- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A064850

Undiscovered Gems In South Korea To Watch This September 2024

Reviewed by Simply Wall St

The South Korean market has remained flat over the past year, with a notable 5.6% gain in the Healthcare sector last week. As earnings are forecast to grow by 29% annually, identifying promising stocks within this stable yet evolving landscape can offer significant opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation develops, manufactures, and sells chemical process pumps in South Korea and internationally, with a market cap of ₩334.69 billion.

Operations: Young Poong Precision's revenue is primarily derived from the sale of chemical process pumps. The company reported a net profit margin of 12.5% in the latest financial period, reflecting its ability to manage costs effectively despite fluctuations in raw material prices.

Earnings for Young Poong Precision grew by 10.1% over the past year, outpacing the Machinery industry’s 5.4%. The company is debt-free and trades at nearly 80% below its estimated fair value. Despite a volatile share price in recent months, it remains profitable with positive free cash flow. Recently, Korea Corporate Investment Holdings offered approximately ₩140 billion to acquire a 43.43% stake, with completion expected by October 2024.

- Get an in-depth perspective on Young Poong Precision's performance by reading our health report here.

Gain insights into Young Poong Precision's past trends and performance with our Past report.

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★☆

Overview: Soulbrain Holdings Co., Ltd. develops, manufactures, and supplies core materials for the semiconductor, display, and secondary battery cell industries in South Korea and internationally with a market cap of ₩1.18 trillion.

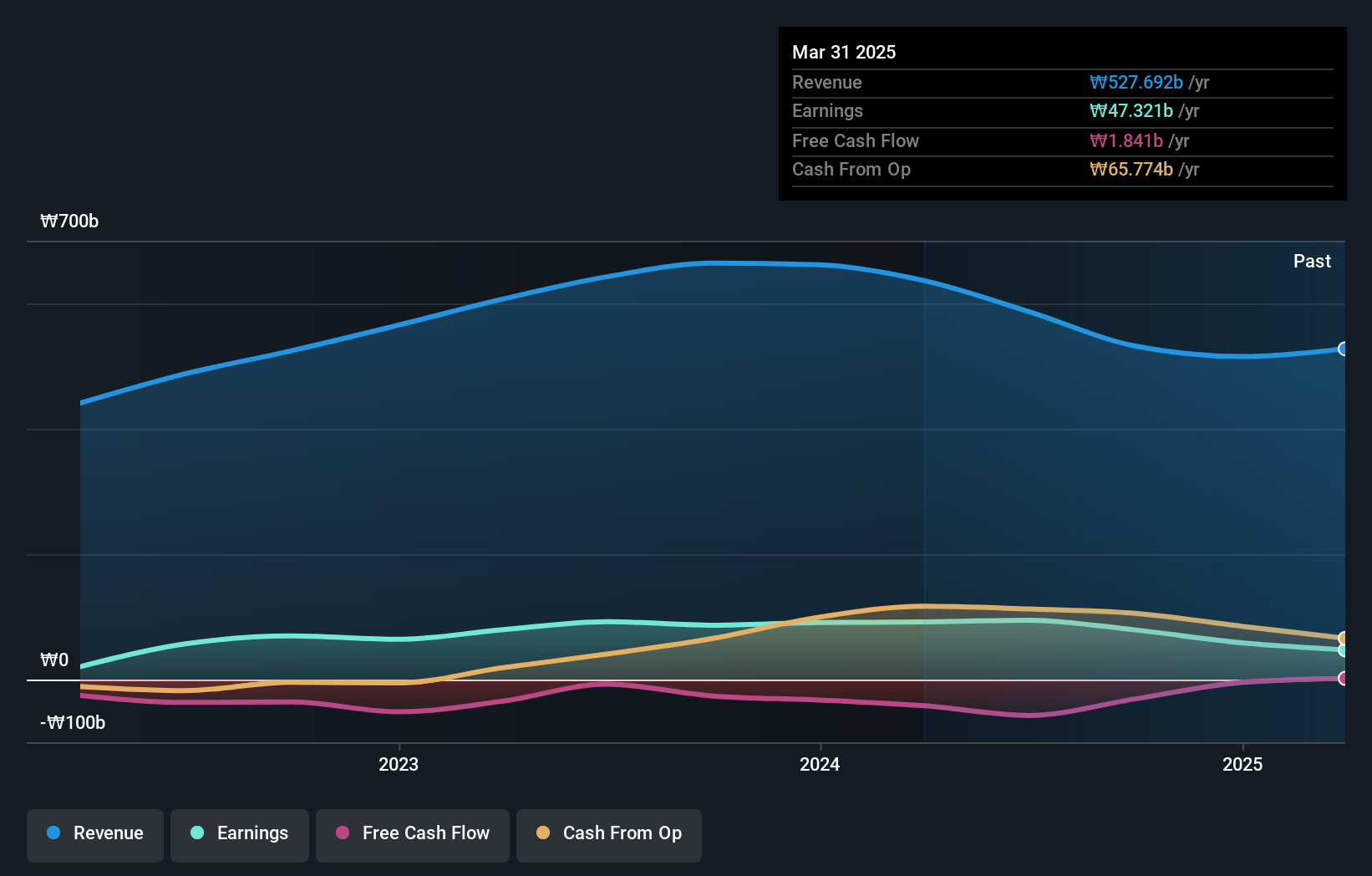

Operations: Soulbrain Holdings generates revenue primarily from product manufacturing (₩428.42 billion) and distribution and service (₩105.34 billion).

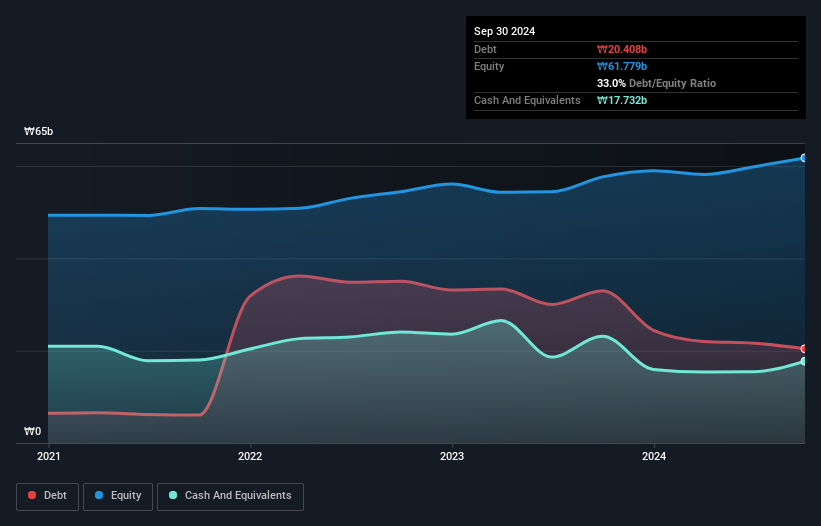

Soulbrain Holdings, a notable player in South Korea's chemicals sector, has shown resilient performance with earnings growth of 2.4% over the past year, outpacing the industry average of -5.1%. The company's net debt to equity ratio stands at a satisfactory 3.3%, indicating prudent financial management. Despite recent share price volatility, Soulbrain trades at 69.2% below its fair value estimate and boasts high-quality earnings with interest payments well covered by EBIT (7.6x).

FnGuide (KOSDAQ:A064850)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FnGuide Inc. provides online-based financial information services and has a market cap of ₩436.41 billion.

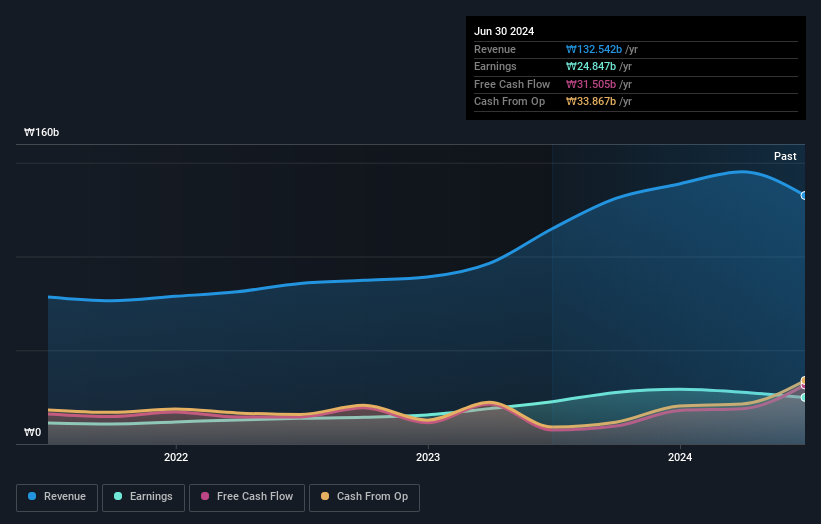

Operations: FnGuide Inc. generates revenue primarily from online financial information services, amounting to ₩31.33 billion.

FnGuide, a small-cap financial services firm in South Korea, has shown impressive earnings growth of 38.8% over the past year, outpacing the Capital Markets industry average of 21.5%. The company's net debt to equity ratio stands at a satisfactory 10.3%, indicating prudent financial management. Additionally, FnGuide's interest payments are well covered by EBIT with a coverage ratio of 20.6x. However, recent results were impacted by a one-off gain of ₩2.5B as of June 2024.

- Dive into the specifics of FnGuide here with our thorough health report.

Gain insights into FnGuide's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock more gems! Our KRX Undiscovered Gems With Strong Fundamentals screener has unearthed 186 more companies for you to explore.Click here to unveil our expertly curated list of 189 KRX Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A064850

FnGuide

Engages in development and provision of programs related to securities investment information and financial information.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives