- Sweden

- /

- Commercial Services

- /

- OM:ITAB

Discover 3 Prominent Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

Amid a backdrop of record highs in major U.S. indices and optimism surrounding potential trade deals, global markets are experiencing a wave of positive sentiment driven by political developments and AI investment announcements. As investors navigate these dynamic conditions, dividend stocks can offer a compelling option for those seeking income stability and potential growth, especially when market volatility looms large.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

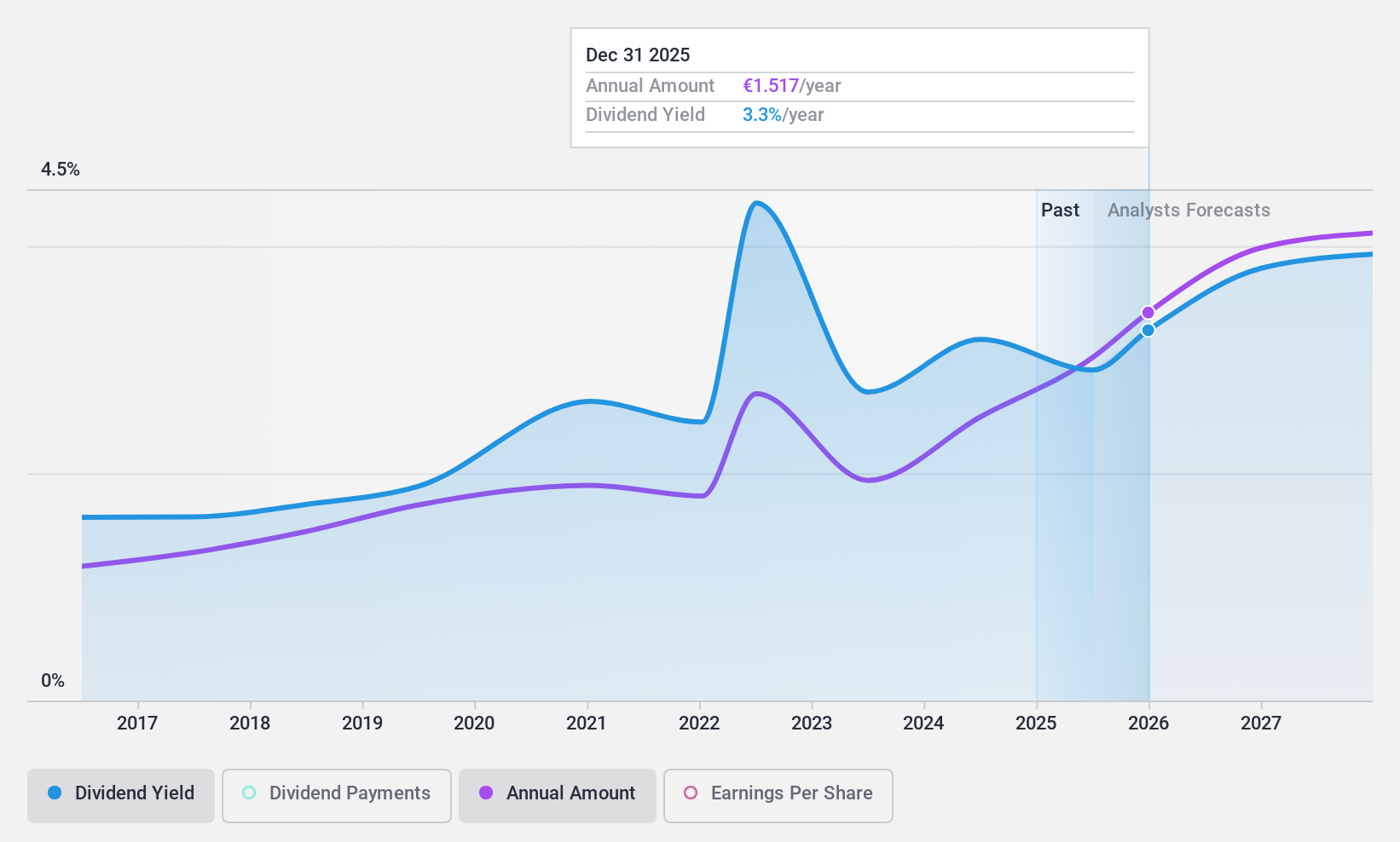

Construcciones y Auxiliar de Ferrocarriles (BME:CAF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Construcciones y Auxiliar de Ferrocarriles, S.A. (BME:CAF) is a company engaged in the design, manufacture, maintenance, and supply of equipment and components for railway systems, with a market cap of approximately €1.19 billion.

Operations: Construcciones y Auxiliar de Ferrocarriles, S.A. generates revenue through its activities in the design, manufacture, maintenance, and supply of railway system equipment and components.

Dividend Yield: 3.1%

Construcciones y Auxiliar de Ferrocarriles (CAF) shows a mixed profile for dividend investors. The company's dividends are well-covered by earnings, with a payout ratio of 35.5%, and cash flows, at 75.9%. However, the dividend yield of 3.11% is below the Spanish market's top tier. CAF has increased dividends over the past decade but maintains an unstable track record due to volatility in payments. Earnings growth and undervaluation relative to peers add potential appeal despite these concerns.

- Get an in-depth perspective on Construcciones y Auxiliar de Ferrocarriles' performance by reading our dividend report here.

- Our valuation report here indicates Construcciones y Auxiliar de Ferrocarriles may be undervalued.

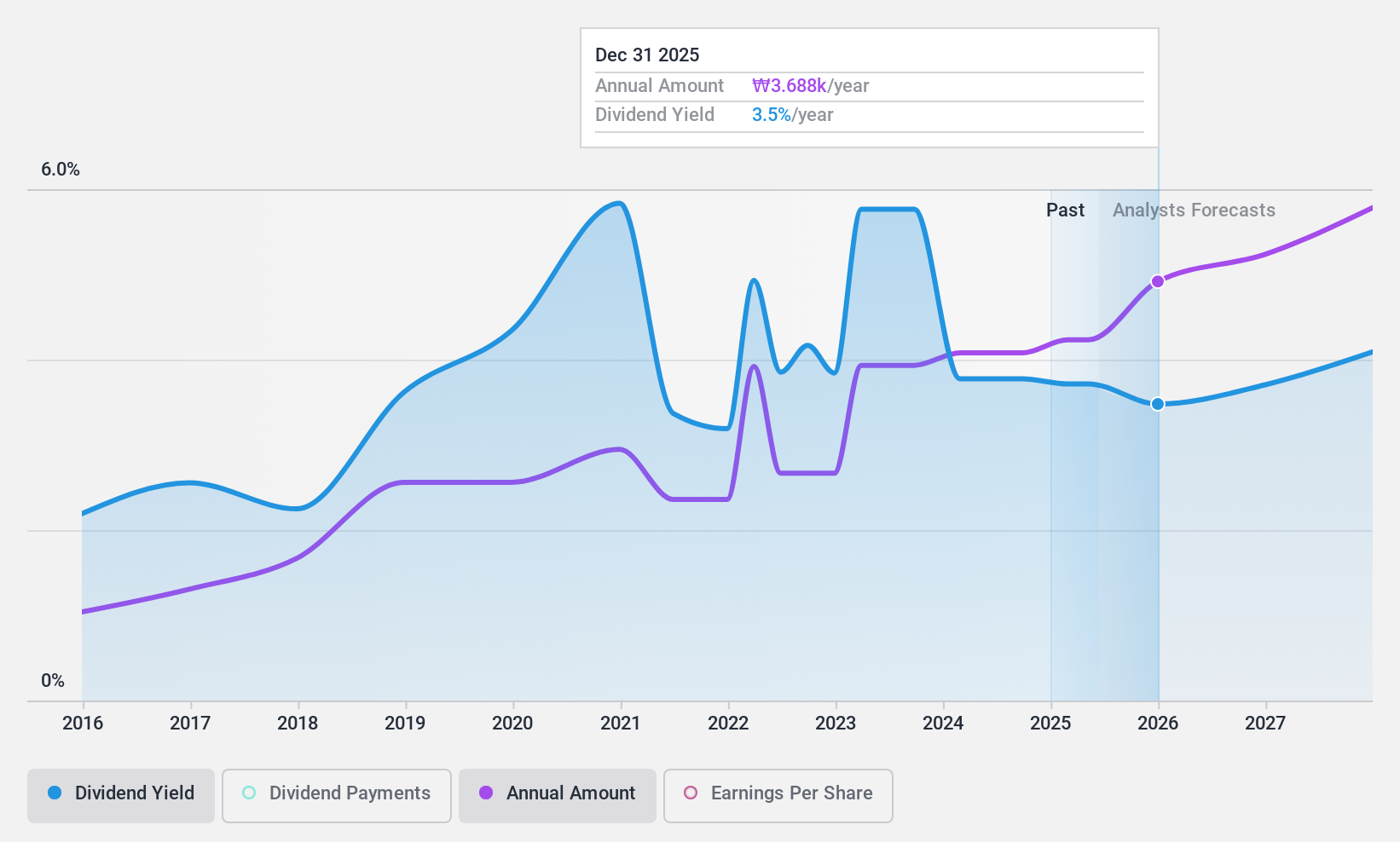

KB Financial Group (KOSE:A105560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KB Financial Group Inc. offers a variety of banking and financial services to both consumers and corporations across several countries, with a market cap of ₩34.34 trillion.

Operations: KB Financial Group's revenue segments include ₩4.47 trillion from the Banking Sector - Corporate Finance, ₩3.97 trillion from the Banking Sector - Household Finance, ₩1.76 trillion from Securities, ₩1.23 trillion from Non-Life Insurance Sector, ₩1.15 trillion from the Credit Card Sector, and ₩1.06 trillion from Banking Sector - Other, alongside contributions from Life Insurance amounting to ₩311.63 billion.

Dividend Yield: 3.3%

KB Financial Group's dividend profile reveals both strengths and weaknesses. The dividends are well-covered by earnings, with a payout ratio of 33.3%, and are forecast to remain sustainable with a future coverage of 24.1%. However, the dividend yield of 3.34% is lower than the top tier in Korea's market, and its history shows volatility over the past decade. Recent share buybacks worth KRW 400 billion may indicate confidence in financial stability despite these concerns.

- Delve into the full analysis dividend report here for a deeper understanding of KB Financial Group.

- The analysis detailed in our KB Financial Group valuation report hints at an deflated share price compared to its estimated value.

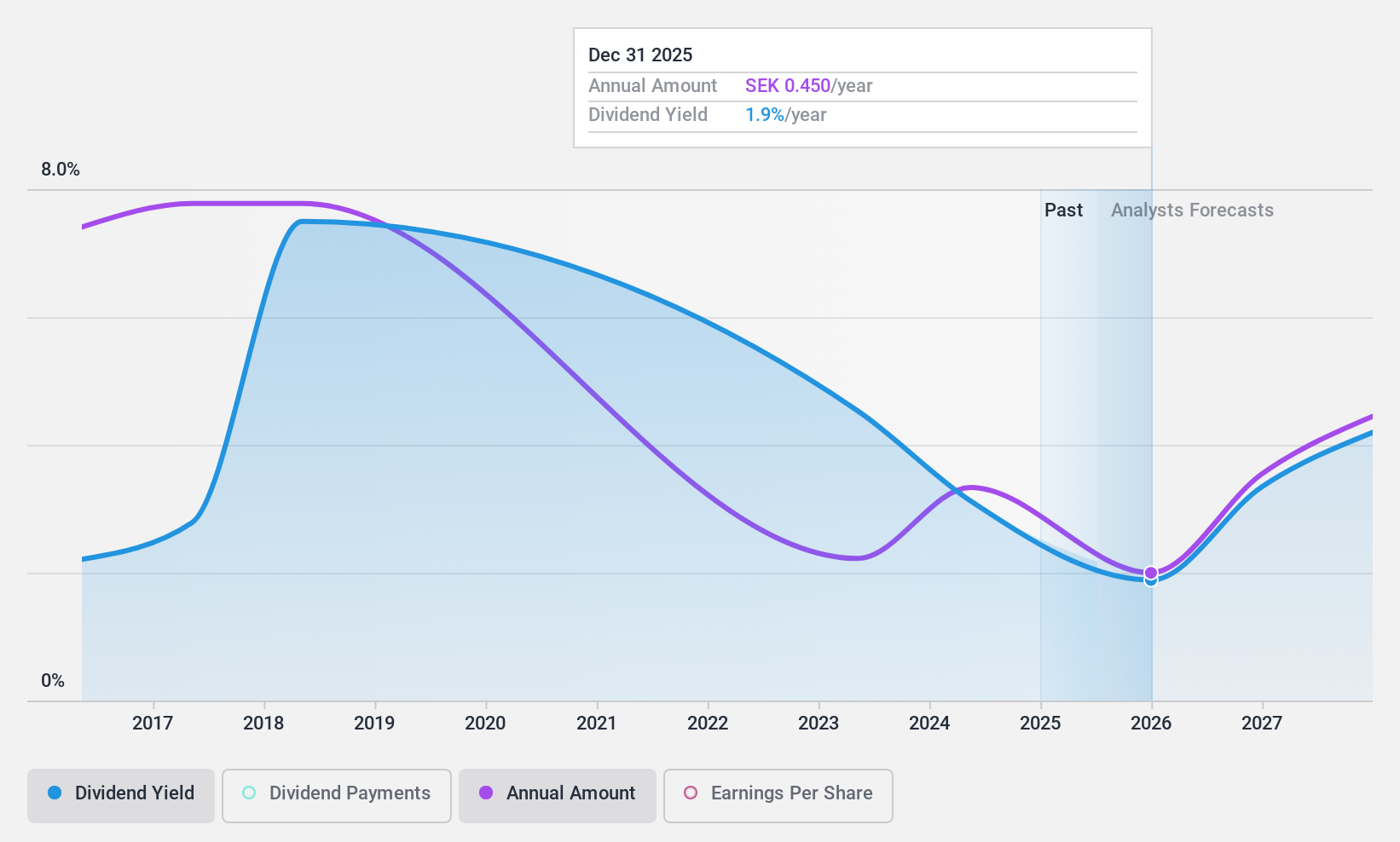

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) specializes in providing solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.27 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue from its Furniture & Fixtures segment, which amounts to SEK6.42 billion.

Dividend Yield: 3.5%

ITAB Shop Concept's dividend profile shows mixed signals. While the dividend yield of 3.49% is below Sweden's top tier, dividends are well-covered by earnings and cash flows with payout ratios of 46.4% and 39.2%, respectively. However, its history is marked by volatility and unreliability over the past decade, despite recent growth in payments. Trading at a discount to estimated fair value may attract investors seeking potential capital appreciation alongside dividends.

- Unlock comprehensive insights into our analysis of ITAB Shop Concept stock in this dividend report.

- Our expertly prepared valuation report ITAB Shop Concept implies its share price may be lower than expected.

Taking Advantage

- Click this link to deep-dive into the 1938 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives