- South Korea

- /

- Construction

- /

- KOSDAQ:A101670

Companies Like Korea (KOSDAQ:101670) Are In A Position To Invest In Growth

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Korea (KOSDAQ:101670) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Korea

When Might Korea Run Out Of Money?

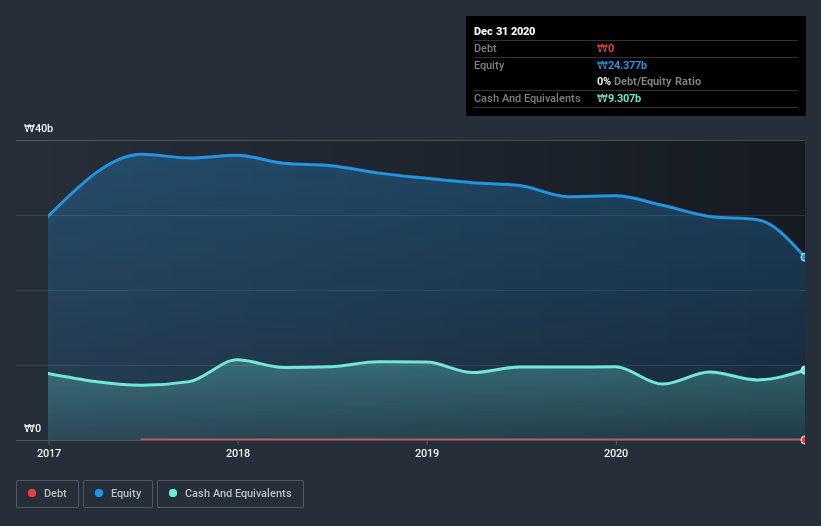

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2020, Korea had ₩9.3b in cash, and was debt-free. Importantly, its cash burn was ₩983m over the trailing twelve months. Therefore, from December 2020 it had 9.5 years of cash runway. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Well Is Korea Growing?

At first glance it's a bit worrying to see that Korea actually boosted its cash burn by 12%, year on year. In light of that, the flat year on year operating leverage is a bit off-putting. In light of the data above, we're fairly sanguine about the business growth trajectory. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Korea is building its business over time.

How Hard Would It Be For Korea To Raise More Cash For Growth?

Even though it seems like Korea is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Korea has a market capitalisation of ₩23b and burnt through ₩983m last year, which is 4.3% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Korea's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Korea's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Korea (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Korea, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hydro Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A101670

Hydro Lithium

Engages in the development of products for the construction industry in South Korea and internationally.

Low with weak fundamentals.

Market Insights

Community Narratives