- South Korea

- /

- Machinery

- /

- KOSDAQ:A083650

Asian Treasures 3 Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly turning their attention to Asia's small-cap sector, which has shown resilience amidst broader market fluctuations. In this dynamic environment, identifying promising small-cap stocks often involves looking for companies with strong fundamentals and growth potential that can navigate the challenges posed by geopolitical shifts and evolving consumer trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 23.32% | 24.44% | ★★★★★★ |

| Subaru Enterprise | NA | 1.92% | 4.82% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.64% | 15.30% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 42.96% | 1.97% | 5.91% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 3.24% | 18.00% | -5.63% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 30.76% | 10.83% | 8.47% | ★★★★★☆ |

| Ebara JitsugyoLtd | 3.93% | 5.24% | 6.40% | ★★★★★☆ |

| Shanghai Material Trading | 1.95% | -9.84% | -12.61% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 70.94% | 21.41% | 14.67% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

BHI (KOSDAQ:A083650)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHI Co., Ltd. develops, manufactures, and supplies power plant equipment globally with a market capitalization of ₩1.67 billion.

Operations: BHI Co., Ltd. generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to ₩549.91 million.

BHI seems to have made significant strides, with its debt to equity ratio dropping from 258.8% to 83.6% over five years, indicating improved financial health. The company reported a remarkable net income of KRW 29,888 million for Q2 2025 compared to KRW 1,501 million a year ago, showcasing substantial growth in earnings. Additionally, BHI's earnings per share surged from KRW 49 to KRW 966 within the same period. Despite having a high net debt to equity ratio at 66.5%, its interest payments are well covered by EBIT at a multiple of 6.3x, reflecting strong operational efficiency amidst volatility in share price recently observed.

- Unlock comprehensive insights into our analysis of BHI stock in this health report.

Gain insights into BHI's historical performance by reviewing our past performance report.

Dongguan Development (Holdings) (SZSE:000828)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongguan Development (Holdings) Co., Ltd. operates in various sectors and has a market cap of CN¥12.48 billion.

Operations: The company generates revenue from multiple sectors, with a focus on specific industries. It has a market cap of CN¥12.48 billion.

Dongguan Development (Holdings) showcases a compelling profile with its net debt to equity ratio at 23.4%, deemed satisfactory, and trading significantly below its estimated fair value by 83.8%. Despite a rise in the debt to equity ratio from 41.2% to 51.2% over five years, the company remains profitable, negating cash runway concerns. Earnings have surged by 75%, outpacing the infrastructure sector's -2% growth rate, highlighting robust performance and high-quality earnings. Recent dividends of CNY 1.50 per ten shares underscore shareholder returns amidst these dynamics, reflecting both strength and strategic financial management in this small-cap entity.

Suzhou Hailu Heavy IndustryLtd (SZSE:002255)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hailu Heavy Industry Co., Ltd specializes in the design, manufacture, and sale of industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment with a market capitalization of approximately CN¥7.89 billion.

Operations: Suzhou Hailu Heavy Industry generates revenue primarily from its industrial manufacturing segment, contributing approximately CN¥2.15 billion, followed by its environmental protection construction service at CN¥240.47 million. The new energy business adds CN¥136.49 million, while environmental protection operations contribute CN¥94.19 million.

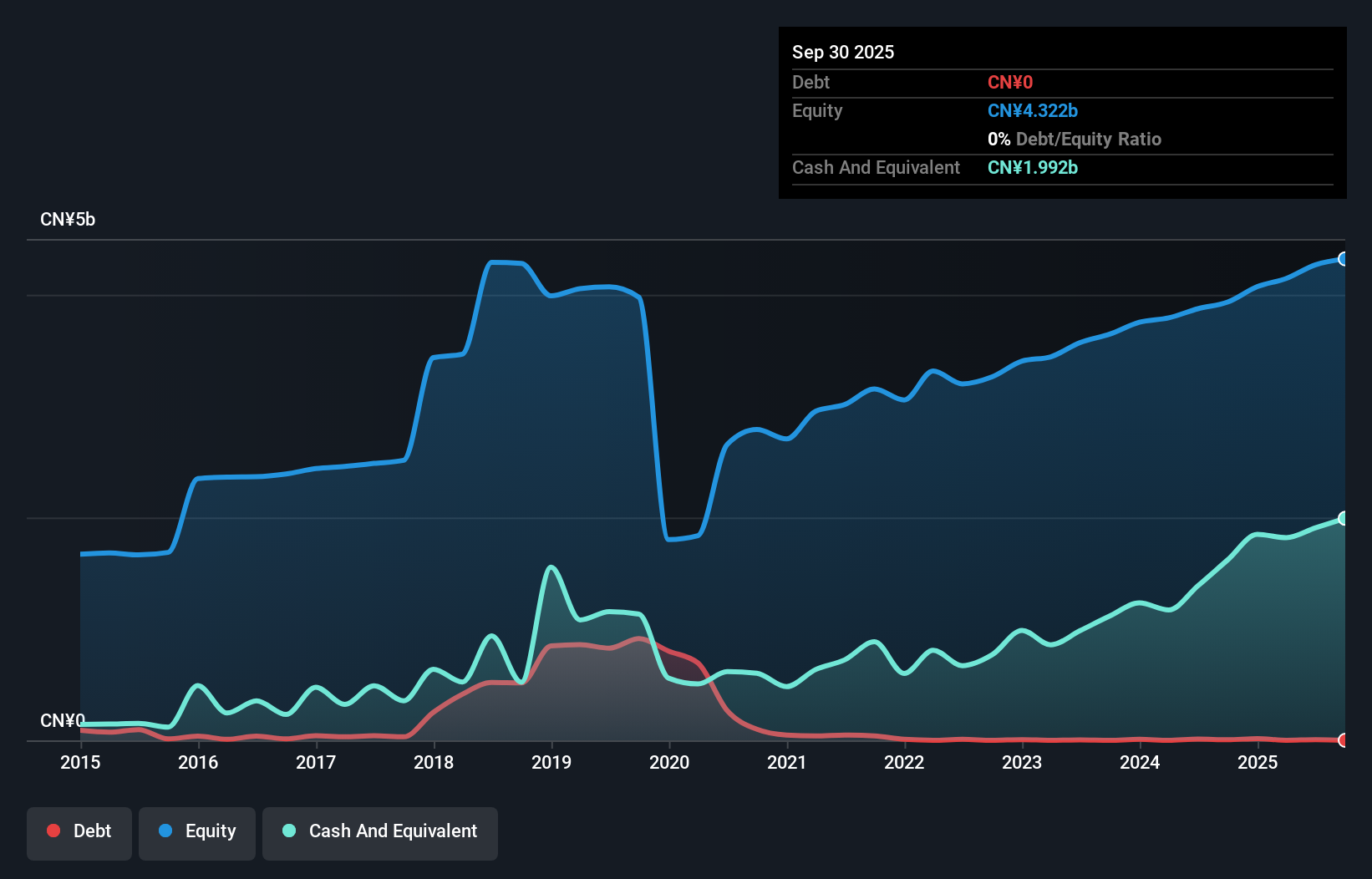

Suzhou Hailu Heavy Industry has shown impressive growth, with earnings surging by 42.5% over the past year, significantly outpacing the machinery industry's 3.9%. The company's debt-to-equity ratio improved from 10% to just 0.1% over five years, indicating effective debt management. Trading at a substantial discount of 43.1% below its estimated fair value suggests potential upside for investors. Recent inclusion in the S&P Global BMI Index and a declared interim cash dividend of CNY 0.55 per ten shares highlight its growing recognition and shareholder returns, while net income rose to CNY 191 million from CNY 128 million last year, reflecting robust financial health.

Make It Happen

- Reveal the 2361 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A083650

BHI

Engages in the development, manufacture, and supply of power plant equipment worldwide.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives