- South Korea

- /

- Machinery

- /

- KOSDAQ:A023160

Tae Kwang's (KOSDAQ:023160) Stock Price Has Reduced 47% In The Past Three Years

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Tae Kwang Corporation (KOSDAQ:023160) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 36%. And over the last year the share price fell 28%, so we doubt many shareholders are delighted. The good news is that the stock is up 1.1% in the last week.

View our latest analysis for Tae Kwang

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Tae Kwang moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

The modest 1.4% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 8.6% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Tae Kwang further; while we may be missing something on this analysis, there might also be an opportunity.

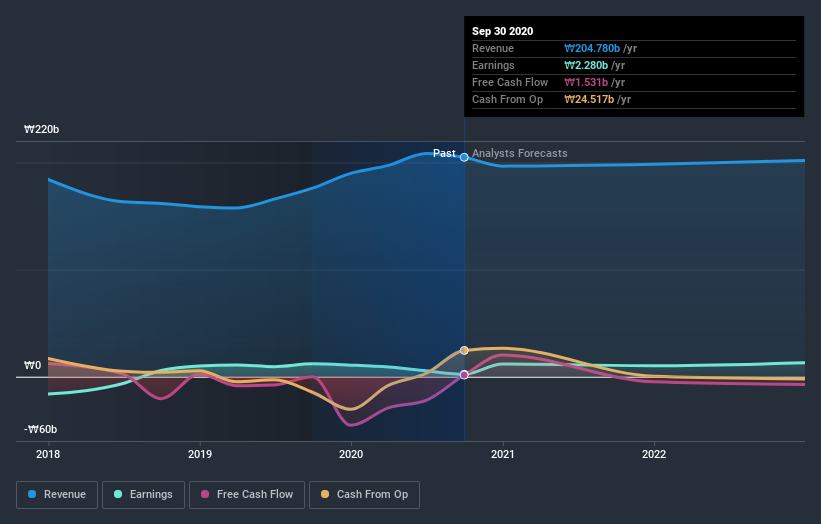

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Tae Kwang has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Tae Kwang stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 43% in the last year, Tae Kwang shareholders lost 27% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Tae Kwang , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Tae Kwang, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tae Kwang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A023160

Tae Kwang

Manufactures, supplies, and sells butt weld pipe fittings for oil and gas, chemical and petrochemical, power plant, and shipbuilding businesses in Korea and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives