- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

Exploring High Insider Ownership Growth Companies On The KRX

Reviewed by Simply Wall St

The South Korean market has shown stability with a flat performance over the last week, complemented by a 5.7% rise over the past year and expectations of robust annual earnings growth of 29%. In this context, stocks with high insider ownership can be particularly compelling as they often indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| Modetour Network (KOSDAQ:A080160) | 12.4% | 45.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.2% | 122.7% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 74.2% |

| Devsisters (KOSDAQ:A194480) | 27.2% | 73.5% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Enchem (KOSDAQ:A348370) | 21.3% | 105.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 102.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Hana Materials (KOSDAQ:A166090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Materials Inc. is a South Korean company that specializes in manufacturing and selling silicon electrodes and rings, with a market capitalization of approximately ₩1.05 billion.

Operations: The company primarily generates revenue through the production and sale of silicon electrodes and rings.

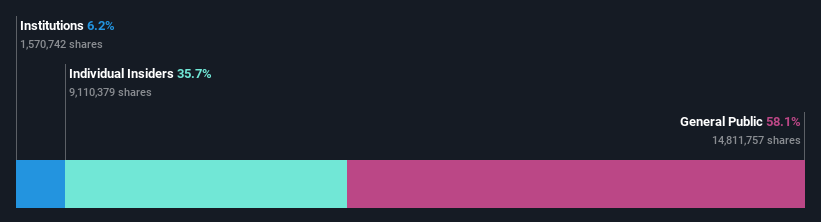

Insider Ownership: 12.5%

Revenue Growth Forecast: 22.1% p.a.

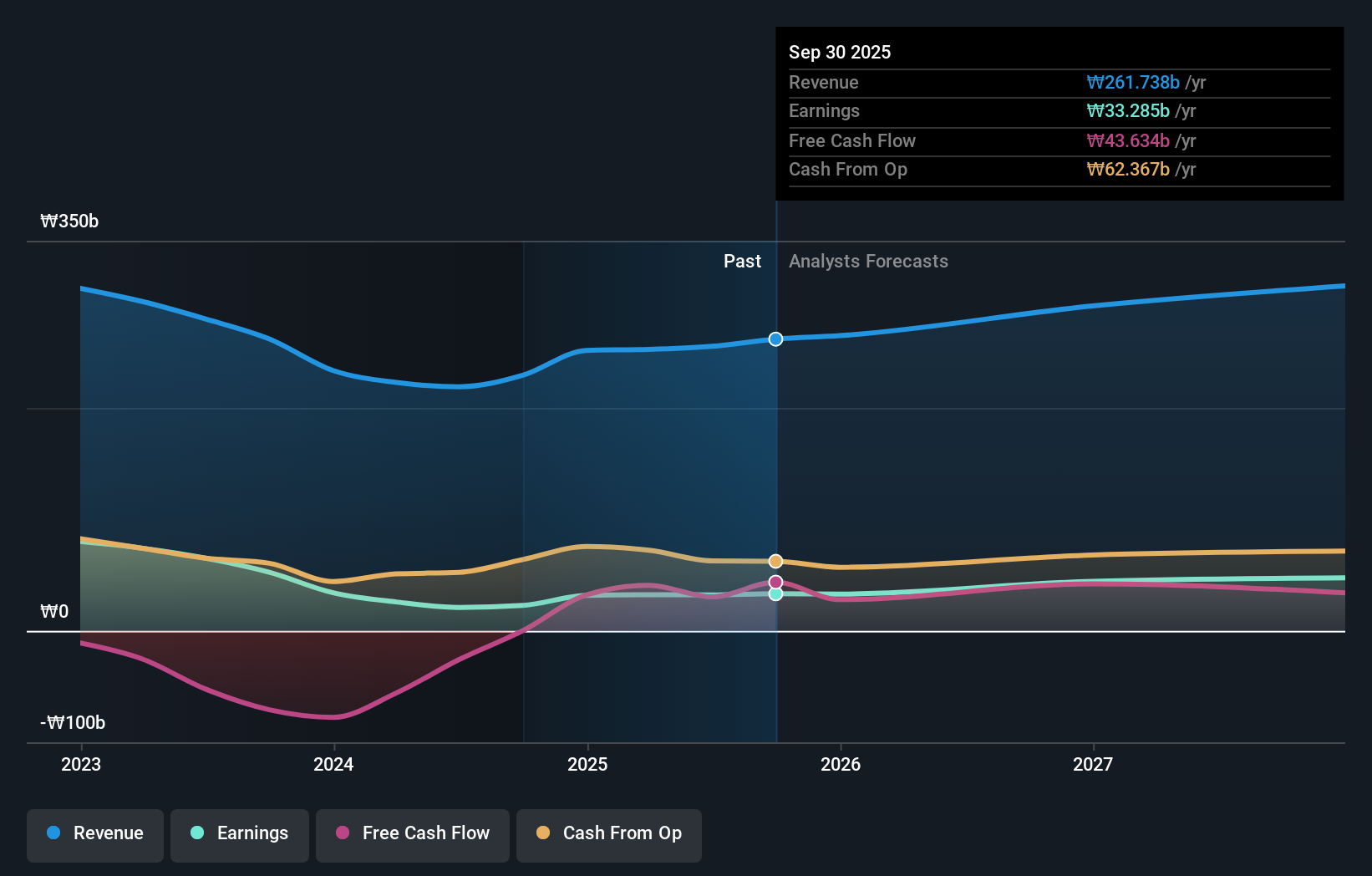

Hana Materials, a company in South Korea, showcases strong growth potential with its revenue expected to increase by 22.1% annually, outpacing the broader Korean market's 10.2%. Despite a high level of debt and reduced profit margins from last year's 25.1% to 11.6%, earnings are projected to surge by approximately 46% annually over the next three years. However, its Return on Equity is anticipated to remain low at 18.2%. There is no recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of Hana Materials stock in this growth report.

- Our expertly prepared valuation report Hana Materials implies its share price may be too high.

RFHIC (KOSDAQ:A218410)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RFHIC Corporation, based in South Korea, specializes in designing and manufacturing radio frequency (RF) and microwave components for various applications including wireless infrastructure, commercial and military radar, and RF energy, with a market capitalization of approximately ₩450.39 billion.

Operations: RFHIC's revenue from wireless communications equipment totals approximately ₩111.43 billion.

Insider Ownership: 35.1%

Revenue Growth Forecast: 22.4% p.a.

RFHIC, a South Korean company, exhibits robust growth with earnings projected to rise by 37.1% annually and revenue forecasted to increase by 22.4% per year, both metrics surpassing local market averages. Despite these promising figures, its Return on Equity is expected to be modest at 11.5% in three years. The company has experienced very large profit growth over the past year and maintains high-quality earnings predominantly from non-cash sources. No recent insider trading activity has been reported.

- Click to explore a detailed breakdown of our findings in RFHIC's earnings growth report.

- Upon reviewing our latest valuation report, RFHIC's share price might be too optimistic.

Hana Technology (KOSDAQ:A299030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Technology Co., Ltd. specializes in developing precision automation solutions for the industrial sector in South Korea, with a market capitalization of approximately ₩456.74 billion.

Operations: The company generates revenue primarily from the development of precision automation solutions for the industrial sector in South Korea.

Insider Ownership: 29.0%

Revenue Growth Forecast: 20.1% p.a.

Hana Technology, despite a challenging first quarter in 2024 with a shift from net income to a net loss and increased sales, is positioned for potential growth. The company recently issued KRW 60 billion in convertible bonds, indicating strategic financial maneuvering aimed at future expansion. Analysts predict a significant annual revenue growth rate of 20.1%, outpacing the South Korean market's average, with expectations of profitability within three years. However, recent shareholder dilution and a modest forecasted Return on Equity of 11.2% suggest cautious optimism is warranted.

- Click here to discover the nuances of Hana Technology with our detailed analytical future growth report.

- The analysis detailed in our Hana Technology valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Gain an insight into the universe of 83 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hana Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

Adequate balance sheet with moderate growth potential.