- South Korea

- /

- Construction

- /

- KOSDAQ:A319400

Discovering Undiscovered Gems with Promising Potential In December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, small-cap stocks have notably outperformed their larger counterparts, with the Russell 2000 Index advancing significantly. This environment of cautious optimism presents an opportune moment to explore lesser-known stocks that show potential for growth; identifying such gems requires a keen understanding of market dynamics and the ability to recognize companies poised to thrive amid current conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Q P Group Holdings | 17.07% | -2.56% | -2.55% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Palasino Holdings | 8.57% | 4.07% | -18.45% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

| Grupo Gigante S. A. B. de C. V | 34.19% | 6.87% | 32.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

HYUNDAI MOVEX (KOSDAQ:A319400)

Simply Wall St Value Rating: ★★★★★★

Overview: HYUNDAI MOVEX Co., Ltd. engages in the information technology and logistics system sectors both domestically and internationally, with a market capitalization of approximately ₩1.09 trillion.

Operations: HYUNDAI MOVEX generates revenue primarily from its IT and logistics system businesses. The company has a market capitalization of approximately ₩1.09 trillion.

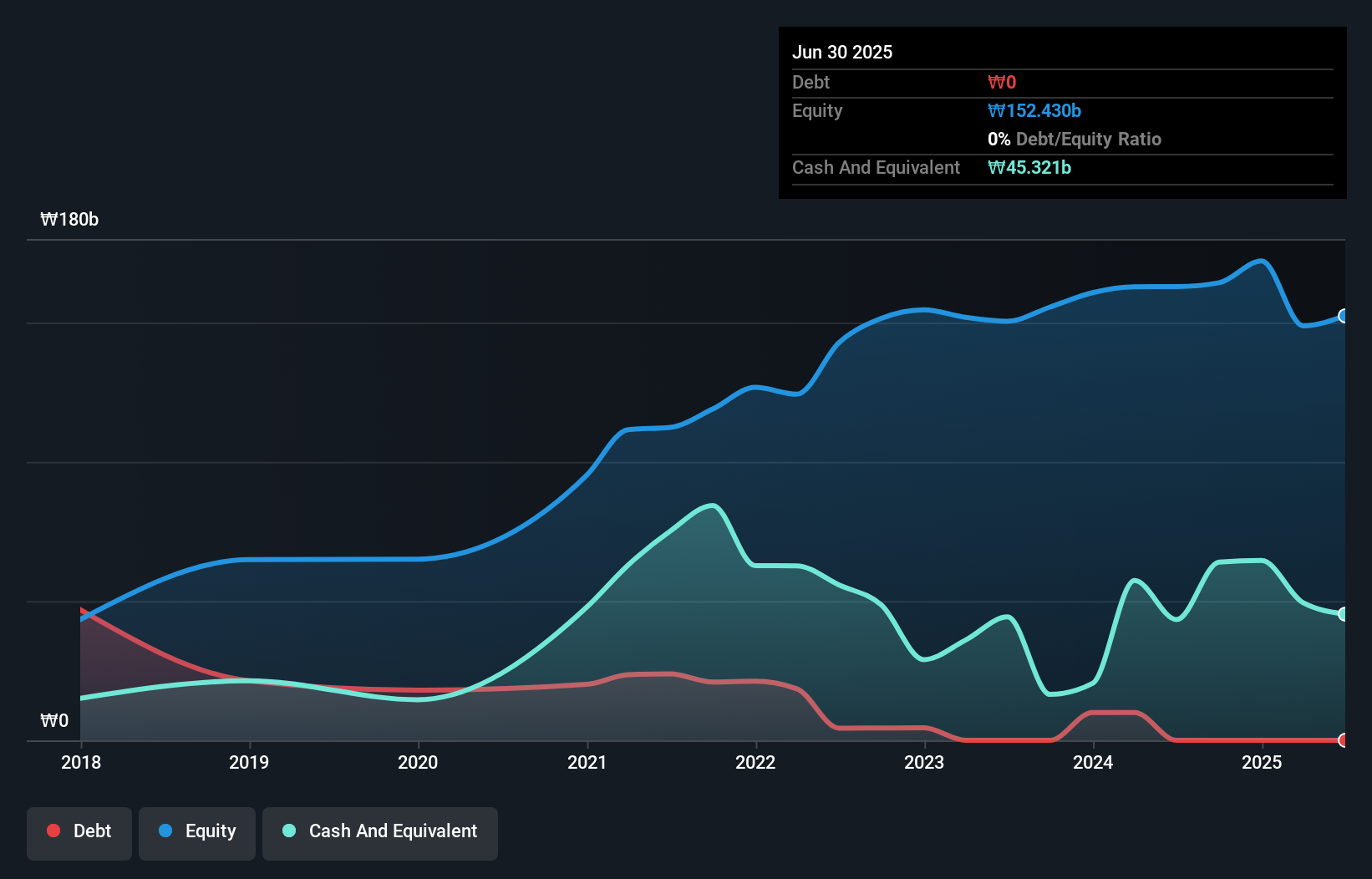

HYUNDAI MOVEX, a nimble player in its field, has shown impressive earnings growth of 65.2% over the past year, outpacing the construction industry's 4.7%. The firm is debt-free now compared to five years ago when it had a debt-to-equity ratio of 22.3%, signaling financial prudence. Recent quarterly results highlight sales soaring to KRW 103 billion from KRW 84 billion last year, with net income rising slightly to KRW 5 billion. Despite volatile share prices recently, an annual dividend of KRW 50 per share was affirmed for April next year, suggesting confidence in future cash flows and stability.

- Dive into the specifics of HYUNDAI MOVEX here with our thorough health report.

Examine HYUNDAI MOVEX's past performance report to understand how it has performed in the past.

Anhui Gourgen Traffic ConstructionLtd (SHSE:603815)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Gourgen Traffic Construction Ltd, with a market cap of CN¥7.62 billion, primarily engages in infrastructure development and construction projects.

Operations: With a market cap of CN¥7.62 billion, Anhui Gourgen Traffic Construction Ltd generates revenue mainly from its construction industry segment, totaling CN¥4.35 billion. The company's financial performance is influenced by its ability to manage costs within this primary revenue stream.

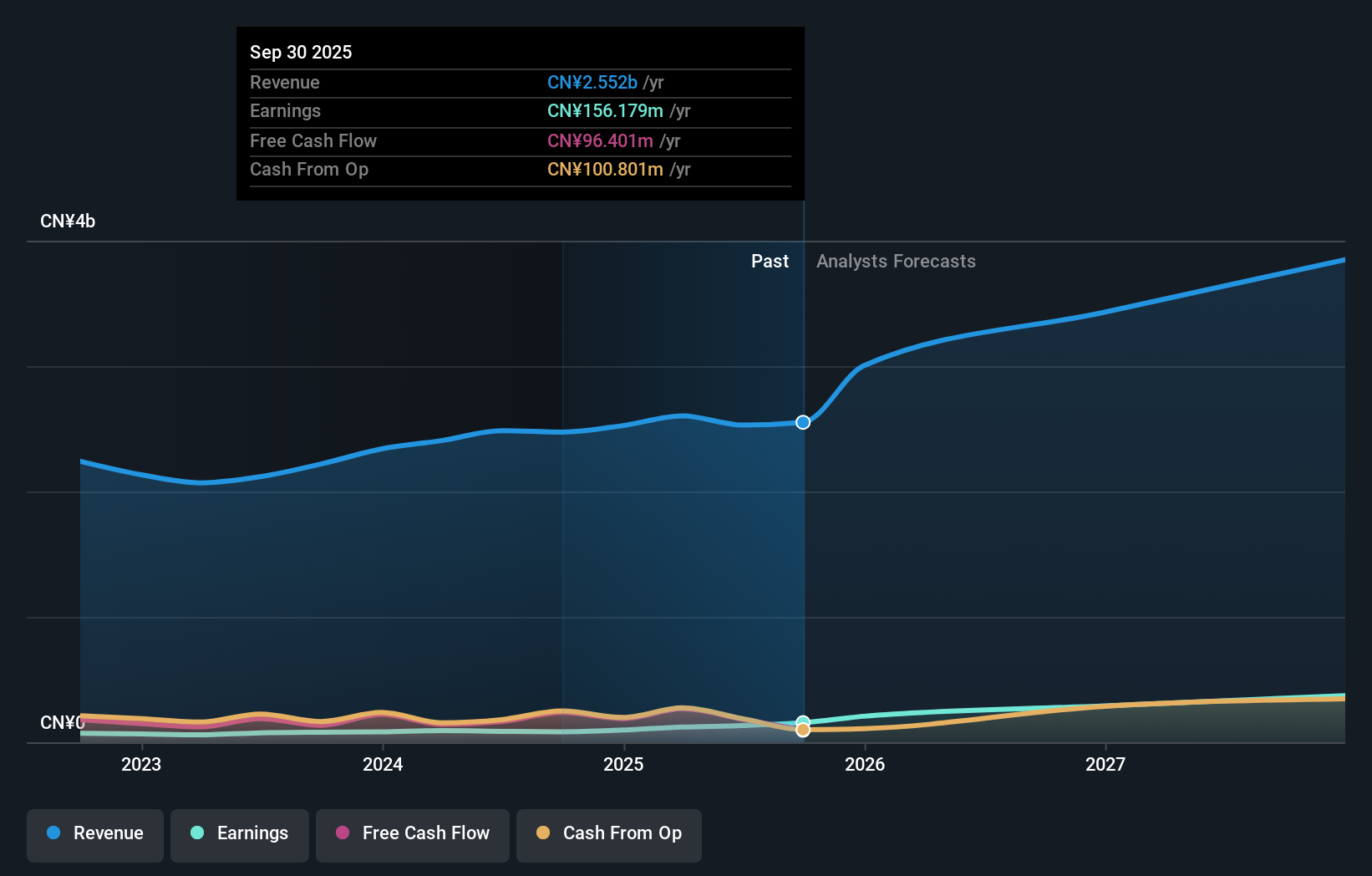

Anhui Gourgen Traffic Construction Ltd. stands out with its earnings growth of 15.6% over the past year, surpassing the construction industry average of -7.3%. The company's net debt to equity ratio is a satisfactory 39.4%, showing financial prudence as it decreased from 84.6% to 69.9% over five years, while interest payments are well covered by EBIT at a ratio of 3.3x, indicating strong operational efficiency. Despite a volatile share price recently, Anhui Gourgen reported nine-month sales of CNY 3 billion and net income rose to CNY 137 million from CNY 100 million last year, reflecting robust performance amidst industry challenges.

- Navigate through the intricacies of Anhui Gourgen Traffic ConstructionLtd with our comprehensive health report here.

Learn about Anhui Gourgen Traffic ConstructionLtd's historical performance.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the specialty materials industry and has a market capitalization of CN¥10.55 billion.

Operations: Suzhou Hesheng Special Material generates revenue primarily from its operations in the specialty materials sector. The company's financial performance is characterized by a focus on specific revenue streams within this industry, although detailed segment data is not provided.

Suzhou Hesheng Special Material has shown impressive financial progress, with earnings surging 86.2% over the past year, significantly outpacing the 8.4% growth in the Metals and Mining industry. The company's debt to equity ratio has notably improved from 137.5% to 20.3% over five years, indicating a stronger balance sheet position. Recent earnings reports for nine months ending September 2025 revealed net income of CNY 144 million compared to CNY 85 million previously, highlighting robust profitability despite a volatile share price recently observed in the market.

Seize The Opportunity

- Explore the 3014 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYUNDAI MOVEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A319400

HYUNDAI MOVEX

Operates in the information technology (IT) and logistics system businesses in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026