- South Korea

- /

- Building

- /

- KOSDAQ:A018310

Sammok S-FormLtd's(KOSDAQ:018310) Share Price Is Down 48% Over The Past Five Years.

It is doubtless a positive to see that the Sammok S-Form Co.,Ltd (KOSDAQ:018310) share price has gained some 53% in the last three months. But if you look at the last five years the returns have not been good. In fact, the share price is down 48%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Sammok S-FormLtd

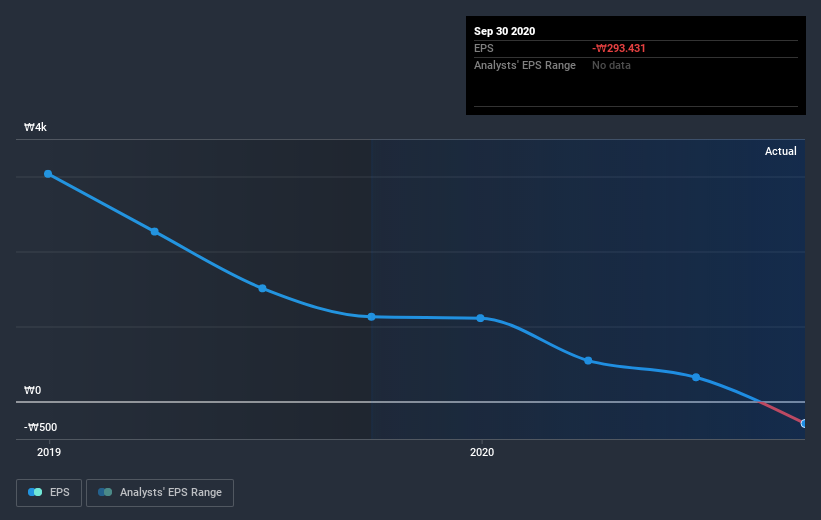

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

In the last half decade Sammok S-FormLtd saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Sammok S-FormLtd's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Sammok S-FormLtd's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Sammok S-FormLtd's TSR, which was a 40% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Sammok S-FormLtd's TSR for the year was broadly in line with the market average, at 42%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 7%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Sammok S-FormLtd (including 1 which makes us a bit uncomfortable) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Sammok S-FormLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A018310

Sammok S-FormLtd

Engages in the manufactures, sells, and leases formwork for construction and civil engineering works in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives