- South Korea

- /

- Electrical

- /

- KOSDAQ:A033100

Undiscovered Gems In South Korea To Watch This September 2024

Reviewed by Simply Wall St

The South Korean stock market has seen a positive trend recently, buoyed by a series of gains that have pushed the KOSPI index above the 2,580-point mark. This optimism is reflected in broader global markets as well, with significant rallies in European and U.S. indices driven by favorable economic indicators and interest rate decisions. In this environment of growing confidence, identifying promising small-cap stocks can be particularly rewarding for investors. Here are three undiscovered gems in South Korea to watch this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Woori Technology (KOSDAQ:A032820)

Simply Wall St Value Rating: ★★★★★☆

Overview: Woori Technology, Inc. manufactures and sells switchboard and electric control panels, with a market capitalization of ₩416.21 billion.

Operations: Woori Technology generates revenue primarily from the manufacture sale sector (₩59.99 billion), supplemented by rental income (₩3.31 billion), service sales (₩2.65 billion), and product sales (₩2.40 billion). The company’s diverse revenue streams highlight its multifaceted business model within the electric control panel industry.

Woori Technology, a small cap firm in South Korea, has seen its debt to equity ratio improve from 141.9% to 59.8% over the past five years. Despite this progress, its net debt to equity remains high at 50.6%. The company’s earnings surged by 136.3% last year, outpacing the Electronic industry’s -13.4%. Recent private placements raised KRW 10 billion through convertible bonds set to mature in August 2029, reflecting investor confidence and potential for future growth.

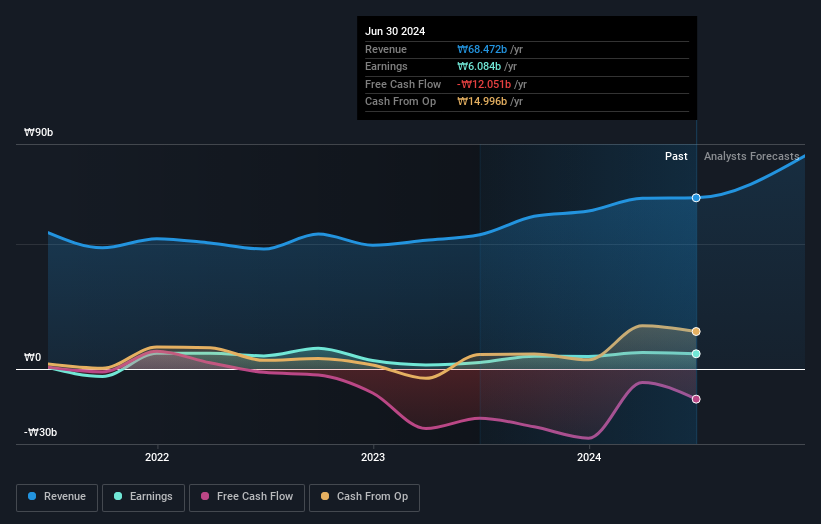

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea, with a market cap of ₩963.74 billion.

Operations: Cheryong Electric Co., Ltd. generates revenue primarily from the sale of power electric equipment in South Korea, with a market cap of ₩963.74 billion.

Cheryong Electric Ltd. has demonstrated impressive growth, with earnings surging by 134% over the past year, significantly outpacing the Electrical industry's 25.5%. The company is debt-free, a marked improvement from five years ago when its debt to equity ratio was 2.3%. Despite a highly volatile share price in recent months, Cheryong trades at 79.7% below its estimated fair value and reports high-quality earnings.

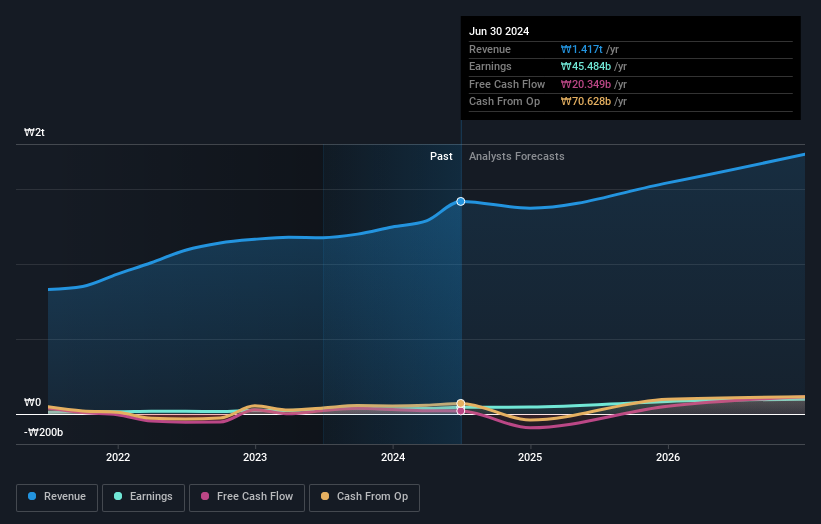

Iljin ElectricLtd (KOSE:A103590)

Simply Wall St Value Rating: ★★★★★★

Overview: Iljin Electric Co., Ltd operates as a heavy electric machinery company in South Korea and internationally, with a market cap of ₩1.01 billion.

Operations: Iljin Electric Co., Ltd generates revenue primarily from its Wire segment (₩1.17 trillion) and Power System segment (₩329.01 billion). The company's consolidated revenue is impacted by adjustments amounting to -₩81.32 billion.

Iljin Electric Ltd. has shown impressive earnings growth of 55.6% over the past year, significantly outpacing the Electrical industry’s 25.5%. The company repurchased shares in 2024, indicating confidence in its prospects. Its net debt to equity ratio stands at a satisfactory 10.4%, reflecting prudent financial management. Trading at 83.8% below its estimated fair value, Iljin appears undervalued with high-quality earnings and a forecasted annual growth rate of 34.63%.

Turning Ideas Into Actions

- Reveal the 190 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A033100

Cheryong ElectricLtd

Manufactures and sells power electric equipment in South Korea.

Outstanding track record with flawless balance sheet.