- South Korea

- /

- Machinery

- /

- KOSDAQ:A129920

There's Reason For Concern Over Daesung Hi-Tech Co., Ltd.'s (KOSDAQ:129920) Massive 30% Price Jump

Daesung Hi-Tech Co., Ltd. (KOSDAQ:129920) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

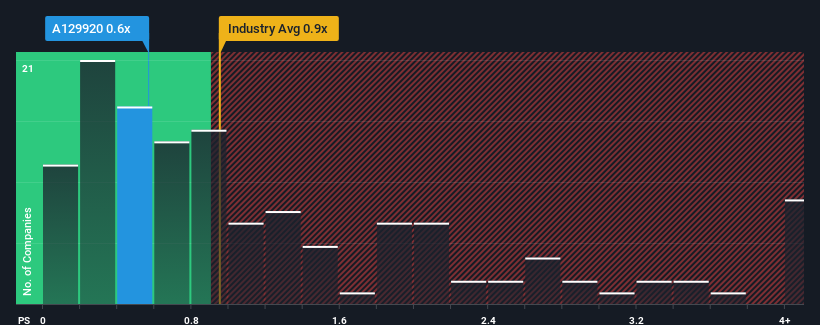

Even after such a large jump in price, it's still not a stretch to say that Daesung Hi-Tech's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Machinery industry in Korea, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Daesung Hi-Tech

How Daesung Hi-Tech Has Been Performing

Daesung Hi-Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Daesung Hi-Tech will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Daesung Hi-Tech would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.3% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

In light of this, it's curious that Daesung Hi-Tech's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Daesung Hi-Tech's P/S?

Its shares have lifted substantially and now Daesung Hi-Tech's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of Daesung Hi-Tech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Daesung Hi-Tech (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Daesung Hi-Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A129920

Daesung Hi-Tech

Manufactures and sells precision parts for various industrial machines in South Korea and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives