- South Korea

- /

- Electrical

- /

- KOSDAQ:A140670

The one-year earnings decline has likely contributed toRS AutomationLtd's (KOSDAQ:140670) shareholders losses of 41% over that period

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the RS Automation Co.,Ltd. (KOSDAQ:140670) share price is down 41% in the last year. That falls noticeably short of the market decline of around 0.5%. However, the longer term returns haven't been so bad, with the stock down 3.9% in the last three years. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Since RS AutomationLtd has shed ₩16b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for RS AutomationLtd

RS AutomationLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year RS AutomationLtd saw its revenue fall by 32%. That's not what investors generally want to see. Shareholders have seen the share price drop 41% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

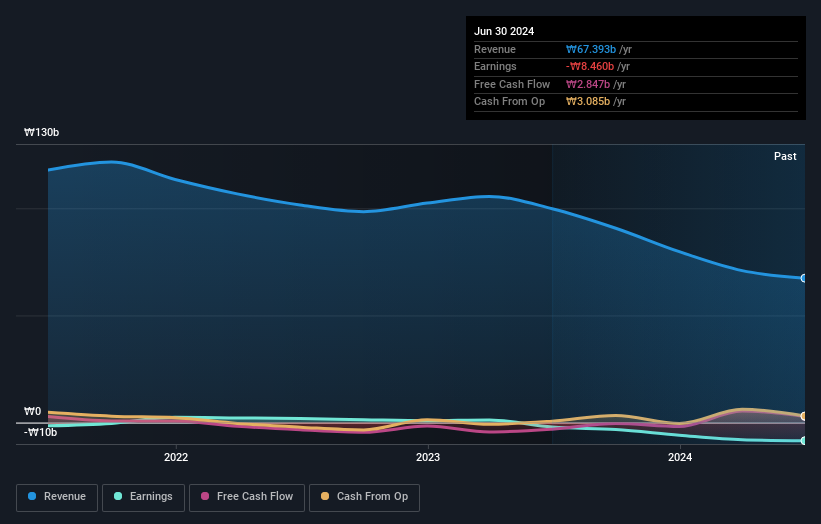

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 0.5% in the twelve months, RS AutomationLtd shareholders did even worse, losing 41%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for RS AutomationLtd (of which 1 is a bit concerning!) you should know about.

Of course RS AutomationLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A140670

RS AutomationLtd

Designs, develops, manufactures, sells, and services automation equipment and systems in South Korea and internationally.

Excellent balance sheet low.