- South Korea

- /

- Machinery

- /

- KOSDAQ:A014940

Oriental Precision & EngineeringLtd (KOSDAQ:014940) Shareholders Have Enjoyed An Impressive 203% Share Price Gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Oriental Precision & Engineering Co.,Ltd. (KOSDAQ:014940) share price has soared 203% in the last year. Most would be very happy with that, especially in just one year! Meanwhile the share price is 2.1% higher than it was a week ago. Looking back further, the stock price is 152% higher than it was three years ago.

Check out our latest analysis for Oriental Precision & EngineeringLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Oriental Precision & EngineeringLtd went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

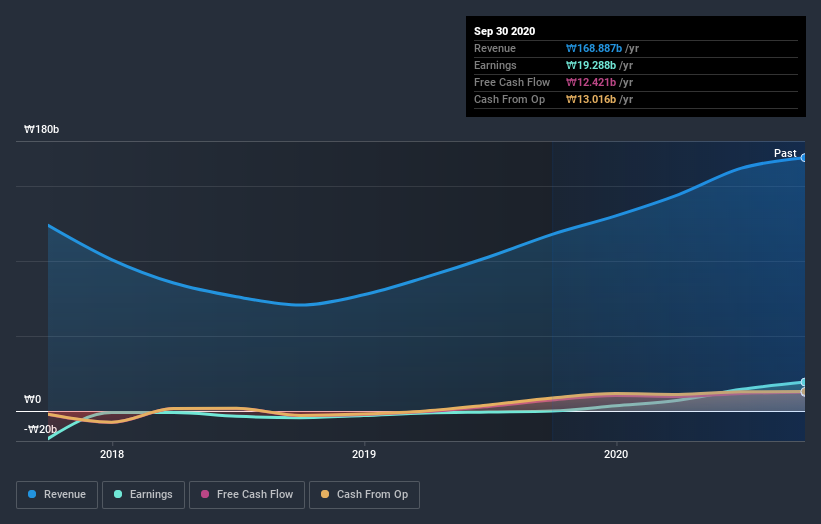

We think that the revenue growth of 43% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Oriental Precision & EngineeringLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Oriental Precision & EngineeringLtd has rewarded shareholders with a total shareholder return of 203% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Oriental Precision & EngineeringLtd .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Oriental Precision & EngineeringLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A014940

Oriental Precision & EngineeringLtd

Oriental Precision & Engineering Co.,Ltd.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives