- South Korea

- /

- Machinery

- /

- KOSDAQ:A083650

BHI (KOSDAQ:083650) soars 17% this week, taking five-year gains to 822%

It might be of some concern to shareholders to see the BHI Co., Ltd. (KOSDAQ:083650) share price down 13% in the last month. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 822% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. We love happy stories like this one. The company should be really proud of that performance!

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

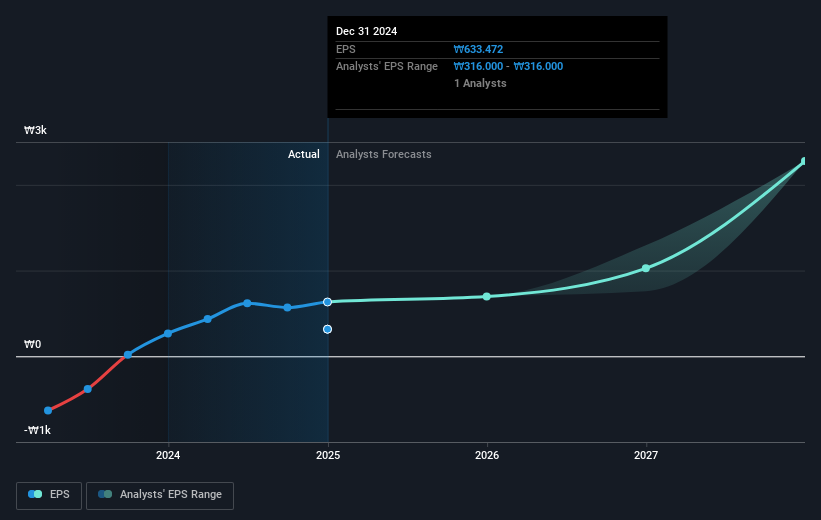

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, BHI became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how BHI has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at BHI's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that BHI shareholders have received a total shareholder return of 121% over the last year. That gain is better than the annual TSR over five years, which is 56%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with BHI (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

We will like BHI better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BHI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A083650

BHI

Engages in the development, manufacture, and supply of power plant equipment worldwide.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives