- South Korea

- /

- Machinery

- /

- KOSDAQ:A098070

Uncovering Three Undiscovered Gems in Global Markets

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, where major indices like the S&P 500 and Dow Jones Industrial Average have slipped into negative territory for the year, small-cap stocks have faced even steeper declines, with indexes such as the Russell 2000 experiencing significant drops. This environment of heightened uncertainty and shifting economic indicators offers a unique opportunity to explore lesser-known companies that may possess strong fundamentals or growth potential often overlooked by larger market players.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Donpon Precision | 45.74% | 2.76% | 46.41% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hantech (KOSDAQ:A098070)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hantech Co., Ltd. is a South Korean company that specializes in the production and sale of chemical process equipment, storage tanks, and cryogenic containers with a market capitalization of ₩435.95 billion.

Operations: Hantech generates revenue primarily from its chemical equipment manufacturing segment, which accounts for ₩155.88 billion.

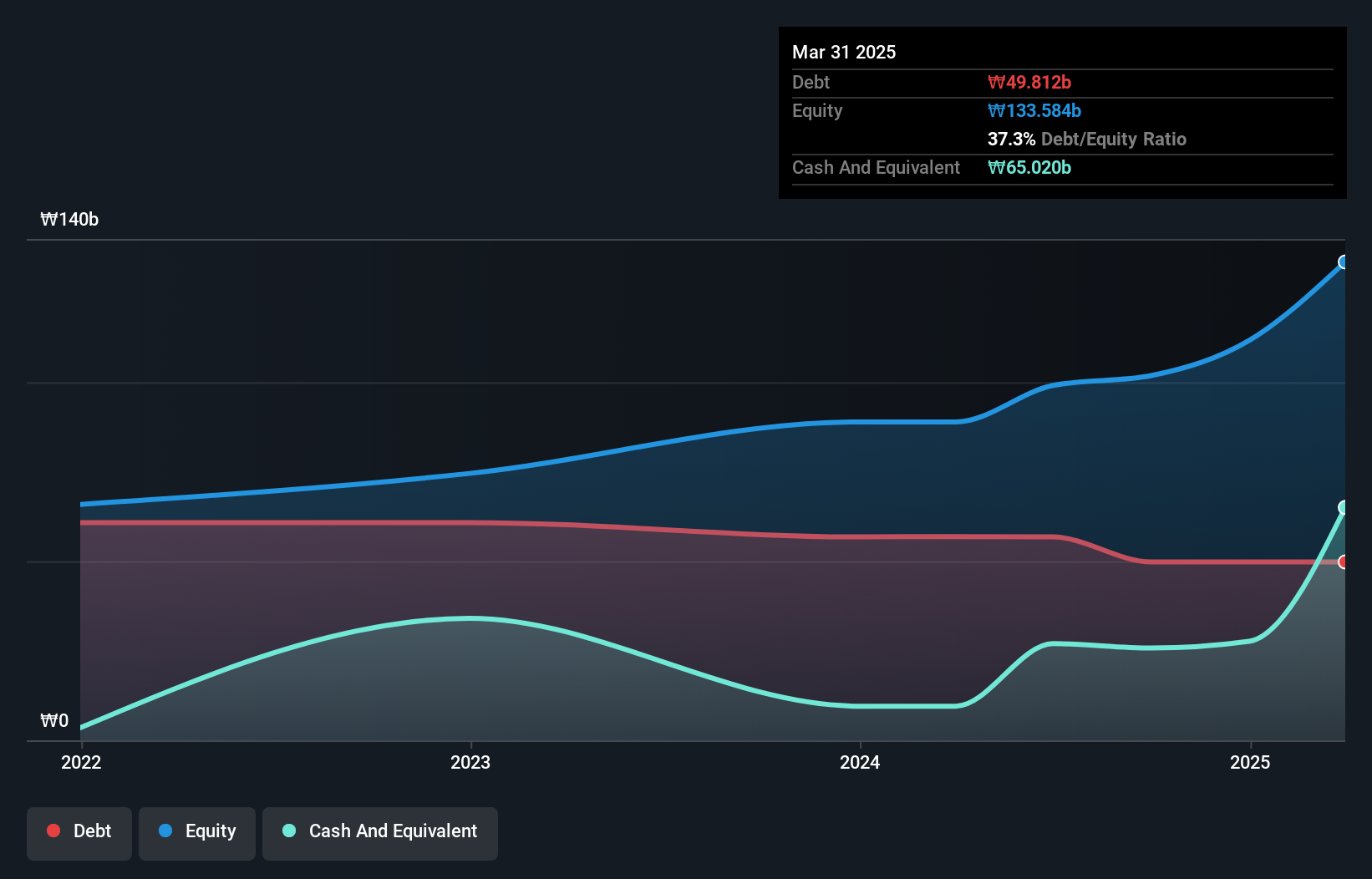

Hantech, a smaller player in the machinery sector, recently completed an IPO raising KRW 35.74 billion. Despite a revenue dip of 12.7% over the past year, its earnings surged by 76.9%, outpacing industry growth of 2.6%. The company's interest coverage is robust at 7.9 times EBIT, highlighting strong debt management capabilities with a net debt to equity ratio of 19.8%. While share price volatility has been notable in recent months, Hantech's price-to-earnings ratio stands at an attractive 18.9x compared to the industry average of 20.4x, suggesting potential value for investors seeking opportunities in this space.

- Click here and access our complete health analysis report to understand the dynamics of Hantech.

Gain insights into Hantech's past trends and performance with our Past report.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Value Rating: ★★★★★★

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science sector and has a market capitalization of CN¥8.48 billion.

Operations: Inner Mongolia Furui Medical Science generates revenue primarily from its operations in the medical science sector. The company's financial performance is characterized by a focus on specific revenue streams, with a notable gross profit margin trend that reflects its operational efficiency.

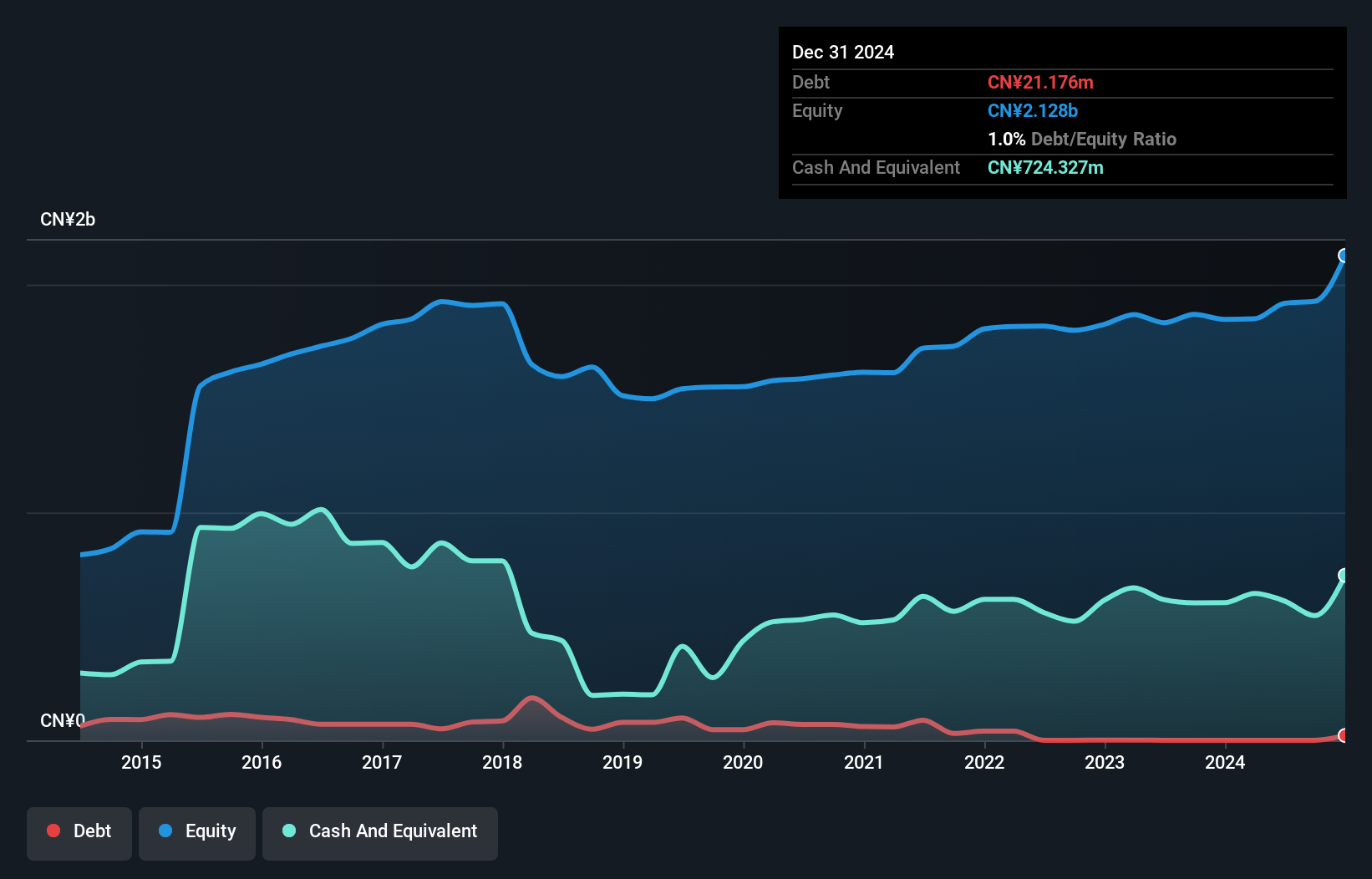

Inner Mongolia Furui Medical Science, a nimble player in the pharmaceuticals sector, has shown promising growth with earnings increasing by 11.5% last year, outpacing the industry average of -1.9%. The company's financial health appears robust as its debt-to-equity ratio improved from 3% to 1% over five years and it holds more cash than total debt. Despite a modest decline in net income to CNY 28.64 million for Q1 2025 compared to CNY 42.72 million last year, annual sales rose significantly to CNY 1.35 billion from CNY 1.15 billion, indicating strong revenue momentum and potential for future expansion.

Jiujiang Shanshui TechnologyLtd (SZSE:301190)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiujiang Shanshui Technology Co., Ltd. is involved in the research, development, production, and sale of dye intermediates, pesticides, and pharmaceutical intermediates in China with a market cap of CN¥4.73 billion.

Operations: The company generates revenue primarily from its specialty chemicals segment, amounting to CN¥528.33 million. The net profit margin is a key indicator of financial performance.

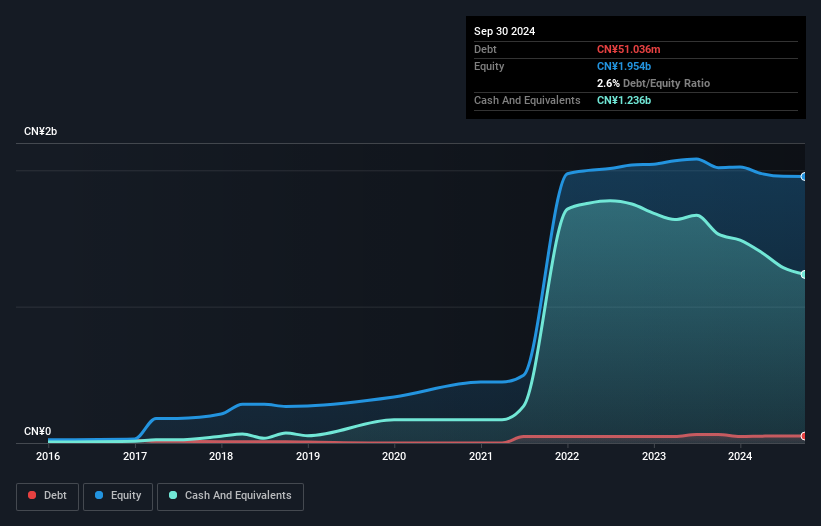

Jiujiang Shanshui Technology Ltd, a nimble player in the chemicals sector, has demonstrated impressive earnings growth of 293% over the past year, outpacing the industry average of 3%. Despite this surge, its share price has been highly volatile recently. The company reported CNY 504.62 million in sales for 2024 with net income rising to CNY 52.95 million from CNY 21.05 million previously. However, over five years, earnings have seen a yearly decline of about 31%. A recent buyback saw repurchase of shares worth CNY 52.22 million, reflecting strategic capital management efforts amidst fluctuating free cash flow figures.

Next Steps

- Navigate through the entire inventory of 3183 Global Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hantech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A098070

Hantech

Produces and sells chemical process equipment/storage tanks and cryogenic containers in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives