- South Korea

- /

- Electrical

- /

- KOSDAQ:A393890

W-Scope Chungju Plant Co., Ltd.'s (KOSDAQ:393890) Popularity With Investors Under Threat As Stock Sinks 27%

To the annoyance of some shareholders, W-Scope Chungju Plant Co., Ltd. (KOSDAQ:393890) shares are down a considerable 27% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

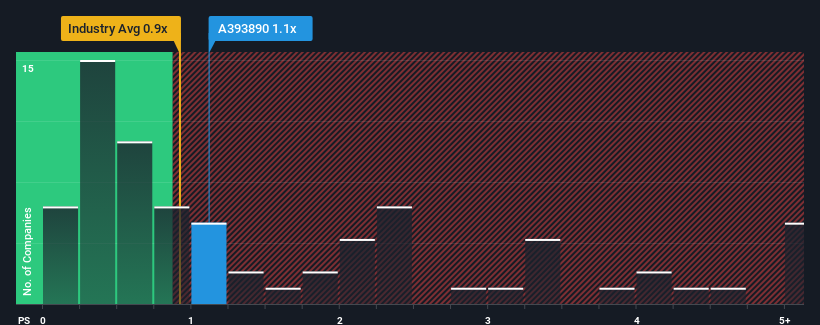

Even after such a large drop in price, there still wouldn't be many who think W-Scope Chungju Plant's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in Korea's Electrical industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for W-Scope Chungju Plant

What Does W-Scope Chungju Plant's Recent Performance Look Like?

Recent times have been pleasing for W-Scope Chungju Plant as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on W-Scope Chungju Plant will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like W-Scope Chungju Plant's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The latest three year period has also seen an excellent 114% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 22% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that W-Scope Chungju Plant's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does W-Scope Chungju Plant's P/S Mean For Investors?

W-Scope Chungju Plant's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that W-Scope Chungju Plant's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with W-Scope Chungju Plant (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if W-Scope Chungju Plant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A393890

W-Scope Chungju Plant

Provides battery parts and materials for automobiles and energy storage.

High growth potential very low.

Market Insights

Community Narratives