- South Korea

- /

- Machinery

- /

- KOSDAQ:A277810

3 Asian Growth Stocks With Insider Ownership Up To 27%

Reviewed by Simply Wall St

As trade tensions escalate between the U.S. and China, investor sentiment in Asia has been impacted, leading to fluctuations in major indices such as the CSI 300 and Shanghai Composite. In this environment of uncertainty, growth companies with high insider ownership can offer a unique appeal, as insiders' stakes often signal confidence in the company's long-term prospects despite short-term market volatility.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Schooinc (TSE:264A) | 21.6% | 68.9% |

| Synspective (TSE:290A) | 12.8% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's dive into some prime choices out of the screener.

Rainbow RoboticsLtd (KOSDAQ:A277810)

Simply Wall St Growth Rating: ★★★★★★

Overview: Rainbow Robotics Co., Ltd. is a professional technological mechatronics company specializing in robotic system engineering technology, with a market cap of ₩5.37 trillion.

Operations: Rainbow Robotics Co., Ltd. generates revenue primarily from its Industrial Automation & Controls segment, amounting to ₩19.35 billion.

Insider Ownership: 23.6%

Rainbow Robotics has demonstrated a significant turnaround, reporting KRW 2.14 billion in net income for 2024 compared to a loss the previous year. Samsung Electronics' recent acquisition of a 20.29% stake underscores confidence in its growth potential, although insider ownership has shifted slightly with this transaction. Despite high volatility, the company is expected to achieve substantial earnings and revenue growth, outpacing the broader Korean market significantly over the next three years.

- Get an in-depth perspective on Rainbow RoboticsLtd's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Rainbow RoboticsLtd's share price might be on the expensive side.

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanchip (Tianjin) Technology Co., Ltd. designs, manufactures, and sells radio frequency front end and high end analog chips in China, with a market cap of CN¥16.07 billion.

Operations: The company's revenue is primarily derived from its electronic components and parts segment, which generated CN¥2.10 billion.

Insider Ownership: 16.9%

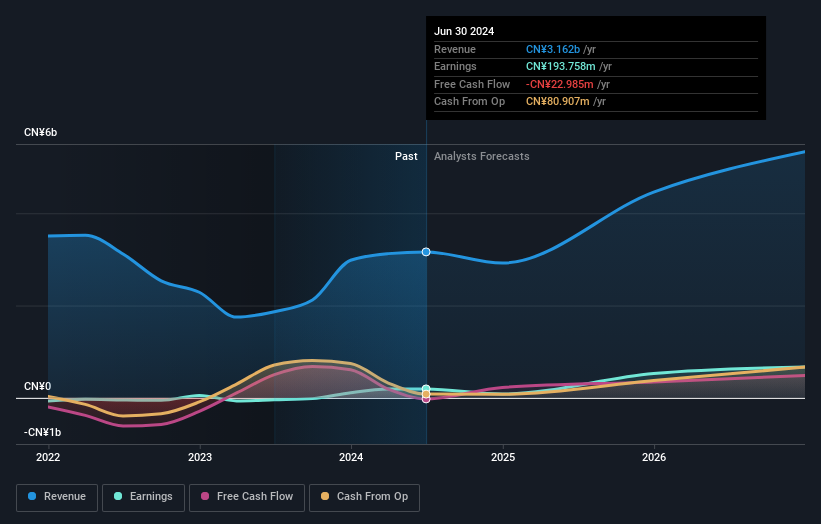

Vanchip (Tianjin) Technology is poised for substantial growth, with revenue expected to increase by 33% annually, outpacing the Chinese market. Despite recent volatility and a net loss of CNY 23.73 million in 2024, profitability is anticipated within three years. The company completed a share buyback worth CNY 119.99 million, indicating confidence in its future prospects despite low forecasted return on equity and no significant insider trading activity recently reported.

- Click to explore a detailed breakdown of our findings in Vanchip (Tianjin) Technology's earnings growth report.

- Our valuation report unveils the possibility Vanchip (Tianjin) Technology's shares may be trading at a premium.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China with a market cap of CN¥45.66 billion.

Operations: Maxscend Microelectronics generates revenue primarily from merchandise sales, amounting to CN¥4.47 billion, with additional income from premium services at CN¥1.55 billion and IP authorization and services contributing CN¥6.79 million.

Insider Ownership: 27.8%

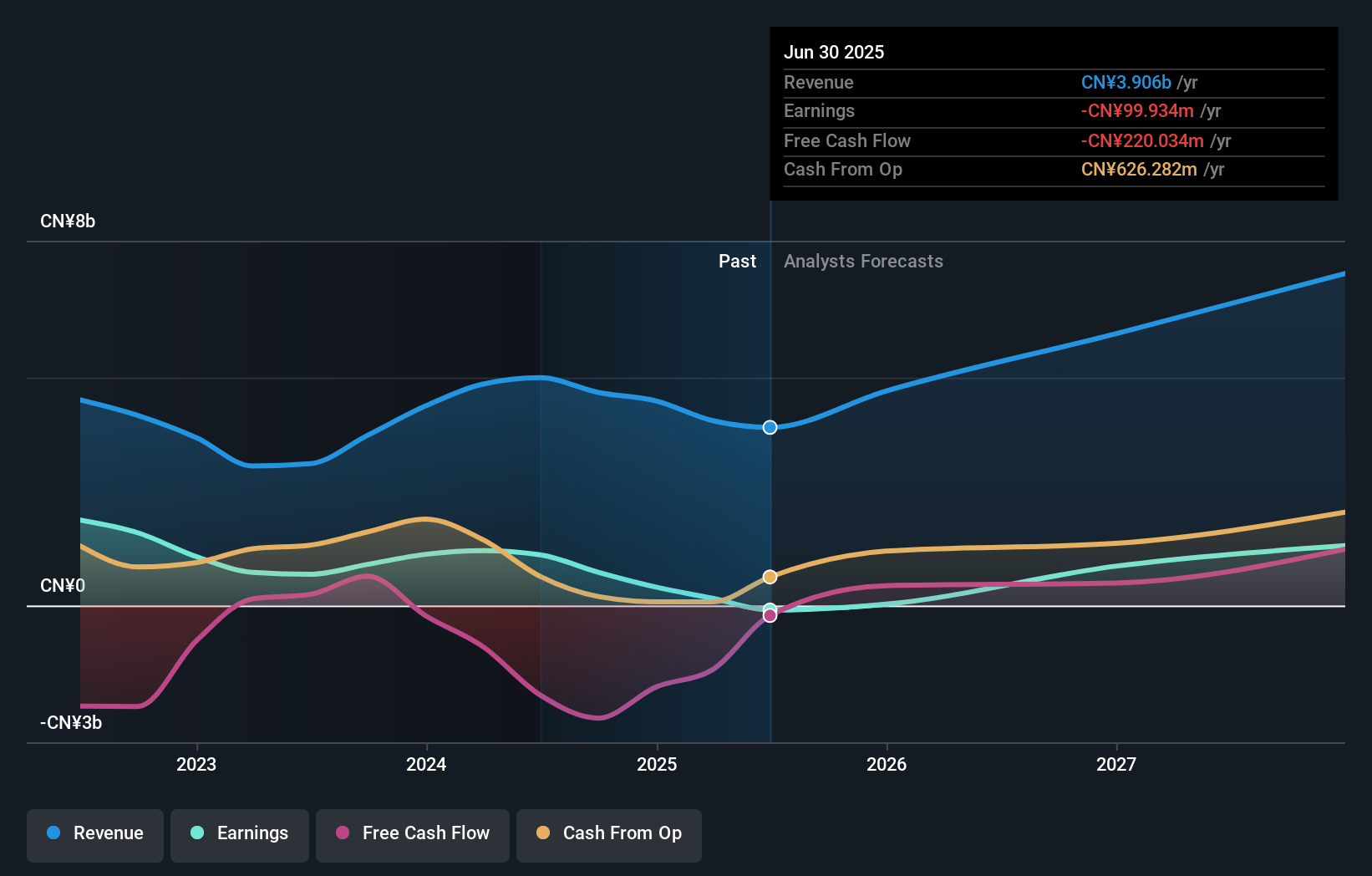

Maxscend Microelectronics demonstrates potential for growth, with its revenue forecasted to grow faster than the Chinese market at 16.4% annually. Despite a significant drop in net income from CNY 1.12 billion to CNY 401.83 million in 2024, earnings are expected to grow significantly by 28.9% annually over the next three years. The company is trading below its estimated fair value and recently announced a private placement raising CNY 3.5 billion, indicating strategic expansion plans despite declining profit margins and reduced dividends.

- Take a closer look at Maxscend Microelectronics' potential here in our earnings growth report.

- The analysis detailed in our Maxscend Microelectronics valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 633 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A277810

Rainbow RoboticsLtd

A professional technological mechatronics company, provides robotic system engineering technology.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives