- South Korea

- /

- Auto

- /

- KOSE:A000270

Top KRX Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

The South Korean market has seen a 2.2% increase over the last week, though it has remained flat overall in the past year with earnings forecasted to grow by 29% annually. In this context, identifying strong dividend stocks becomes crucial for investors looking to capitalize on stable returns and potential growth.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.57% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.23% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.67% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.36% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.33% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.76% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.08% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.48% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 5.97% | ★★★★☆☆ |

| Korea Ratings (KOSDAQ:A034950) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 63 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation manufactures and sells vehicles in South Korea, North America, and Europe with a market cap of ₩39.38 trillion.

Operations: Kia Corporation generates revenue primarily from its auto manufacturing segment, which amounts to ₩103.65 billion.

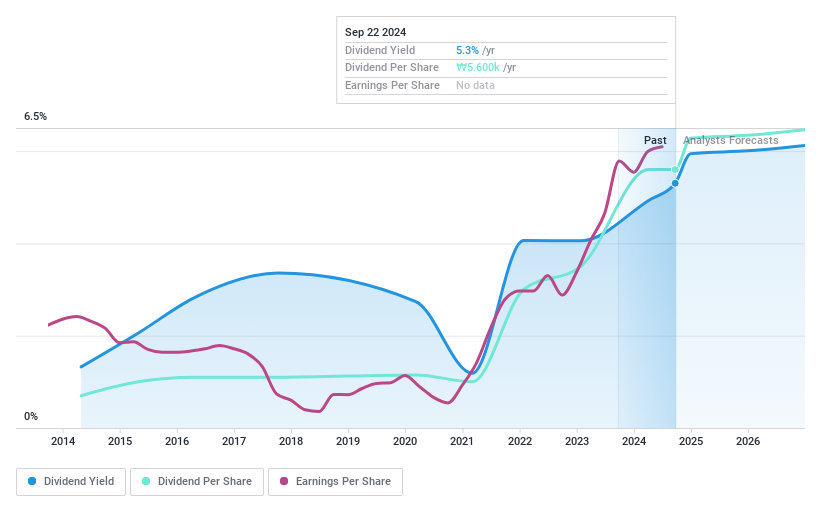

Dividend Yield: 5.6%

Kia offers a compelling dividend profile with stable and growing payments over the past decade, a high yield of 5.57%, and strong coverage by both earnings (23% payout ratio) and free cash flow (32%). Trading at 67.9% below estimated fair value, it presents good relative value compared to peers. Recent participation in patent pools highlights its commitment to innovation, despite legal settlements impacting short-term financials.

- Navigate through the intricacies of Kia with our comprehensive dividend report here.

- The analysis detailed in our Kia valuation report hints at an deflated share price compared to its estimated value.

KB Financial Group (KOSE:A105560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KB Financial Group Inc. offers banking and financial services to consumers and corporations across various countries, including South Korea, the United States, and China, with a market cap of ₩30.21 trillion.

Operations: KB Financial Group Inc.'s revenue segments are comprised of Securities (₩1.64 billion), Life Insurance (₩0.25 billion), Credit Card Sector (₩1.10 billion), Banking Sector - Other (₩0.67 billion), Non-Life Insurance Sector (₩1.21 billion), Banking Sector - Corporate Finance (₩4.53 billion), and Banking Sector - Household Finance (₩4.06 billion).

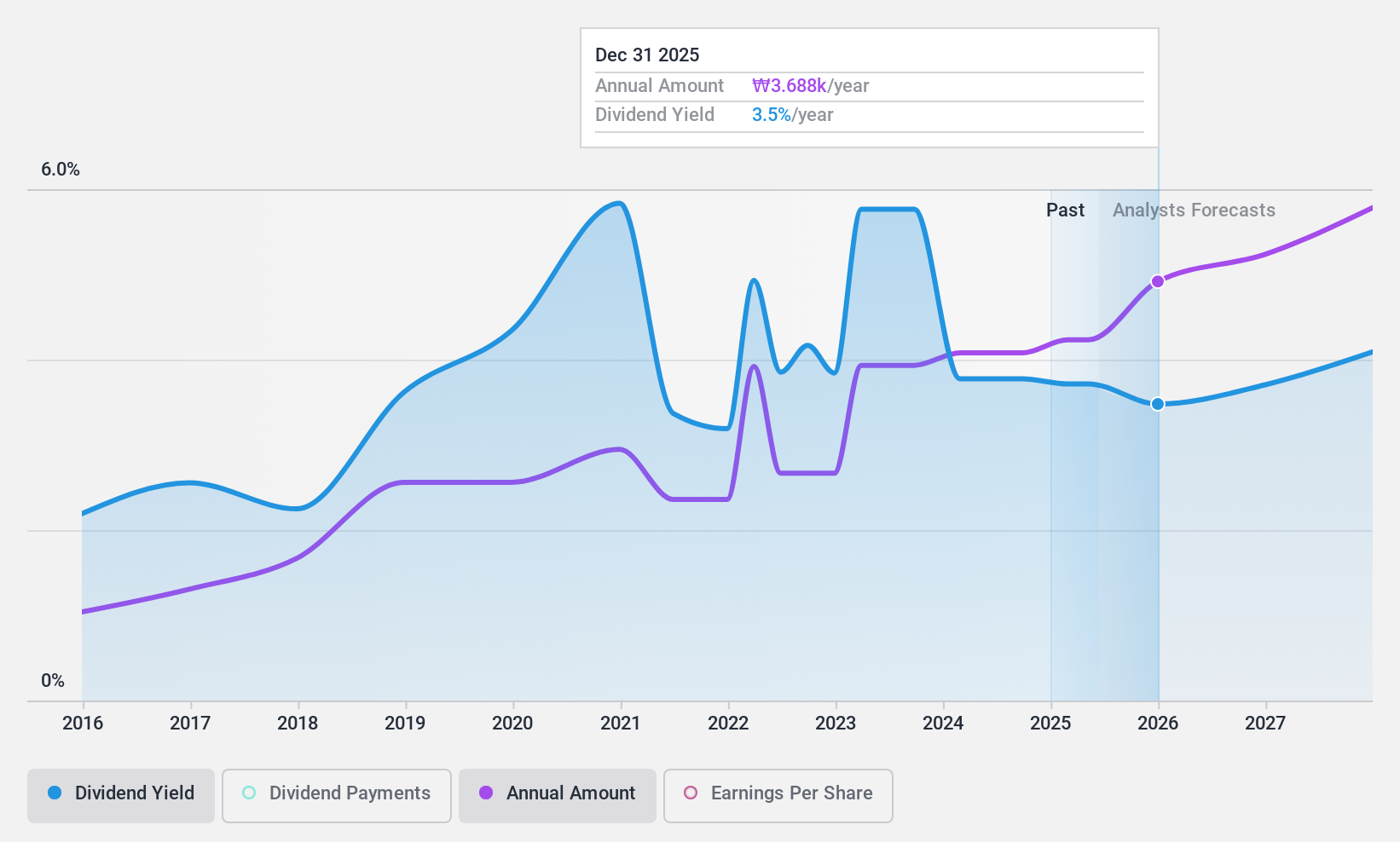

Dividend Yield: 3.7%

KB Financial Group's dividends are well-covered by earnings, with a current payout ratio of 32.7% and a forecasted ratio of 24.1% in three years. Despite this, the dividend yield is slightly below the top quartile in South Korea. The company has increased its dividend payments over the past decade but has shown volatility. Recent share buybacks totaling ₩319.99 billion aim to enhance shareholder value, alongside a declared quarterly cash dividend of ₩791 per common share.

- Unlock comprehensive insights into our analysis of KB Financial Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that KB Financial Group is priced lower than what may be justified by its financials.

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩3.12 trillion.

Operations: BNK Financial Group Inc. generates revenue primarily through Busan Bank (₩1.30 billion), Gyeongnam Bank (₩974.64 million), BNK Capital (₩206.99 million), BNK Investments Securities (₩155.86 million), and BNK Savings Bank (₩38.85 million).

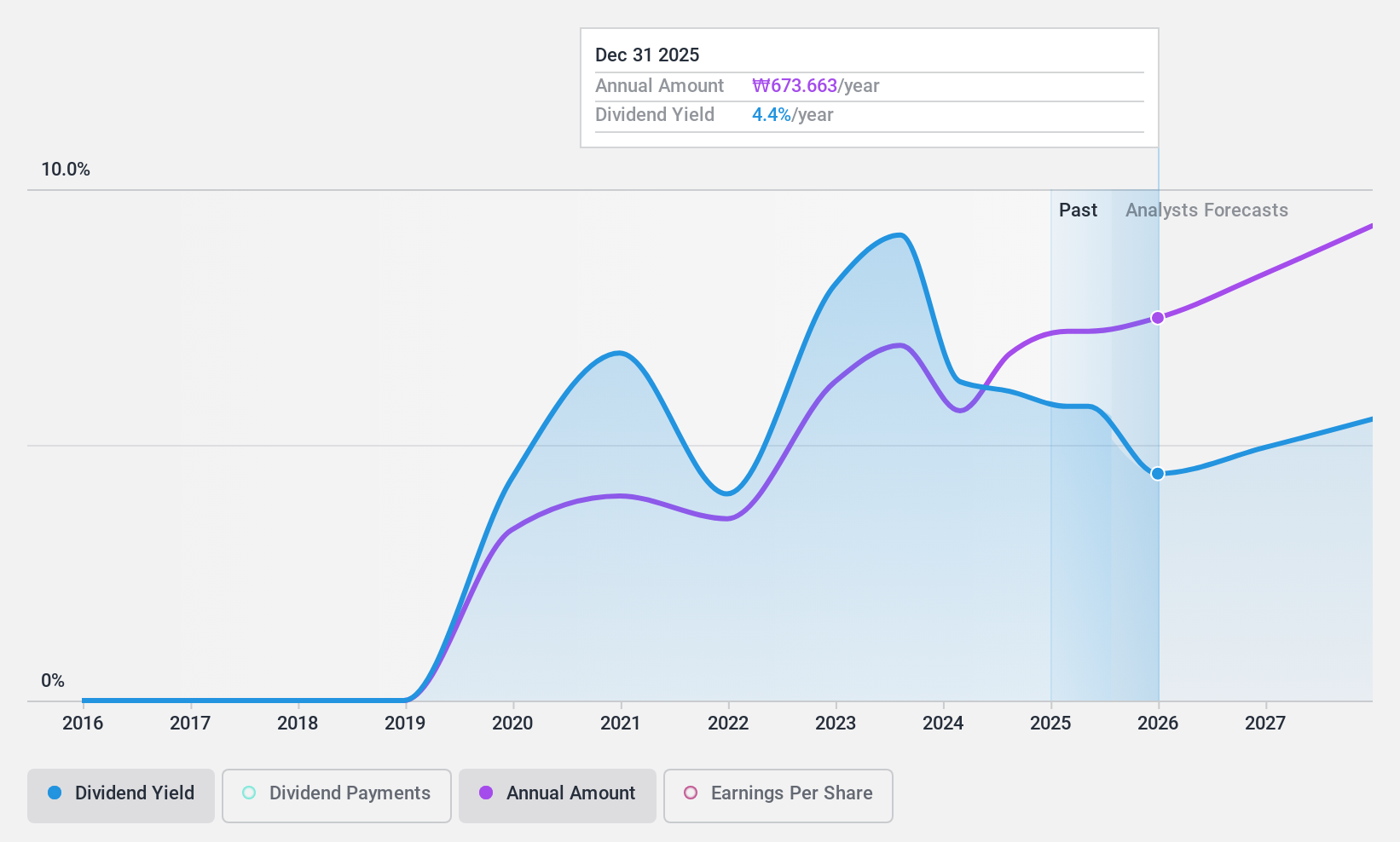

Dividend Yield: 8.4%

BNK Financial Group's dividend yield is in the top 25% of South Korean companies, with a well-covered payout ratio of 25.6%, forecasted to remain sustainable at 28.7% in three years. The company has only paid dividends for five years but shows stable and increasing payments. Recent buybacks totaling ₩12.99 billion aim to enhance shareholder value, reflecting strong earnings growth with net income rising to ₩492.31 billion for the first half of 2024.

- Dive into the specifics of BNK Financial Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, BNK Financial Group's share price might be too pessimistic.

Key Takeaways

- Discover the full array of 63 Top KRX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Very undervalued with flawless balance sheet and pays a dividend.