- Taiwan

- /

- Semiconductors

- /

- TPEX:5314

Discovering Asia's Undiscovered Gems This October 2025

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, Asian indices have shown resilience, with Japan's Nikkei 225 Index experiencing significant gains amid political shifts. In this dynamic environment, identifying emerging opportunities in Asia's small-cap sector can be crucial for investors seeking to navigate market volatility; these stocks often benefit from unique growth potential and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lumax International | NA | 5.83% | 6.31% | ★★★★★★ |

| Champion Building MaterialsLtd | 29.77% | -2.25% | 8.58% | ★★★★★★ |

| Zhejiang Wanfeng ChemicalLtd | 11.75% | 18.70% | -24.16% | ★★★★★★ |

| Triocean Industrial Corporation | 41.36% | 46.98% | 79.47% | ★★★★★★ |

| BIO-FD&CLtd | 0.15% | 2.82% | 18.20% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 2.16% | 35.13% | ★★★★★★ |

| Te Chang Construction | 15.29% | 14.72% | 17.71% | ★★★★★☆ |

| Kinpo Electronics | 106.22% | 5.77% | 45.80% | ★★★★★☆ |

| Praise Victor Industrial | 46.95% | 8.93% | 39.31% | ★★★★★☆ |

| Shenzhen Leaguer | 62.41% | 0.65% | -18.79% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

HYUNDAI MOVEX (KOSDAQ:A319400)

Simply Wall St Value Rating: ★★★★★★

Overview: HYUNDAI MOVEX Co., Ltd. engages in IT and logistics system operations both in South Korea and internationally, with a market cap of approximately ₩1.14 trillion.

Operations: The company's revenue primarily comes from its logistics segment, generating approximately ₩373.15 billion, while the IT sector contributes around ₩26.59 billion.

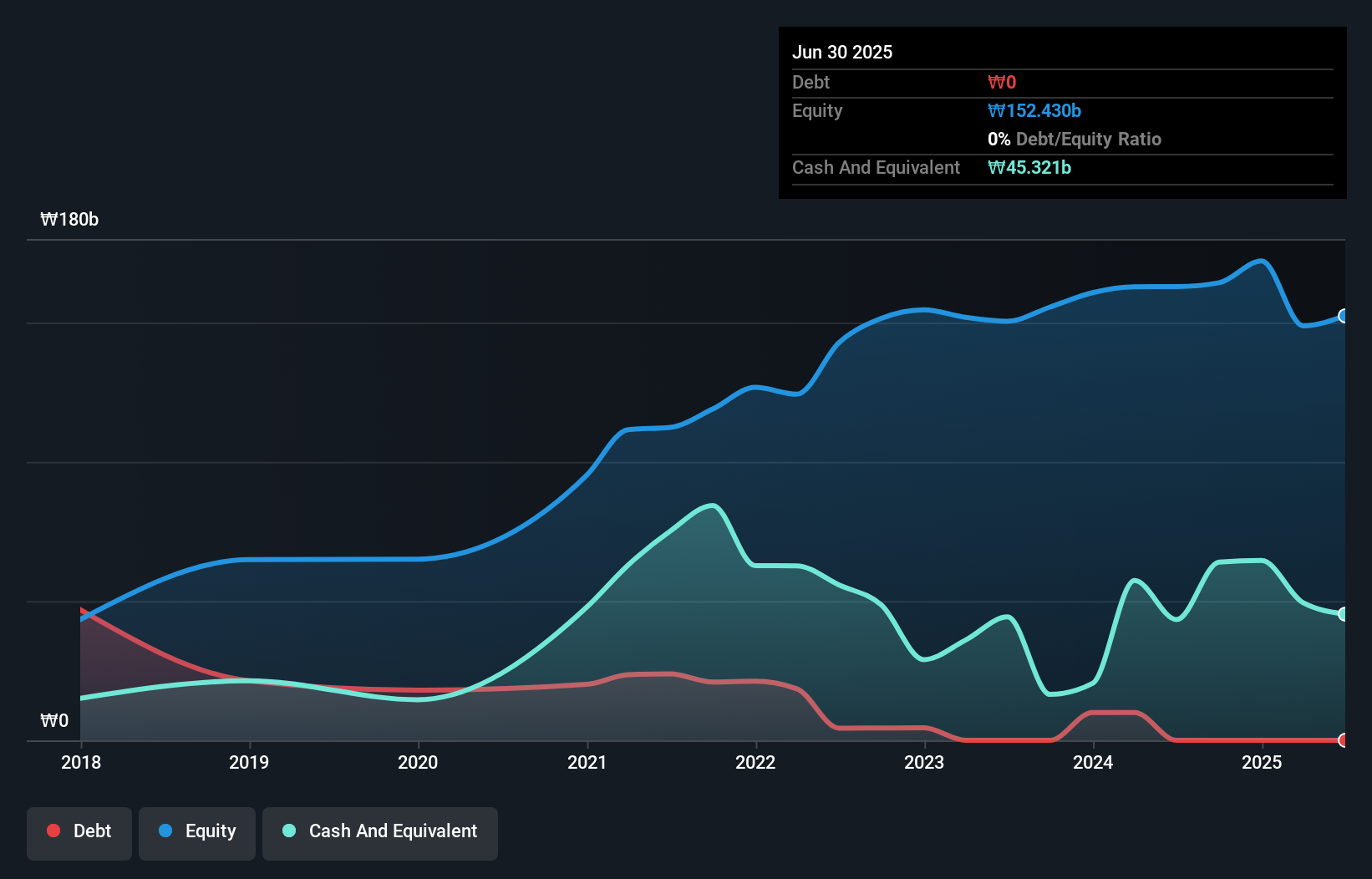

Hyundai Movex, a dynamic player in the Asian market, has shown impressive growth with earnings surging by 64% over the past year, outpacing the construction industry's -5.4%. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio was 23.8%. Despite a volatile share price recently, Hyundai Movex's sales for Q2 2025 hit ₩98.85 billion (approximately US$73 million), up from ₩72.65 billion last year, while net income reached ₩4.1 billion compared to ₩415 million previously. With earnings forecasted to grow at 16% annually and an M&A transaction involving a 7% stake acquisition underway, Hyundai Movex seems poised for continued expansion in its sector.

- Navigate through the intricacies of HYUNDAI MOVEX with our comprehensive health report here.

Explore historical data to track HYUNDAI MOVEX's performance over time in our Past section.

Myson Century (TPEX:5314)

Simply Wall St Value Rating: ★★★★★☆

Overview: Myson Century, Inc. designs, manufactures, and sells integrated circuit systems in Taiwan, Mainland China, and internationally, with a market capitalization of NT$40.57 billion.

Operations: Myson Century's revenue primarily comes from its operations under Myson Century, Inc. and Zavio Inc., contributing NT$573.29 million and NT$356.09 million, respectively. The company has a segment adjustment of NT$517.33 million and an adjustment and elimination of -NT$19.46 million impacting the overall financials.

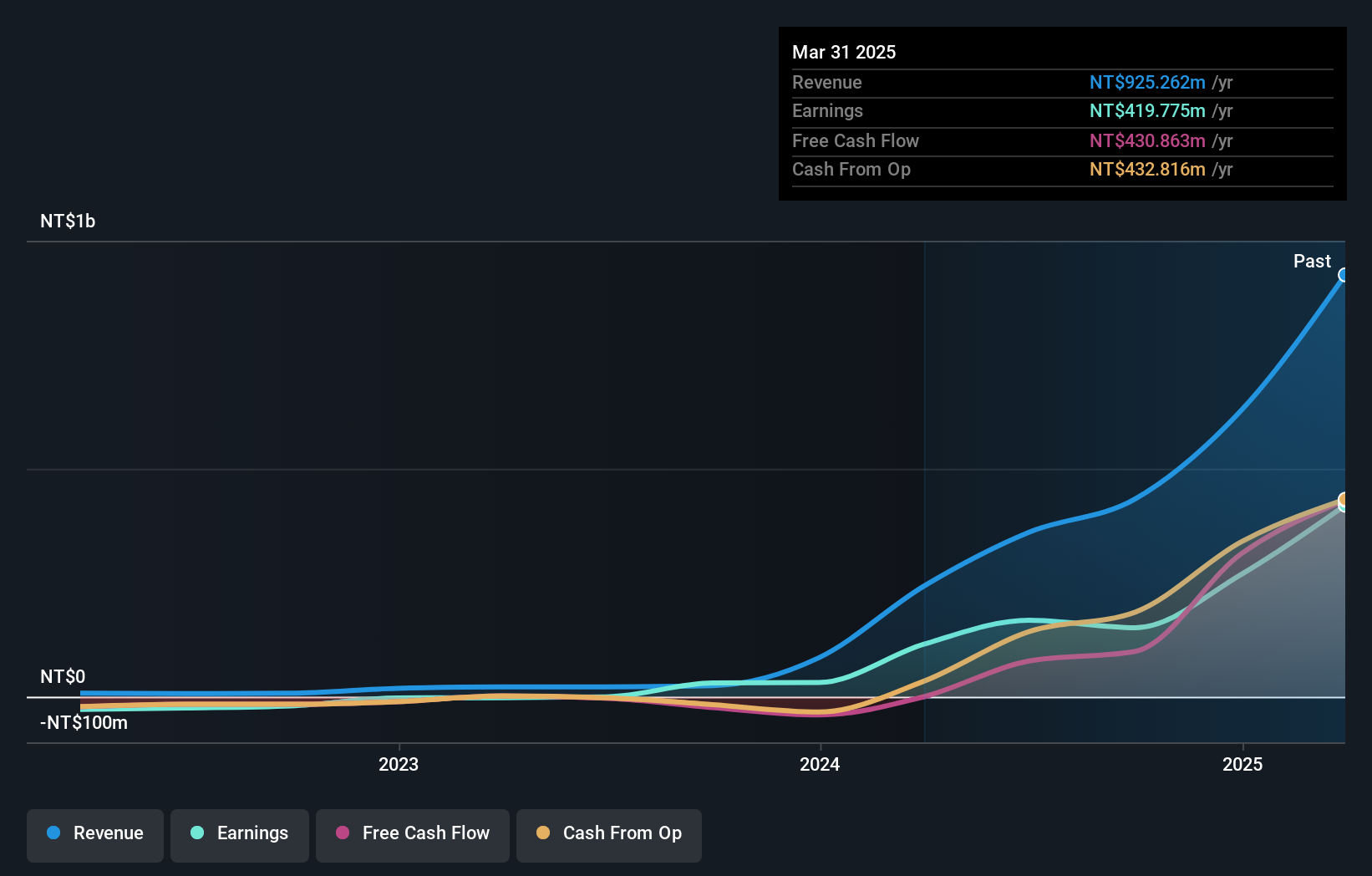

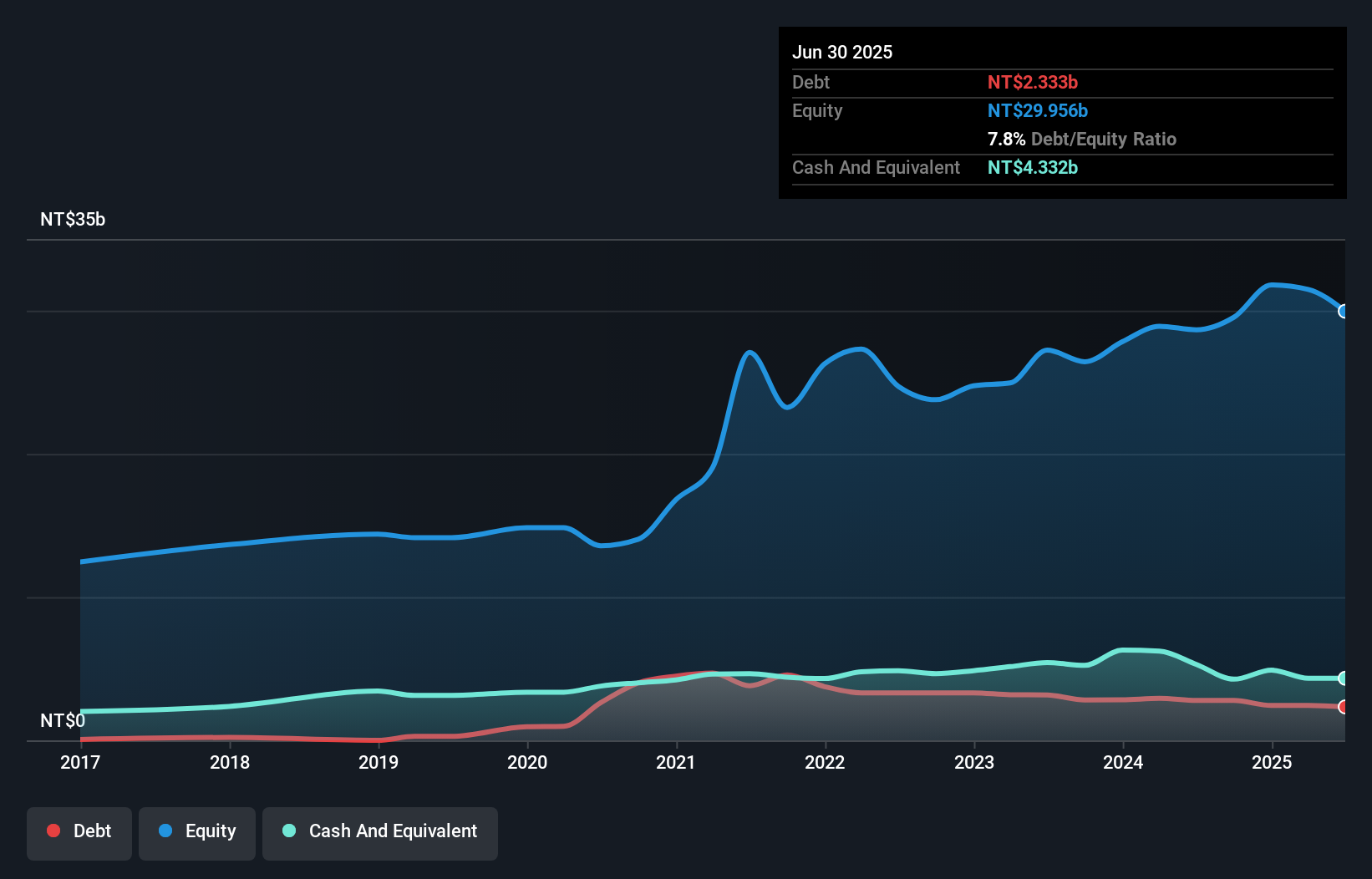

Myson Century, a semiconductor player, has shown impressive growth with earnings surging by 260.1% over the past year, outpacing the industry's -6.5%. The company reported second-quarter sales of TWD 622.75 million and net income of TWD 232.97 million, reflecting significant improvement from last year's figures. Trading at 6.1% below its estimated fair value suggests potential undervaluation in the market's eyes. Despite a volatile share price recently, Myson's debt to equity ratio stands at 18.2%, up from zero five years ago; however, it holds more cash than total debt and maintains positive free cash flow, indicating robust financial health amidst industry challenges.

- Dive into the specifics of Myson Century here with our thorough health report.

Assess Myson Century's past performance with our detailed historical performance reports.

Evergreen Steel (TWSE:2211)

Simply Wall St Value Rating: ★★★★★★

Overview: Evergreen Steel Corp. operates in steel structure engineering and environmental protection activities in Taiwan, with a market capitalization of NT$45.67 billion.

Operations: Evergreen Steel Corp.'s primary revenue stream is from its Steel Structure segment, generating NT$10.58 billion. Other significant contributions come from Xin Rong and Rongding, with revenues of NT$1.39 billion and NT$1.32 billion, respectively.

Evergreen Steel seems to be an intriguing player in the Asian market, showcasing strong financial metrics. Its recent earnings report highlights a notable increase in net income, reaching TWD 1,248.57 million for Q2 compared to TWD 796.2 million the previous year. Sales also grew to TWD 3,629.32 million from TWD 3,343.62 million year-on-year. With a price-to-earnings ratio of 14.5x below the TW market average of 21x and earnings growth outpacing the industry by over threefold at 21%, Evergreen appears undervalued and promising despite forecasts suggesting potential challenges ahead with expected declines in earnings growth rates over coming years.

- Click here to discover the nuances of Evergreen Steel with our detailed analytical health report.

Gain insights into Evergreen Steel's past trends and performance with our Past report.

Next Steps

- Embark on your investment journey to our 2357 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5314

Myson Century

Together with its subsidiaries and designs, manufacturers, and sells integrated circuit systems in Taiwan, Mainland China, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives