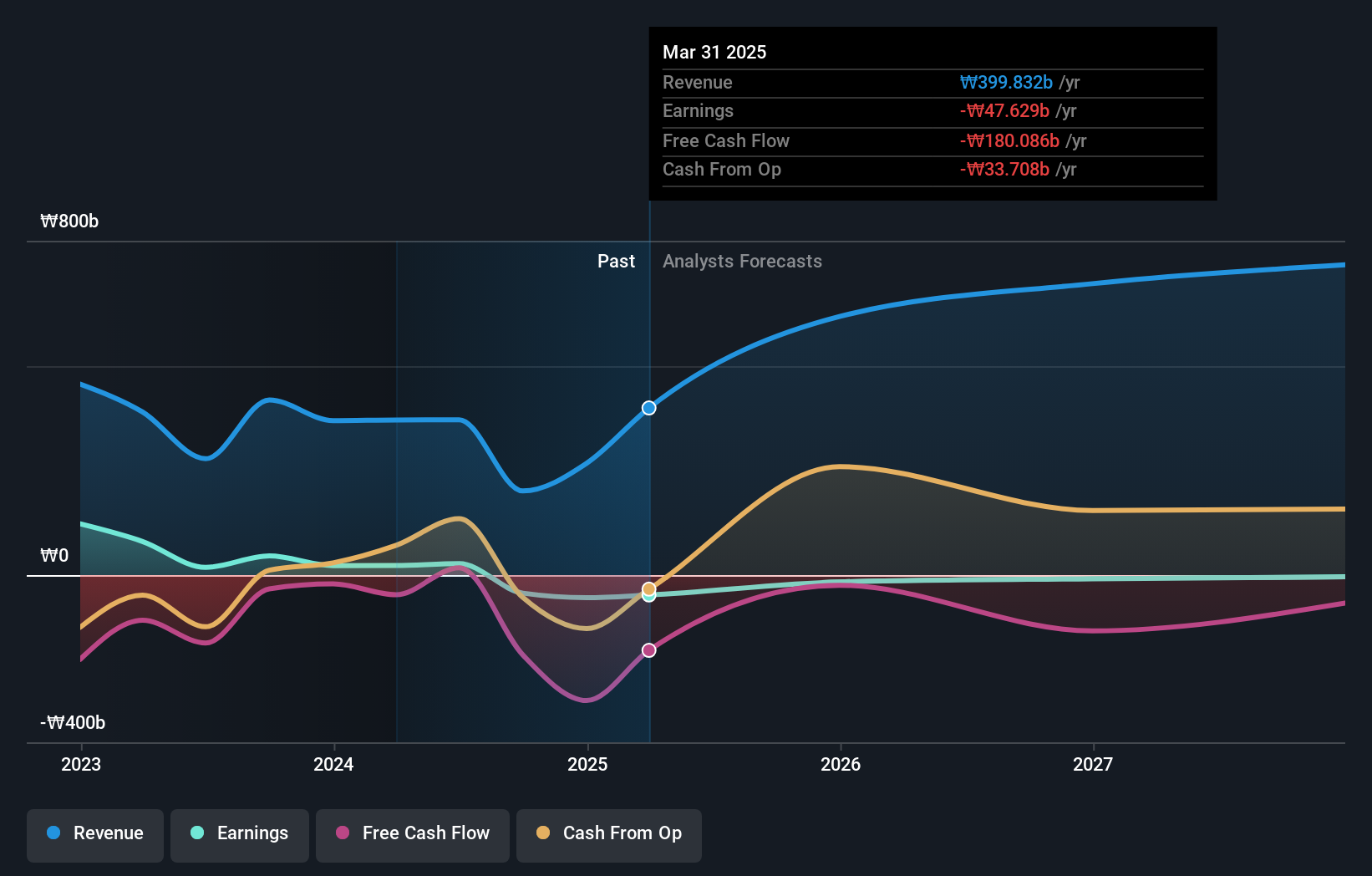

SK bioscienceLtd is making significant strides in the biotech sector, particularly with its recent advancements in mRNA vaccine technology. The company's collaboration with CEPI, backed by up to $140 million in funding, underscores its commitment to addressing global pandemic threats rapidly—a critical capability demonstrated by their development of vaccines against Japanese encephalitis and Lassa fever viruses. This initiative not only enhances SK bioscience's position in cutting-edge vaccine platforms but also aligns with the 100 Days Mission to expedite vaccine production for emerging diseases. Furthermore, the approval of SKYCellflu in Indonesia marks a pivotal expansion into Southeast Asia, showcasing the advantages of cell-culture technology over traditional egg-based methods and setting a precedent for rapid pandemic response. These developments are part of why SK bioscience’s revenue is expected to grow at an impressive rate of 22.2% annually, significantly outpacing the Korean market projection of 8.9%.

- Click here and access our complete health analysis report to understand the dynamics of SK bioscienceLtd.

Assess SK bioscienceLtd's past performance with our detailed historical performance reports.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$23.79 billion.

Operations: Fourth Paradigm generates revenue primarily through its Sage AI Platform, contributing CN¥3 billion, followed by Shift Intelligent Solutions at CN¥1.15 billion, and Sagegpt Aigs Services at CN¥448.1 million. The company's gross profit margin is a notable aspect of its financial profile.

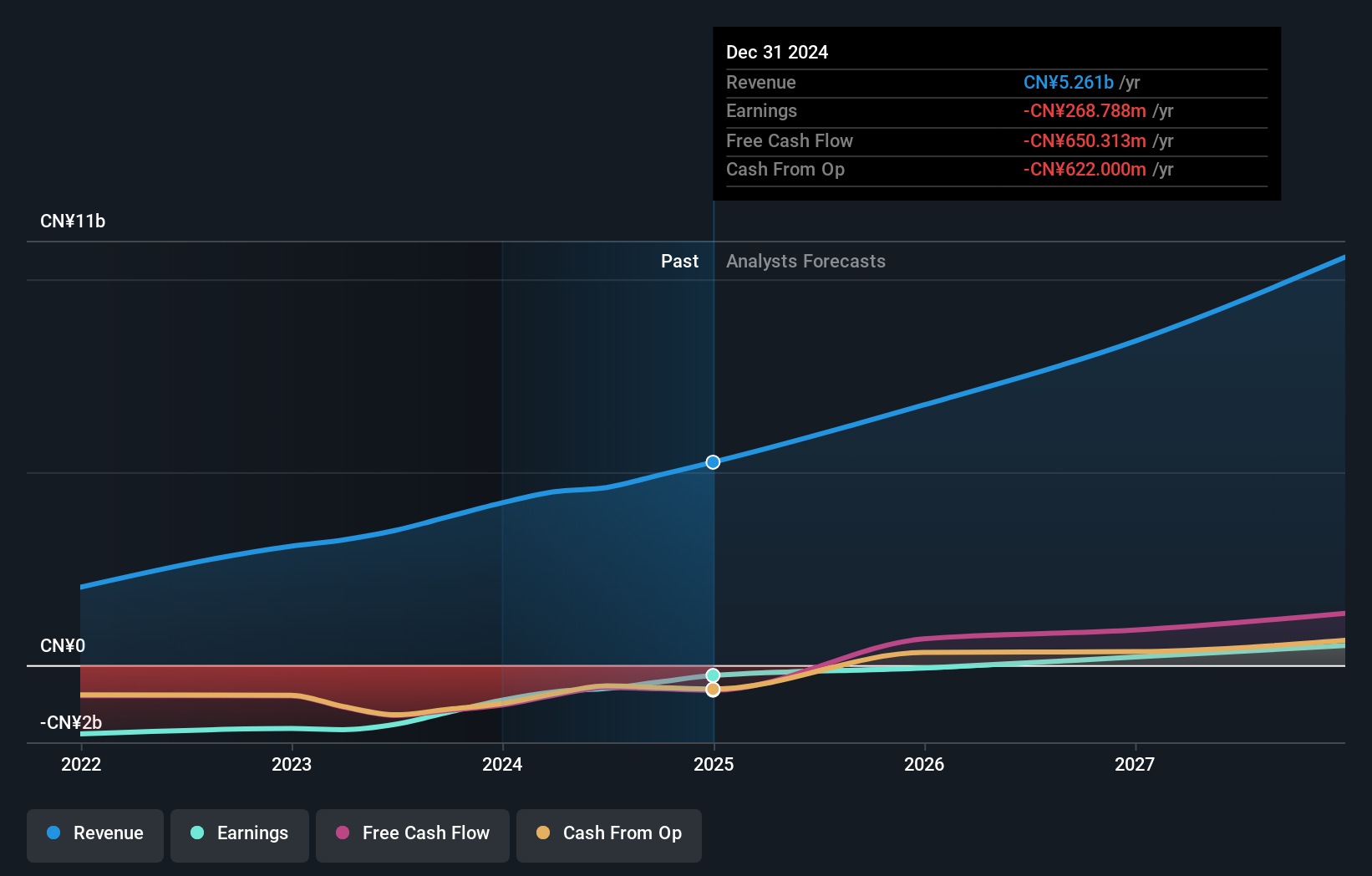

Beijing Fourth Paradigm Technology has recently been added to the S&P Global BMI Index, reflecting its growing prominence in the tech sector. Despite a highly volatile share price in recent months, the company's revenue is expected to increase by 19.3% annually, outpacing the Hong Kong market's growth of 7.8%. This growth is supported by substantial R&D investments aimed at fostering innovation and maintaining competitive edge in software development. Moreover, earnings are projected to surge by 113.1% annually as it moves towards profitability within three years, signaling robust future prospects despite current unprofitability and a forecasted low return on equity of 2.4%.

- Navigate through the intricacies of Beijing Fourth Paradigm Technology with our comprehensive health report here.

Understand Beijing Fourth Paradigm Technology's track record by examining our Past report.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$15.24 billion.

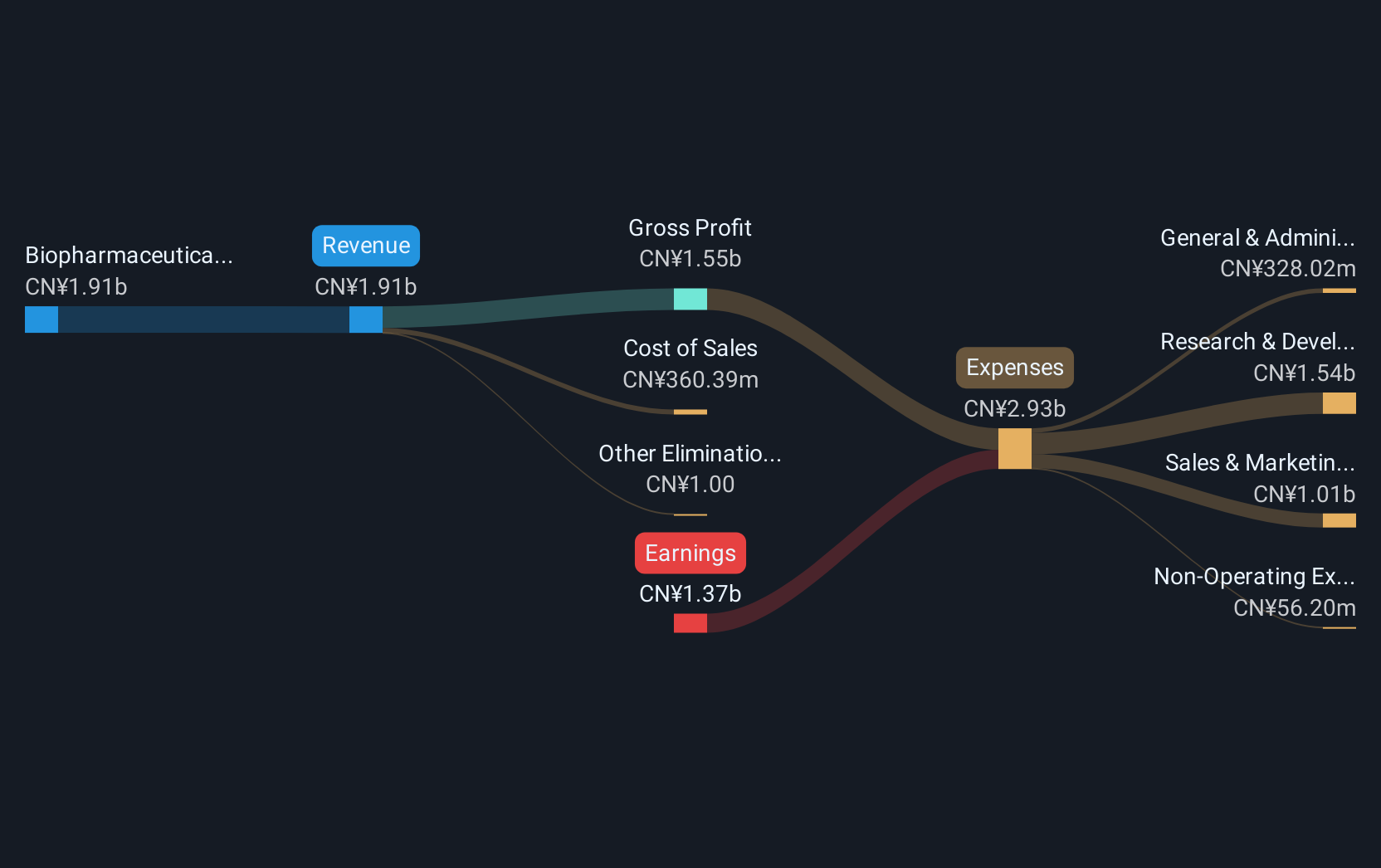

Operations: RemeGen focuses on the discovery, development, and commercialization of biologics targeting autoimmune, oncology, and ophthalmic diseases. Its primary revenue stream is derived from biopharmaceutical research, service, production, and sales amounting to CN¥1.52 billion.

RemeGen's recent presentation at the San Antonio Breast Cancer Symposium showcased its innovative Disitamab Vedotin, marking a significant stride in HER2-positive breast cancer treatment. This aligns with RemeGen’s robust R&D focus, where substantial investments are channeled into developing groundbreaking therapies. Despite current financial challenges reflected by a net loss of CNY 1.07 billion and a volatile share price, the company's revenue has surged to CNY 1.21 billion from last year's CNY 769.47 million, indicating a promising growth trajectory of 26.1% annually. These developments suggest potential for future profitability and position RemeGen as an emerging leader in biotechnology innovations amidst high market expectations for revenue and earnings growth.

- Unlock comprehensive insights into our analysis of RemeGen stock in this health report.

Evaluate RemeGen's historical performance by accessing our past performance report.

Where To Now?

- Click this link to deep-dive into the 1280 companies within our High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A302440

SK bioscienceLtd

Engages in the research and development, production, and distribution of vaccines and biopharmaceuticals in Korea and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives