- China

- /

- Communications

- /

- SZSE:300548

April 2025 Global Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, investors are keenly observing opportunities for value amid the volatility. With U.S. equities showing resilience and European indices buoyed by diplomatic overtures, identifying stocks that may be trading below their intrinsic value can offer a strategic advantage in this environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Andritz (WBAG:ANDR) | €57.05 | €112.70 | 49.4% |

| BYD Electronic (International) (SEHK:285) | HK$31.80 | HK$63.03 | 49.5% |

| TF Bank (OM:TFBANK) | SEK347.00 | SEK682.14 | 49.1% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.20 | €42.13 | 49.7% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €22.87 | 49.5% |

| Sustained Infrastructure Holding (SASE:2190) | SAR29.90 | SAR59.55 | 49.8% |

| Komplett (OB:KOMPL) | NOK11.15 | NOK22.14 | 49.6% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.54 | CN¥20.79 | 49.3% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.50 | CN¥77.68 | 49.2% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.67 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

BHI (KOSDAQ:A083650)

Overview: BHI Co., Ltd. develops, manufactures, and supplies power plant equipment globally, with a market cap of ₩792.12 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, totaling ₩404.74 billion.

Estimated Discount To Fair Value: 14.0%

BHI Co., Ltd. is trading at ₩28,800, 14% below its estimated fair value of ₩33,496.46. Despite recent volatility in its share price and interest payments not being well covered by earnings, the company has demonstrated strong financial performance with net income rising to ₩19.60 billion from ₩7.51 billion year-over-year. Earnings are projected to grow significantly above market rates at 31.9% annually over the next three years, supported by robust revenue growth forecasts of 21.4%.

- Insights from our recent growth report point to a promising forecast for BHI's business outlook.

- Get an in-depth perspective on BHI's balance sheet by reading our health report here.

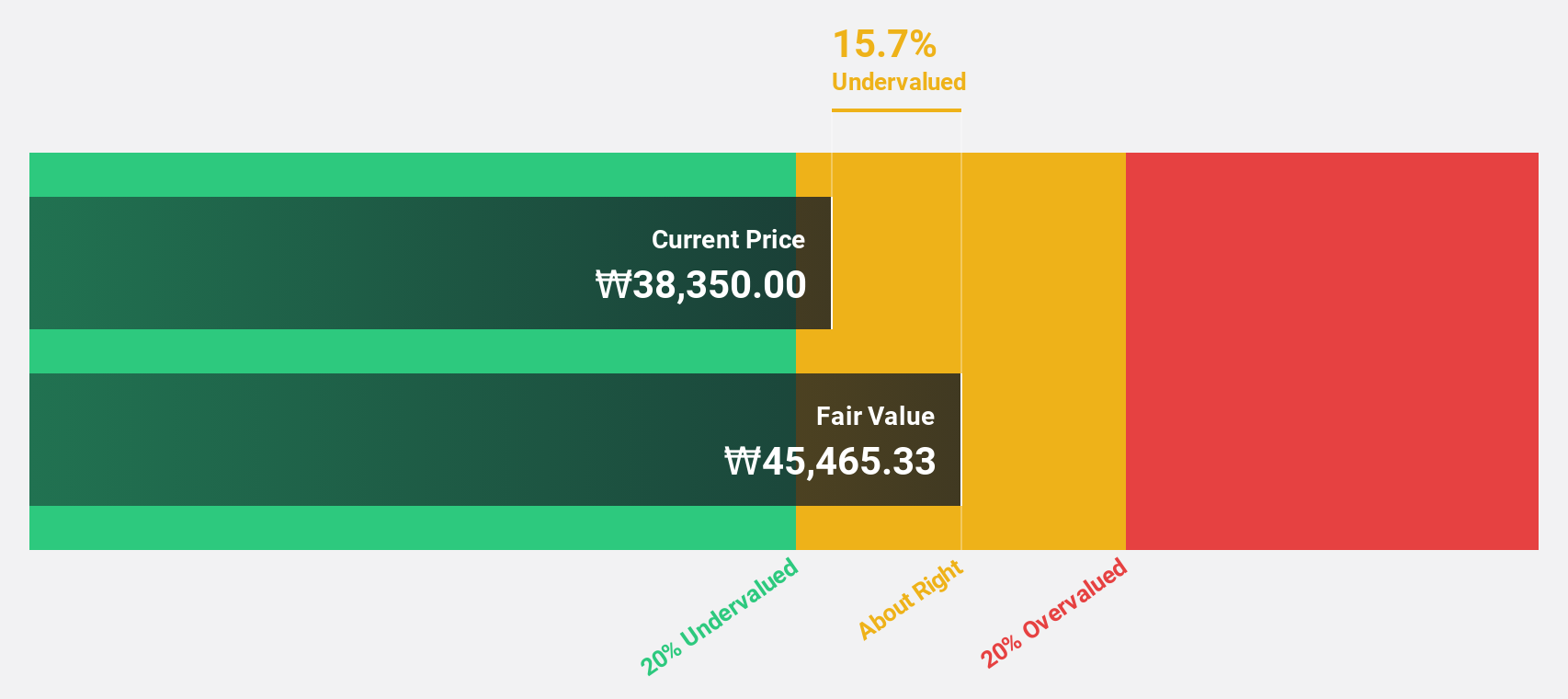

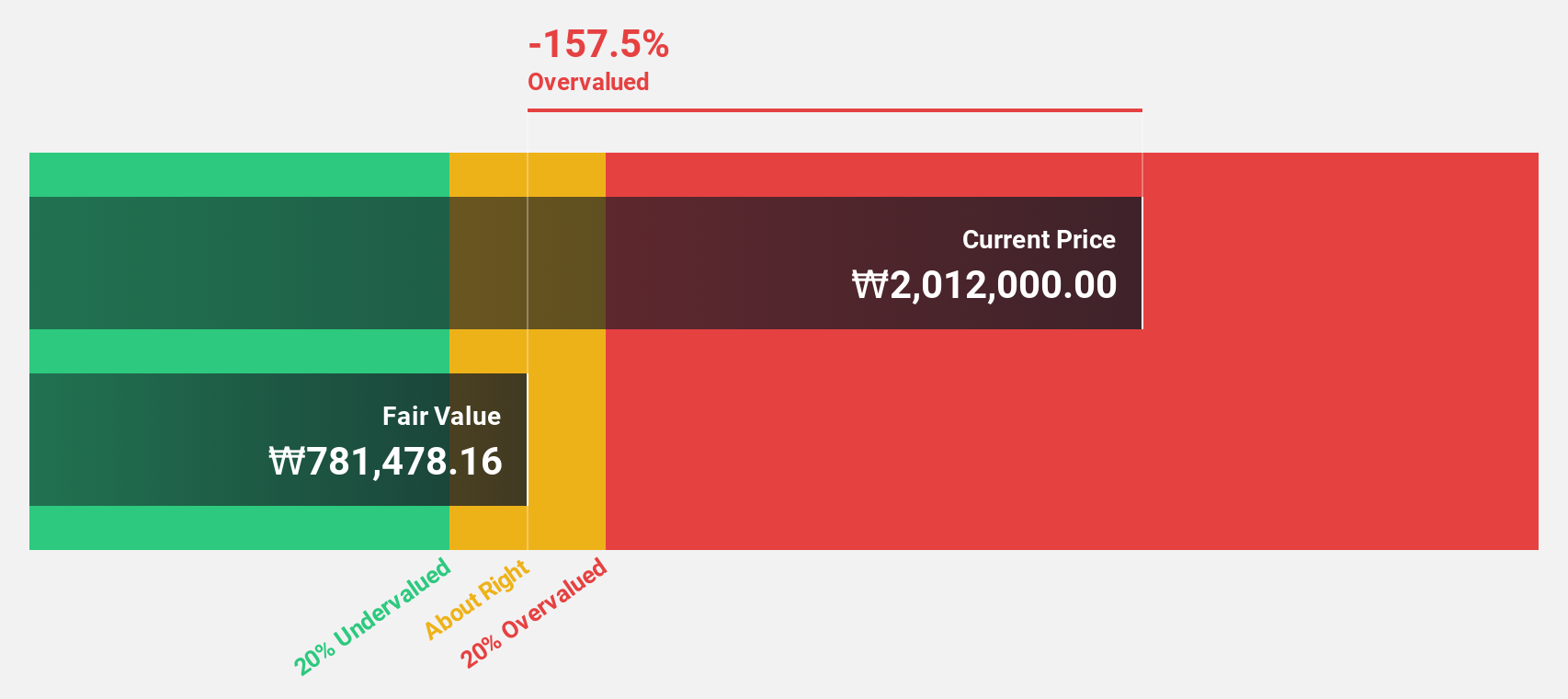

Hyosung Heavy Industries (KOSE:A298040)

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment both in South Korea and internationally, with a market cap of ₩4.51 trillion.

Operations: Hyosung Heavy Industries generates revenue primarily from its Heavy Industry segment at ₩3.80 trillion and Construction segment at ₩1.77 trillion.

Estimated Discount To Fair Value: 43.6%

Hyosung Heavy Industries is trading at ₩517,000, significantly below its estimated fair value of ₩916,806.68. Despite recent share price volatility, the company's earnings are forecast to grow 28.83% annually, outpacing the market's 21.5% growth rate and indicating strong potential for cash flow-driven undervaluation. Revenue growth is expected at 9.5% per year, surpassing the KR market's average of 7.8%, although return on equity remains modestly low at a forecasted 18.7%.

- The analysis detailed in our Hyosung Heavy Industries growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Hyosung Heavy Industries.

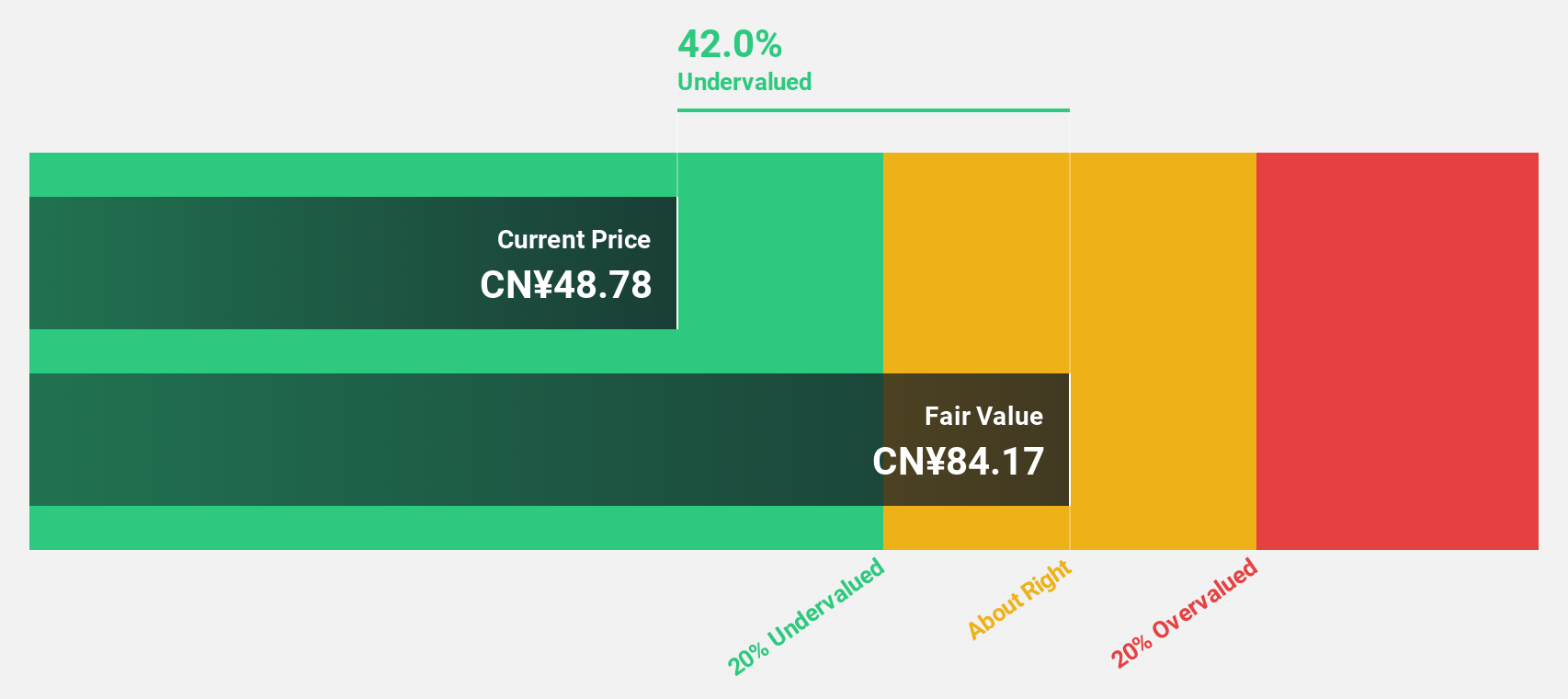

Broadex Technologies (SZSE:300548)

Overview: Broadex Technologies Co., Ltd. is engaged in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥10.65 billion.

Operations: The company's revenue segments include CN¥669.68 million from the Telecom Market and CN¥1.07 billion from Data communications, consumer and industrial interconnection.

Estimated Discount To Fair Value: 45.8%

Broadex Technologies is trading at CN¥44.5, which is significantly below its fair value estimate of CN¥82.14, highlighting its potential undervaluation based on cash flows. Despite a recent decline in net income to CN¥72.07 million from the previous year's CN¥81.47 million, earnings are projected to grow 42.4% annually, outpacing the market's 23.8% growth rate and supporting future cash flow improvements despite historically high share price volatility and modest return on equity forecasts of 14.2%.

- Our expertly prepared growth report on Broadex Technologies implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Broadex Technologies stock in this financial health report.

Where To Now?

- Reveal the 462 hidden gems among our Undervalued Global Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadex Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

Broadex Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives