- South Korea

- /

- Electrical

- /

- KOSDAQ:A393890

What You Can Learn From W-Scope Chungju Plant Co., Ltd.'s (KOSDAQ:393890) P/S After Its 26% Share Price Crash

Unfortunately for some shareholders, the W-Scope Chungju Plant Co., Ltd. (KOSDAQ:393890) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

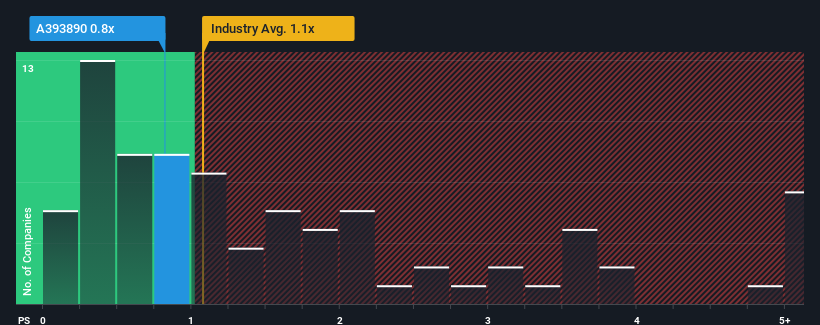

Although its price has dipped substantially, there still wouldn't be many who think W-Scope Chungju Plant's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Korea's Electrical industry is similar at about 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for W-Scope Chungju Plant

What Does W-Scope Chungju Plant's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, W-Scope Chungju Plant has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on W-Scope Chungju Plant will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think W-Scope Chungju Plant's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like W-Scope Chungju Plant's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. This was backed up an excellent period prior to see revenue up by 74% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the seven analysts watching the company. That's shaping up to be similar to the 22% per annum growth forecast for the broader industry.

In light of this, it's understandable that W-Scope Chungju Plant's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

With its share price dropping off a cliff, the P/S for W-Scope Chungju Plant looks to be in line with the rest of the Electrical industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A W-Scope Chungju Plant's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electrical industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for W-Scope Chungju Plant (1 shouldn't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if W-Scope Chungju Plant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A393890

W-Scope Chungju Plant

Provides battery parts and materials for automobiles and energy storage.

High growth potential very low.

Market Insights

Community Narratives