3 Reliable Dividend Stocks To Consider With At Least 3.2% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of potential policy changes under the incoming Trump administration, investors are closely monitoring sector-specific impacts and interest rate expectations. Amidst this backdrop of economic uncertainty and fluctuating indices, dividend stocks with reliable yields can offer a degree of stability and income, making them an attractive consideration for those seeking to balance risk in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.74% | ★★★★★☆ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

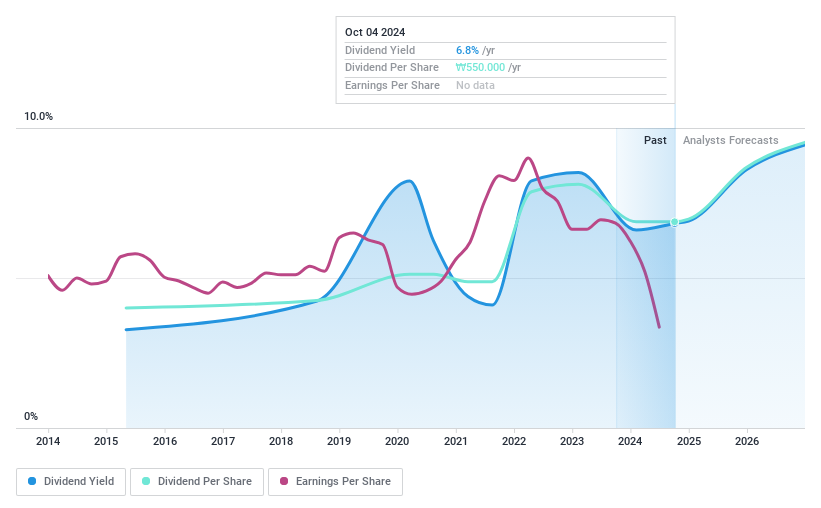

DGB Financial Group (KOSE:A139130)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DGB Financial Group Co., Ltd. operates through its subsidiaries to provide a range of banking products and services in South Korea, with a market cap of ₩1.41 trillion.

Operations: DGB Financial Group generates revenue primarily from its Banking segment (₩2.71 trillion), followed by Securities Investment (₩1.67 trillion), Life Insurance (₩540.77 billion), Credit Sector (₩210.58 billion), and Asset Management (₩21.09 billion).

Dividend Yield: 6.5%

DGB Financial Group's dividend payments are well-supported by a low payout ratio of 46.8%, and dividends have been reliable, growing steadily over the past decade. The company offers an attractive dividend yield of 6.48%, placing it in the top quartile among Korean dividend payers. Despite a decline in profit margins from last year, earnings are forecast to grow annually by 24.71%, suggesting potential for continued dividend sustainability and growth.

- Click here and access our complete dividend analysis report to understand the dynamics of DGB Financial Group.

- In light of our recent valuation report, it seems possible that DGB Financial Group is trading behind its estimated value.

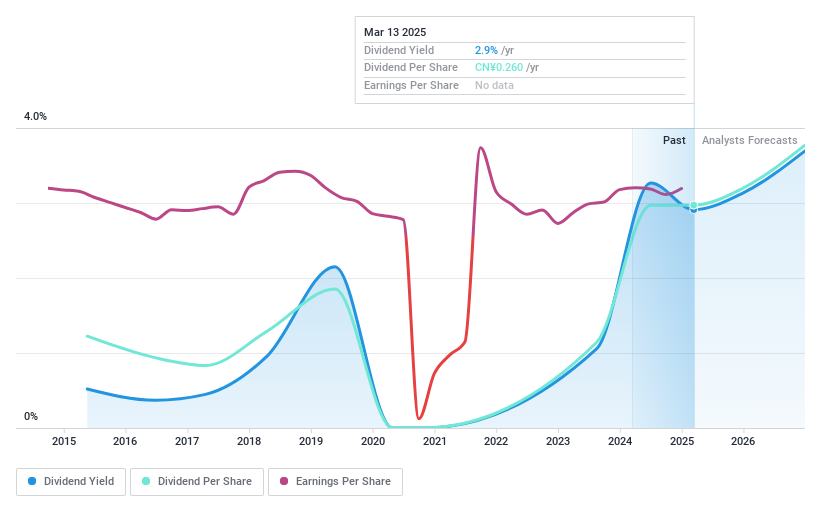

Jinhong Fashion GroupLtd (SHSE:603518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinhong Fashion Group Co., Ltd. operates in China, focusing on the design, development, manufacturing, and sale of apparel and accessories for women, men, and children with a market capitalization of CN¥2.77 billion.

Operations: Jinhong Fashion Group Co., Ltd. generates revenue through its core activities of designing, developing, manufacturing, and selling apparel and accessories for women, men, and children in China.

Dividend Yield: 3.3%

Jinhong Fashion Group Ltd. maintains a low payout ratio of 33.4%, indicating dividends are well-covered by earnings and cash flows, with a cash payout ratio of 12.3%. Although the dividend yield is in the top 25% for CN market payers, past payments have been volatile and unreliable. Recent financials show decreased revenue and net income for the nine months ending September 2024, while strategic buybacks and private placements indicate ongoing shareholder engagement efforts.

- Click here to discover the nuances of Jinhong Fashion GroupLtd with our detailed analytical dividend report.

- Our valuation report unveils the possibility Jinhong Fashion GroupLtd's shares may be trading at a discount.

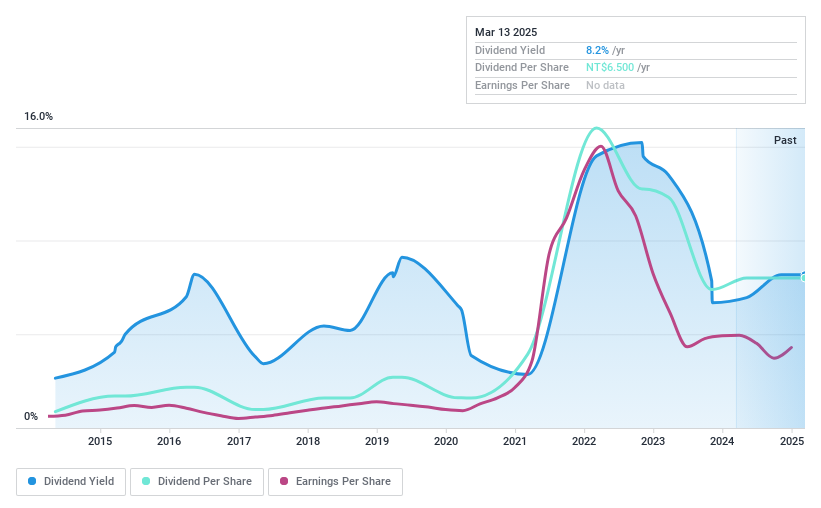

T3EX Global Holdings (TWSE:2636)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: T3EX Global Holdings Corp. is an investment holding company offering integrated logistics services across Taiwan, Hong Kong, China, East Asia, and internationally with a market cap of NT$11.99 billion.

Operations: T3EX Global Holdings generates revenue from its Air Freight/Transportation segment with NT$5.15 billion and Sea Freight/Transportation segment with NT$14.79 billion.

Dividend Yield: 7.4%

T3EX Global Holdings offers a high dividend yield of 7.42%, ranking in the top 25% within the TW market. However, dividends are not well-supported by free cash flows and earnings, with a payout ratio at 79.8%. Despite past growth in dividends over ten years, payments have been volatile and unreliable. Recent leadership changes may impact future strategies, while third-quarter earnings showed decreased net income despite increased sales compared to last year.

- Click to explore a detailed breakdown of our findings in T3EX Global Holdings' dividend report.

- Our valuation report unveils the possibility T3EX Global Holdings' shares may be trading at a premium.

Summing It All Up

- Unlock our comprehensive list of 1970 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T3EX Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2636

T3EX Global Holdings

An investment holding company, provides integrated logistics services in Taiwan, Hong Kong, China, East Asia, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives