- South Korea

- /

- Machinery

- /

- KOSDAQ:A297090

CS BEARING Co., Ltd. (KOSDAQ:297090) Looks Just Right With A 33% Price Jump

CS BEARING Co., Ltd. (KOSDAQ:297090) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

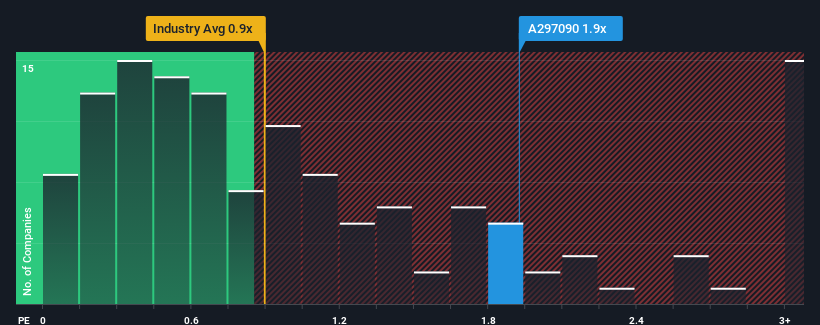

Following the firm bounce in price, given close to half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider CS BEARING as a stock to potentially avoid with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for CS BEARING

How CS BEARING Has Been Performing

With revenue growth that's inferior to most other companies of late, CS BEARING has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CS BEARING.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as CS BEARING's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 31% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 68% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 45%, the company is positioned for a stronger revenue result.

With this information, we can see why CS BEARING is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does CS BEARING's P/S Mean For Investors?

CS BEARING shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CS BEARING maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for CS BEARING that you should be aware of.

If these risks are making you reconsider your opinion on CS BEARING, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade CS BEARING, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A297090

CS BEARING

Engages in the manufacture and sale of bearings in South Korea.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives