- China

- /

- Electrical

- /

- SHSE:688676

3 Global Stocks Estimated To Be Trading At Discounts Of Up To 49.9%

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are navigating a complex landscape marked by geopolitical uncertainty and fluctuating indices. Amidst this volatility, identifying undervalued stocks can be crucial for those looking to capitalize on potential market inefficiencies; stocks trading at significant discounts may offer opportunities when aligned with sound fundamentals and strategic positioning in the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.15 | CN¥38.17 | 49.8% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.65 | CN¥89.13 | 49.9% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| Shanghai V-Test Semiconductor Tech (SHSE:688372) | CN¥81.90 | CN¥163.17 | 49.8% |

| SBO (WBAG:SBO) | €26.80 | €53.44 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.12 | CN¥28.20 | 49.9% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥960.00 | ¥1903.34 | 49.6% |

| Genesem (KOSDAQ:A217190) | ₩9730.00 | ₩19317.81 | 49.6% |

| Envipco Holding (ENXTAM:ENVI) | €5.80 | €11.51 | 49.6% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.33 | €6.63 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

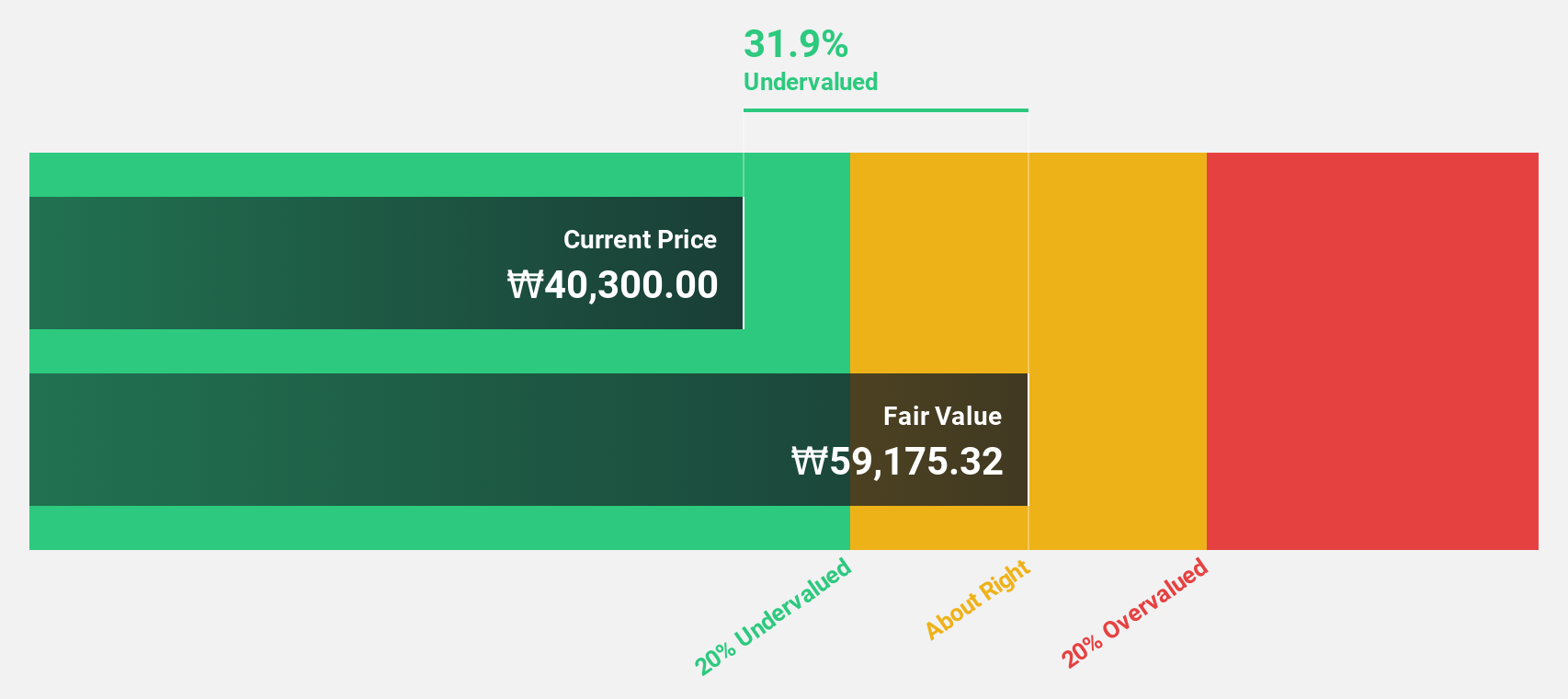

TaewoongLtd (KOSDAQ:A044490)

Overview: Taewoong Co., Ltd specializes in the manufacturing and sale of open-die forgings and ring rolled products both domestically in South Korea and internationally, with a market cap of ₩639.24 billion.

Operations: Taewoong Co., Ltd generates its revenue through the production and distribution of open-die forgings and ring rolled products across domestic and international markets.

Estimated Discount To Fair Value: 48.4%

Taewoong Ltd. is trading at ₩35,600, significantly below its estimated fair value of ₩68,989.33, suggesting potential undervaluation based on cash flows. Despite a volatile share price and reduced profit margins (3.9% from 7.7%), the company's earnings are projected to grow substantially at 51.83% annually over the next three years, outpacing both its revenue growth and the broader Korean market's earnings growth rate of 25.1%.

- In light of our recent growth report, it seems possible that TaewoongLtd's financial performance will exceed current levels.

- Take a closer look at TaewoongLtd's balance sheet health here in our report.

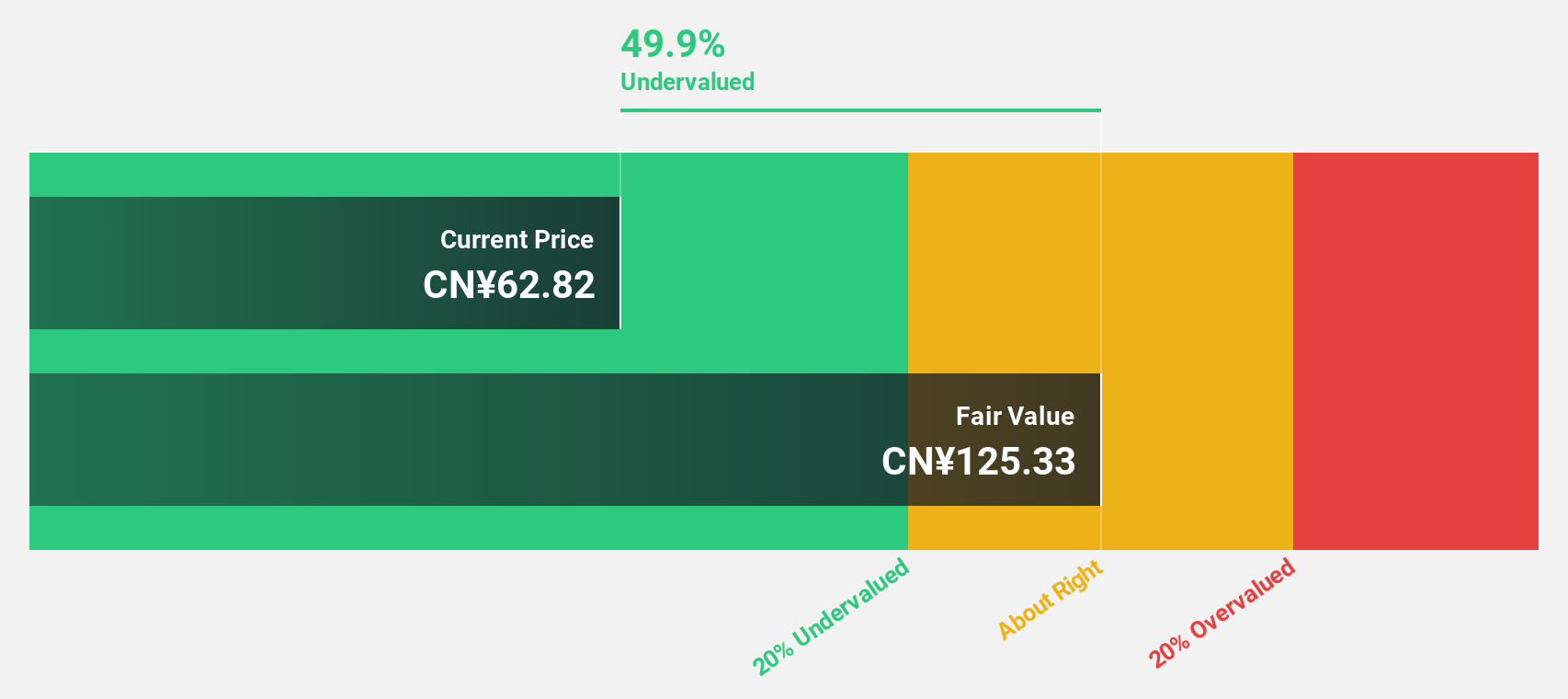

Hainan Jinpan Smart Technology (SHSE:688676)

Overview: Hainan Jinpan Smart Technology Co., Ltd. focuses on the R&D, production, sale, and servicing of power transmission, distribution, and control equipment in China, with a market cap of CN¥26.39 billion.

Operations: The company's revenue segments include the research and development, production, sale, and servicing of power transmission and distribution, as well as control equipment products in China.

Estimated Discount To Fair Value: 44.4%

Hainan Jinpan Smart Technology is trading at CNY 69.41, well below its estimated fair value of CNY 124.94, highlighting potential undervaluation based on cash flows. Despite recent share price volatility and a dividend yield of 0.73% not covered by free cash flows, earnings are expected to grow significantly at 28.6% annually over the next three years, surpassing both revenue growth and the broader Chinese market's earnings growth rate of 26.3%.

- Our expertly prepared growth report on Hainan Jinpan Smart Technology implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Hainan Jinpan Smart Technology stock in this financial health report.

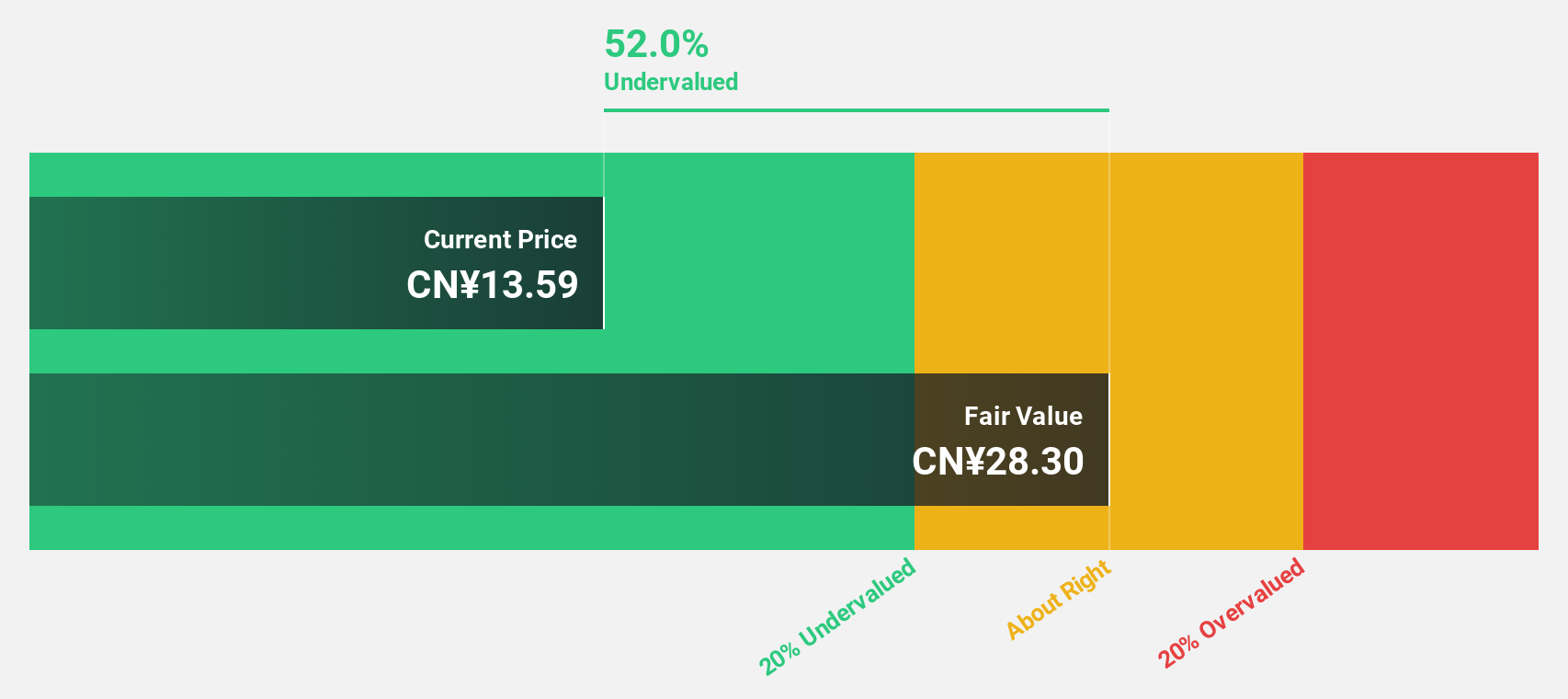

Nanjing COSMOS Chemical (SZSE:300856)

Overview: Nanjing COSMOS Chemical Co., Ltd. operates in the research, development, production, and sale of daily chemical raw materials both in China and internationally, with a market cap of CN¥6.26 billion.

Operations: The company's revenue is primarily derived from Cosmetic Active Ingredients and Raw Materials, contributing CN¥2.10 billion, followed by Aroma Chemical at CN¥388.89 million.

Estimated Discount To Fair Value: 49.9%

Nanjing COSMOS Chemical is trading at CNY 14.12, significantly below its estimated fair value of CNY 28.2, suggesting undervaluation based on cash flows. Despite a sharp decline in recent earnings, with net income dropping to CNY 65.3 million from CNY 421.49 million year-on-year, the company is expected to see robust revenue and earnings growth at rates of 23.7% and 43.9% annually respectively, exceeding market averages in China.

- Insights from our recent growth report point to a promising forecast for Nanjing COSMOS Chemical's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Nanjing COSMOS Chemical.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 506 Undervalued Global Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Jinpan Smart Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688676

Hainan Jinpan Smart Technology

Engages in the research and development, production, sale, and servicing of power transmission and distribution, and control equipment products in China.

High growth potential with proven track record.

Market Insights

Community Narratives