Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hyundai Wia Corporation (KRX:011210) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Hyundai Wia

What Is Hyundai Wia's Debt?

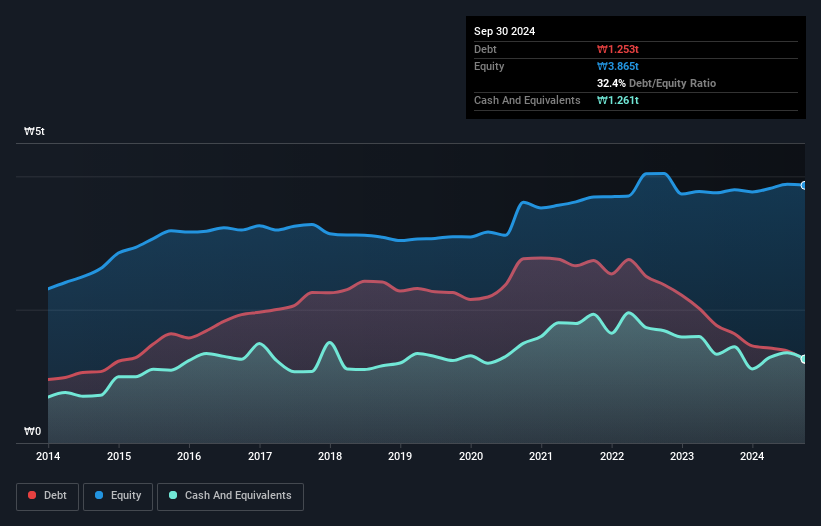

The image below, which you can click on for greater detail, shows that Hyundai Wia had debt of ₩1.25t at the end of September 2024, a reduction from ₩1.64t over a year. But on the other hand it also has ₩1.26t in cash, leading to a ₩7.85b net cash position.

A Look At Hyundai Wia's Liabilities

Zooming in on the latest balance sheet data, we can see that Hyundai Wia had liabilities of ₩2.13t due within 12 months and liabilities of ₩688.5b due beyond that. Offsetting these obligations, it had cash of ₩1.26t as well as receivables valued at ₩1.57t due within 12 months. So these liquid assets roughly match the total liabilities.

Having regard to Hyundai Wia's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₩1.02t company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Hyundai Wia boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Hyundai Wia saw its EBIT drop by 4.0% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hyundai Wia can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Hyundai Wia has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Hyundai Wia actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Hyundai Wia has net cash of ₩7.85b, as well as more liquid assets than liabilities. The cherry on top was that in converted 120% of that EBIT to free cash flow, bringing in ₩179b. So is Hyundai Wia's debt a risk? It doesn't seem so to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Hyundai Wia's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Wia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011210

Hyundai Wia

Manufactures and retails auto parts for vehicles, machinery, and industrial machinery worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026