- South Korea

- /

- Machinery

- /

- KOSDAQ:A222080

Some Creative & Innovative System Corporation (KOSDAQ:222080) Shareholders Look For Exit As Shares Take 28% Pounding

Creative & Innovative System Corporation (KOSDAQ:222080) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

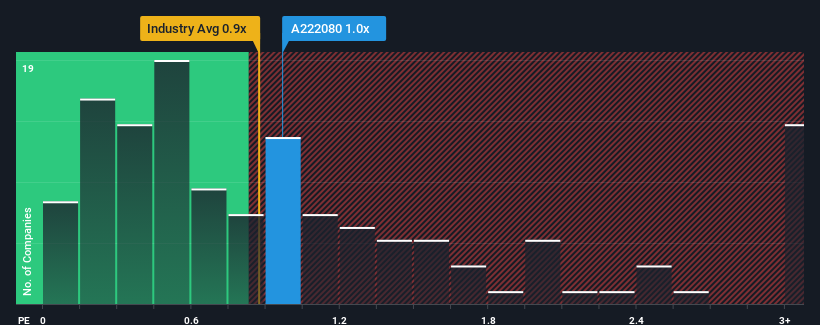

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Creative & Innovative System's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Korea is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Creative & Innovative System

What Does Creative & Innovative System's P/S Mean For Shareholders?

Recent times have been advantageous for Creative & Innovative System as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Creative & Innovative System.Is There Some Revenue Growth Forecasted For Creative & Innovative System?

In order to justify its P/S ratio, Creative & Innovative System would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 7.4% during the coming year according to the only analyst following the company. That's not great when the rest of the industry is expected to grow by 39%.

In light of this, it's somewhat alarming that Creative & Innovative System's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Creative & Innovative System's P/S?

With its share price dropping off a cliff, the P/S for Creative & Innovative System looks to be in line with the rest of the Machinery industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Creative & Innovative System's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - Creative & Innovative System has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A222080

Creative & Innovative System

Manufactures and sells equipment for lithium-ion batteries powering IT instruments, EV lithium-ion batteries, fuel cells, solar cells, displays, etc.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026