- South Korea

- /

- Auto Components

- /

- KOSE:A011210

As Hyundai Wia (KRX:011210) rallies 11% this past week, investors may now be noticing the company's three-year earnings growth

Hyundai Wia Corporation (KRX:011210) shareholders should be happy to see the share price up 11% in the last week. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 33% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Hyundai Wia

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Hyundai Wia became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 5.7% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Hyundai Wia more closely, as sometimes stocks fall unfairly. This could present an opportunity.

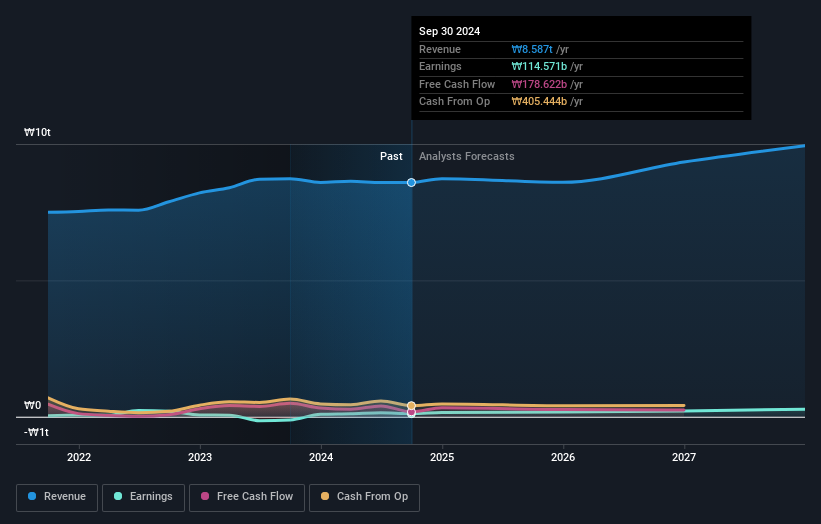

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Hyundai Wia is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Hyundai Wia stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market lost about 2.5% in the twelve months, Hyundai Wia shareholders did even worse, losing 29% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how Hyundai Wia scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Wia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011210

Hyundai Wia

Manufactures and retails auto parts for vehicles, machinery, and industrial machinery worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives